Rug Pull describes unknown investors who have ‘the rug pulled underneath them’ by developers or creators of crypto. These kinds of scams come in different forms. However, the most common type of rug pull is the liquidity scam. This type of scam mostly happens on decentralized exchanges (DEXs).

They are run by consensus with many machines working together as one network, instead of working on a centralized exchange (CEX) that is privately owned by one central party. On a DEX, the developers can create a coin, crypto, or a crypto asset, and then list it for purchase readily, quickly, and for free.

In comparison, a highly rigorous approval process happens on CEXs, which normally need the details of their users to comply with anti-money laundering (AML) or know your customer (KYC) protocols. A new coin that is created on a DEX needs to be paired with another crypto, including a fiat currency (such as the sterling pounds or US dollars), and cannot be traded on the DEXs.

The developers will need to add an amount of the paired crypto along with an amount of their new token to a ‘liquidity pool’ that then facilitates the trading of the coin with a paired crypto. Once a coin is listed on a DEX, the developers of a new coin that intends on rug pulling will mostly whip up a PR storm around the phony coin on social media and then inject considerable liquidity into the pool.

In other cases, they artificially pump up the price of the coin by acquiring huge amounts of the same coin themselves before they slowly sell it like legitimate traders. The process is known as ‘pump and dump’ like the case of Kim Kardashian and Floyd Mayweather Jr. who have already been sued for supposedly engaging in it.

Related: US SEC Charges DJ Khaled, Floyd Mayweather, For Not Disclosing Payments to Shill Centra ICO

Such activities generate value for the coin in the market and then encourage unwitting investors to rush to purchase the coin as prices explode. After the trading volumes of the coin reaches a high level, there will be a considerable amount of paired crypto in the liquidity pool.

At that point, the rug pull happens and the rogue developers withdraw all of the paired cryptos in the liquidity pool and run into the Ether, mostly closing down social media accounts, sites, and other channels of communication. It drives the price of the coin o zero and all investors left holding the bag lose their investment in the coin.

The rug pull strategy may happen over several months or within days, as was the case in CryptoEats where the developer allegedly pocketed $500,000 within minutes. On the other hand, the rogue developers can decide to manipulate the function of tokens to complete a rug pull.

The legitimate developers normally choose a host like ERC20 that has a set of standards that are common to all the coins that use the ERC20 protocol. The standards include a function known as ‘approve’ that allows a token holder to sell the token on a decentralized exchange for the other assets.

Nevertheless, a criminal developer tries to manipulate the ‘approve’ function to prevent the users from managing to sell the token, just enabling the token to be purchased, and then reserving the ability to sell the token to the developers themselves.

In such instances, developers liquidate their holding after the market has driven up prices of the token considerably, while the users are left unable to liquidate any of their holdings. That is the type of manipulation at the core of the recent Squid Game token scam that left many users unable to sell any of their tokens after the price of the coin exploded from 0.012 to $2,861.80, at which instant the founders liquidated their holdings and ran for the hills.

Related: Squid Game Coin Tanks by 99% after Developers “Pull Rug” on Investors

Highlights Of A Rug Pull Scam

The price volatility of the crypto market appeals to those seeking to make a quick profit. Users mostly look for new coins on the DEX, aiming to get in early and, in turn, maximize their profits on what might be the next big coin.

There is nothing wrong with getting in early in a project. Nevertheless, users need to consider what they want to invest in carefully. Particularly, the users need to be wary of these characteristics that are found in most rug pulls.

- Buy only – as highlighted, users are mostly at risk whenever they cannot sell or spend the coins that they hold in their wallets. Coins that do not have any sell functionality in most cases end up being scams.

- Mysterious founders and developers – whenever scanty information is known about the coin’s origins and its founders, it might be a cause for alarm. The recent genuine altcoins have taken to YouTube and Reddit to host AMAs (Ask Me Anything). Any genuine, reputable, and transparent project leadership team might not decide to do a rug pull on the investors.

- Attention to detail – this sign was visible and strong in the SQUID coin. The project’s site, promotional materials, and white paper were filled with grammatical errors, typos, and outrageous claims. That is a red flag for any digital asset.

- Developer holdings – ensure that you check the number of coins in circulation is held by the developers, or in just a few wallets. A significant amount of the token supply held by the creators of the coin shows that they are well-positioned to manipulate the value of the coin.

- Liquidity – low trading volume or liquidity shows that the token might be challenging to exchange for other tokens or fiat. In case the coin’s liquidity is significantly low, it becomes easy for the developers to manipulate the price. Mostly, experienced crypto investors always look for a trading volume of 10% to 40% of the coin’s market capitalization. Anything less than that makes the coin suspicious.

- Locked Liquidity – developers of legitimate crypto softer ‘lock liquidity’ to protect the legitimacy of their coin. That method is where the developers lock the liquidity on the blockchain or with a third party, preventing the developers from interacting with the token supply. When the liquidity is locked, the developers cannot sell the tokens, therefore eliminating the chances of a rug pull. Coins that have locked liquidity are believed to be more trustworthy, and in most cases, the longer the liquidity is locked, the better.

- Project code – a majority of the developers make the project code publicly available as specific signs of a rug pull scam may be spotted in the code. In case the code is not available for public viewing, that might be a red flag.

These red flags make up the more prominent characteristics of crypto rug pulls. However, there are other signs. In most cases, the coins that appear overnight and receive lots of PR and hype need to be approached with caution. Research needs to be done before investors buy coins on DEXs.

For the people that are not ready to invest in DEX-based coins, trusted crypto platforms do an extensive vetting process before they host any coins on their platforms. While many risks still exist, some relief may come from the fact that some of the due diligence has been done for you, the investor.

Here are some of the most recent rug pull incidents:

Coinbase Deletes Crypto Links After ‘Rug Pull’ Warnings

On February 10, 2022, reports emerged that Coinbase Global removed ‘how to buy’ instructions for three crypto tokens that have been marred by ‘rug pull’ warnings that investors might end up losing their money. Coinbase stated that it aims to enhance its security measures to protect investors.

A spokesperson for Coinbase, Jaclyn Sales, explained that the links were removed from the crypto exchange’s site after Reuters brought up the matter. According to the exchange, there will be an upgrade in safeguards on its auto-created web pages.

Nasdaq-listed Coinbase has pages that offer tips on investing in cryptos and the controversial pages were informational and they chose to avoid making them available to trade on its wallet or app. According to sales, the pages had a disclaimer that the information was not investment-related and that the exchange was not liable for any delays or errors. They were just created automatically from the information that is carried by CoinMarketCap.

CoinMarketCap denied being aware of these pages and the vice-president of operations and growth Shaun Heng insisted that there was no partnership with Coinbase. In that context, Sales does not know whether Coinbase exchange ran any security checks on the coins whose information it pulled down.

“Coinbase plans to build a more robust disclaimer for the pages which are being auto-created.”

The exchange added:

“We will build a process to take down any other pages which CoinMarketCap has flagged as potentially being scams. Assets which relate to known scams were not tradeable on the exchange”.

One of the pages that Coinbase deleted featured DeFi100 and they told users to check CoinMarketCap to determine where it could be acquired. But, CoinMarketCap warns:

“We have received multiple reports that this project has exited as a scam. Please exercise caution.”

CoinMArketCap does not sell any crypto on its platform. But, it reports that DeFi100 tokens are yet to record any trading volumes since November 14. DeFi100’s Medium blog page and website are offline and they last tweeted in May 2021. In the same month, Twitter users said that DeFi100 had done a rug pull. Interestingly, DeFi100 denied these allegations in one of its last tweets on May 23.

Coinbase also pulled down a Mercenary token page which is now unavailable on Coinbase’s wallet and app. Mercenary launched in January 2022 and hit a peak of nearly $20. However, on January 26 it crumbled within minutes from around $8 to a fraction of a cent and its price is yet to recover, according to CoinMarketCap data.

Blockchain security firm PeckShield tweeted on January 26 that Mercenary had been marred by a rug pull and warned investors to avoid it. The project’s website and Twitter page are offline. It is unknown when Coinbase launched its Mercenary page. But, CoinMarketCap data shows that it first appeared on January 15.

Coinbase also deleted Squid Game that crashed to nearly zero in November 2021 in what experts and analysts believe is another case of rug pull. The coin is also not available on Coinbase’s wallet or app. The Medium account and website behind the SQUID token were speedily taken offline after the project imploded and remained down. Twitter suspended the project’s account, citing a violation of the network’s rules.

The SQUID developers said on Telegram in November that they had decided to abandon the token since someone was trying to hack them.

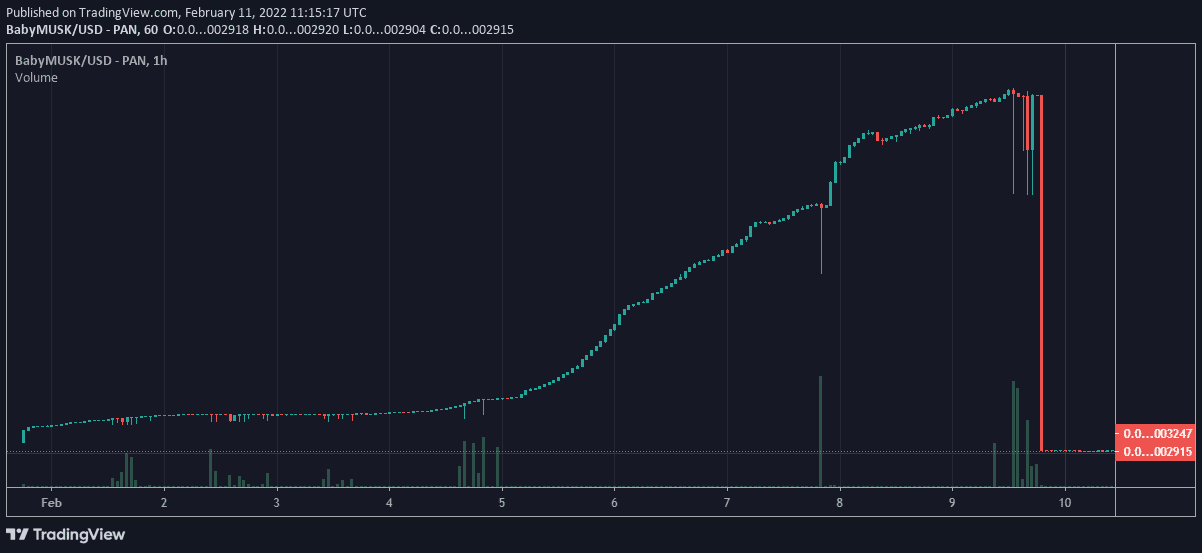

Baby Musk Meme Coin Plunges 100% After Rug Pull

On February 10, the Baby Musk Coin, a meme coined named after Elon Musk, underwent a rug pull as the price dropped steeply by almost 100%. Reports came up revealing that the developer of the project dumped the tokens, which caused the price to drop by a massive amount. Token holders could not sell the token, in what is known as a honeypot.

Baby Musk Coin raised $2 million in its ICO in early February 2022 promising to revolutionize the meme coins space. The developers strived to make the project appear legitimate, by saying that they wanted to revolutionize the crypto sector. The Baby Musk Coin website is now offline. However, it had a roadmap that explained the plans for this project.

After its announcement, the coin saw a price bump and CEO Grant Liu said that it was “just the beginning.” It listed features like an index fund and “Baby Musk Swap” as some of its key features. This, unfortunately, became another rug pull scam in the long list of such thefts that have been degrading the crypto industry recently.

Scams Still Increasing In 2022

Going forward into the year, scams will continue marring the crypto space as projects combat the issue. Notably, NFT scams appear to be prevalent currently as criminals capitalize on the increased interest in the nascent niche. Apart from fake artwork, the NFT marketplaces are also facing issues. Recently$2.2 million in Bored Ape NFTs was stolen, pushing OpenSea to freeze transactions.

The United Nations has even insinuated that North Korea is funding its missile program with stolen crypto. This nation was accused of attacking crypto exchanges and Chainalysis said that it had stolen over $400 million.

Related: Crypto Scams Still Persistent In 2021, SEC Warns About Red Flags To Watch

Education and awareness are important and effective in fighting scams. With regulations coming in later in 2022, better investor protection might help in preventing losses.