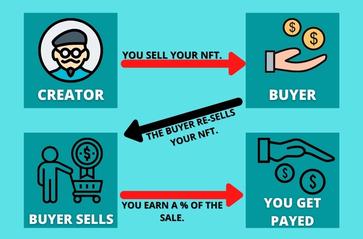

NFT royalties are what give creators a means of getting paid accordingly for their work, even after the original sale of their nonfungible token.

Nonfungible tokens have been an integral technical model and a strong building block of the budding Web3 network. While the growth of NFTs was spearheaded by the Ethereum community in 2020 and 2021, other chains such as Solana and Bitcoin have followed with huge projects launching on the blockchains.

Developers have historically looked for other kinds of income from their work. While there are various laws that help in protecting intellectual property within the Web2 space, implementing and enforcing such laws and protecting the developers’ interests has been quite challenging to accomplish.

Royalty payments are passive income that the NFT creator earns on every transaction of their completed product. These products can be art, music, game utilities, and many other types of digital assets. While the developers always earn significantly from the primary sale of their nonfungible tokens, royalties are also earned for every subsequent transaction involving their product.

Importance Of NFT Royalties

NFT royalties have come in handy to make digital content and art a sustainable income source for the creators. Since payments can potentially be programmatic, many creators can readily benefit from the model.

From an economic and principle perspective, NFT royalties provide several benefits to the ecosystem. It is difficult to track the subsequent transactions and purchases of artwork in the Web2 creative industries of art, music, and graphic design. Besides that, the contracts drafted between marquee studios or corporations and creative professionals are mostly one-sided and profoundly against the creator of the artwork.

The imbalance in economic relationships is what the Web3 model aims to correct. In Web3, any piece that gets minted as a nonfungible token can be tracked via subsequent purchases that are recorded on the blockchain. Hence, the creator can programmatically remain at the top of the chain of transactions and earn royalties after every transaction.

Additionally, the art creator can go to an NFT marketplace and list and sell their nonfungible tokens without the marketplace directly acquiring a royalty on every executed purchase.

Related:Music-Focused NFTs from Band Royalty Allow Fans to Earn Royalties

NFTs are crucial since one can develop an economy around creators, which has not essentially been the strong point of Web2 business models. For most of the NFT collections, the royalties were an ideal mechanism for funding all their operational costs.

NFT royalties can also eliminate wash trading practices. By Setting up many wallets or accounts, a market participant can purchase an NFT or other digital asset they want to inflate the price of artificially. These individuals use the wallets to buy an NFT from each other to make the market participants think that the demand is high and consequently pump up the price of the nonfungible token.

For spectators who are not keen, the activity appears like high demand for the NFT. Nevertheless, that is far from the case. Enforcing NFT royalties ensures for every transaction between the wash traders’ wallets, there is a price that has to be paid. Hence, the cost of keeping these prices high increases rapidly, making it challenging for wash traders to engage in their illicit activities.

How Marketplaces Contribute To NFT Royalties

Marketplaces offer a platform for digital creators to develop their content, mint it and eventually put it up for sale. Also, they help digital content artists to tap into the demand for secondary sales of their original creations.

Notably, the marketplaces play an integral role in the Web3 space, helping the NFT ecosystem to thrive and create commerce. Every blockchain platform has its marketplaces and cross-chain marketplaces for selling and buying digital assets. Apart from creating a section for NFTs with royalties, the marketplaces also add lots of credibility to projects by listing them publicly.

These marketplaces can also set royalties for NFTs successfully sold on their platform. That may have an adverse effect on the NFT ecosystem, directly influencing the volumes. NFT trading volumes are an important performance indicator that helps assess the health of an NFT collection or the ecosystem that exists on a chain.

Marketplaces like OpenSea have attempted to eliminate royalties and introduce optional royalties where the buyer decides whether they want to pay royalties to the original creators. These types of policies are detrimental and may hurt creators since their recurring source of income is now inexistent.

Eventually, the creator economy becomes less competitive and sustainable, since the newcomers struggle to keep up with established creative studios. Thus, the royalty fees determined by the marketplaces can break or make the heart and soul of this budding innovation.

Multiple NFT marketplaces have come up in the past several years, and each of them has a growth hacking strategy. In some instances, these strategies have favored the general NFT industry, while in others, they have hurt the entire ecosystem.

While the competition in the space caused reductions in royalty fees, some of the marketplaces have made a significant move in blocking sales of NFTs in secondary markets that have no royalties. Some critics slammed this move but others support it believing it is a measure to help protect the creators’ interests.

A case where NFT collections do not charge royalties makes it a challenge for them to fund their business and they become heavily reliant on venture capital funding sources. This can be difficult since venture capital firms are still hesitant to invest in the space and are still fine-tuning their strategies to fund NFT projects.

Related:What Are the Best Uses of NFTs Beyond Art? (Roundtable Interview)

The Future

2022 was severe in many aspects for the NFT and Web3 spaces. Scams increased as prices plummeted due to macroeconomic conditions. Despite all these challenges and hiccups, NFT royalties can play an integral role in the generation of creator revenue.

Moreover, it can help increase customer loyalty for organizations that incentivize the selling and buying of collectibles and offer significant revenue back to the customers, resulting in a great brand experience.

With many new concepts such as dynamic NFTs, where the NFT metadata can be changed or upgraded resulting in new unique traits for a few loyal users, NFTs power the attention and loyalty economies in Web3. Intelligent NFTs introduce an element of artificial intelligence (AI) to nonfungible tokens by making the holders believe that their profile pictures (PFPs) are nearer to their physical selves due to AI.

With that in mind, NFT royalties are here for the long term, and firms that adopt the business model might have an upper hand over their competition in the coming years.