As the world continues to teeter on the brink of climate chaos, world governments have tried to find solutions that will spur greater efforts in creating solutions to the various environmental problems that are at the heart of climate change.

One such recent effort was the recent United Nations climate change conference (COP26) which took place at Glasgow Scotland from 31st October-12 November, 2021.

One solution that was brought to light at the conference is the SDG Exchange Carbon Credit Trading Platform.

Powered entirely by blockchain technology, the exchange could herald a new paradigm where emerging technologies are used to solve global problems.

We reached out to Jason Cooner who is the Chief Executive Officer (CEO) at SDG Exchange. He was gracious to us by answering our questions even on the sidelines of the conference!

Here is what he had to say.

Jason Cooner CEO at SDG Exchange

E-Crypto News:

What is the impact of carbon credits on global markets?

Jason Cooner, Chief Executive Officer SDG Exchange: A carbon credit is an instrument that represents ownership of one metric tonne of carbon dioxide equivalent (using co2 as a unit to measure different greenhouse gases) that can be traded, sold or retired.

Carbon credits are assets obtained from mandatory regulated markets (compliance markets) and can be traded (sold) or retired when a company doesn’t utilize (send into the atmosphere) its full allotment of carbon as allowed under cap and trade regimes in regulated markets.

This unit of carbon emissions isn’t, however, representing a reduction in GHGs from the atmosphere (draw down), which are achieved via projects specifically designed to cut down GHG emissions (for example, regenerative agriculture which absorbs carbon back into soil and/or plants).

Instead, tradable carbon credits are the consequence of a company’s efforts to reduce its allotted emissions via actions like making operations more efficient or using green energy rather than energy generated by carbon intensive fuels like coal or natural gas or using wood from sustainably managed forests.

Carbon credits are only traded in regulated, compliance mandated cap-and-trade markets.

E-Crypto News:

How do increases in carbon credits affect the environment? Please, can you give the big picture?

Cooner: Carbon credits allow companies to compensate for their greenhouse gas emissions.

Now a new blueprint offers a route to create a universally comparable standard for much carbon they save. And lays down the ground rules for transparent carbon credit trading.

E-Crypto News:

Please, can you tell us more about the SDG Exchange?

Cooner: SDG Exchange was founded to fully enable efficient, transparent and trusted global marketplaces for carbon offsets.

It delivers the marketplace infrastructure needed to implement Article 6 of the Paris Agreement.

The SDG Exchange platform uses blockchain technology (ETH) to track verified carbon offsets, facilitate trading, normalize standards and pricing, verify compliance and carbon offset (credit) retirement.

We are providing a long-term solution for the $300B sustainability marketplace.

It seamlessly integrates all voluntary carbon offset markets globally, allowing for quick, safe, and profitable trading of these assets.

E-Crypto News:

How is the SDG Exchange a world-first when it comes to carbon credit exchange?

Cooner: As the first global sustainability asset marketplace, SDG Exchange enables countries and companies to accelerate their adherence to Paris Agreement compliance through seamless, secure and transparent blockchain asset transactions at a global scale.

SDGx delivers turnkey SDG market infrastructure for countries that require offset markets and offset solutions to meet Paris Agreement commitments (NDCs), as well as provides trading and custodial solutions for companies to meet requirements of the Task Force on Climate-related Financial Disclosures (TCFD).

SDG also offers an independent exchange capable of transacting in and across every market, as well as global offset price normalization.

E-Crypto News:

What are the benefits of blockchain technology’s deployment for the SDG Exchange?

Cooner: Based on blockchain, the SDGx platform eliminates current inefficiencies including double counting, double printing, double spending, and emerging double retirement.

E-Crypto News:

Please, can you take us under the hood for the operations of the SDG exchange?

Cooner: The video might help.

E-Crypto News:

What are the requirements of the Task Force on Climate-related Financial Disclosures (TCFD)?

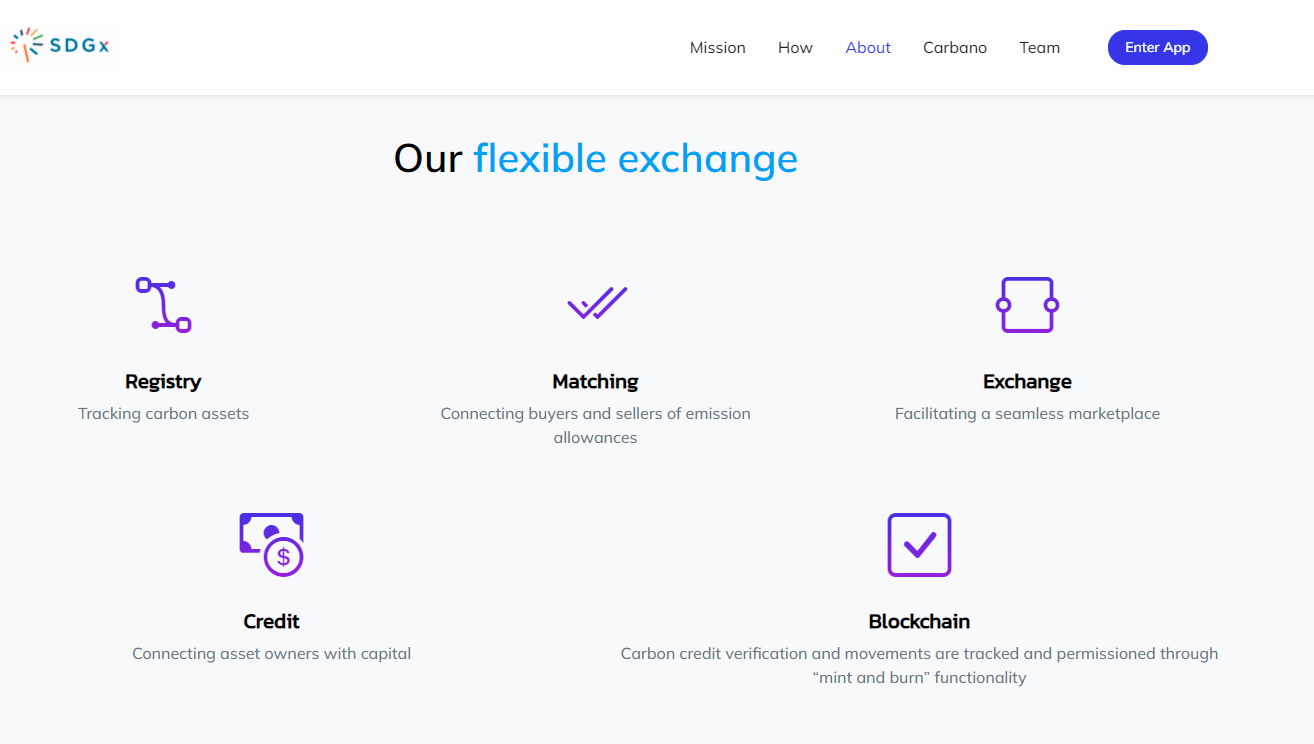

Cooner: Our platform allows for seamless tracking of carbon assets and exchange of emission allowances, where we track carbon assets, connect buyers and sellers of emission allowances, facilitate and the carbon credit verification and movements are tracked and permissioned through “mint and burn” functionality.

Also, the Carbono Token will make purchasing carbon credits, offsets or other assets instant and easy. One token represents a discount on the purchase of an ITMO. Carbono will be a public token. ITMO is a permissioned token that represents one ton of carbon.

E-Crypto News:

How does the SDG Exchange help companies meet these requirements?

Cooner: SDG exchange bridges the gap by allowing countries and companies to trade carbon allowances in order to ensure compliance and keep us on track to reduce global warming by 1.5°C before 2030.

E-Crypto News:

Please, can you tell us more about the global offset price normalization of carbon credits?

Cooner: A carbon offset generates carbon credit from projects having clear boundaries, titles, verification plans, etc and reduction of carbon dioxide emissions from Carbon offsets are outside the “four walls” of a company usually.

Projects like building a wind farm, supporting truck stop electrification projects, planting trees or preserving forests are very common carbon offset projects.

Carbon offsets are exciting because they have the opportunity to reduce global climate change at a fraction of the cost than if every entity were forced to reduce their emissions only internally.

E-Crypto News:

How can companies gain access to the SDG Exchange platform?

Cooner: Sign up at https://sdgexchange.io

E-Crypto News:

Who are the major key players in the blockchain space that have backed your venture? Please, can you tell us more about them?

Cooner: The SDG Exchange platform has been in development for four years and is backed by many well-known blockchain angel investors, including Michael Terpin (Transform Group), Nikolai Mushegian (MakerDAO), and Brock Pierce (Tether).

E-Crypto News:

Will carbon credits trading work?

Cooner: Yes!

E-Crypto News:

How are you going to bring big players, especially from developing countries, up to speed on the various issues, practices, and processes of carbon credit trading?

Cooner: Government and private entities can participate.

E-Crypto News:

What strategies are you deploying for greater inclusion of companies who are in non-compliant jurisdictions but are willing to cooperate?

Cooner: SDG Exchange is an all inclusive global platform.

E-Crypto News:

How have you navigated the waters of a world where no consensus on climate change exists?

Cooner: SDGx started designing Paris Agreement compliant infrastructure 4 years ago, and Article 6 is by most experts’ opinion almost entirely completed.

Any additional changes that are made to finalize any part of the Paris Agreement should be minor in overall technical structure, and will be worked into the SDGx platform as finalized to ensure full compliance with the Agreement.

Related: Report shows one-quarter of all tweets about climate change are produced by bots

E-Crypto News:

Is the SDG Exchange the best expression of the Paris Agreement? How does the SDG exchange fall within the paradigms of the Paris Agreement?

Cooner: The International Paris agreement created guidelines for each member country to limit their carbon footprint. Countries and companies that will fall below their maximum carbon allowance are entitled to sell their credits to buyers seeking an alternative to expensive emission cuts.

Likewise, companies can gain credits by developing programs that reduce total carbon.

SDG Exchange seamlessly integrates all carbon compliance markets globally allowing for quick, safe, and profitable trading of these assets using blockchain technology to track carbon, facilitate trading, and verify compliance.

E-Crypto News:

Please, can you tell us more about compliance within the SDG Exchange?

Cooner: The SDGX Platform uses blockchain technology to track carbon, facilitate trading, and verify compliance.

E-Crypto News:

What is the $300 Billion sustainability marketplace?

Cooner: The second part of UNCTAD’s Trade and Development Report 2021 published on October 28 outlines reforms of the international financial system to get more climate adaptation funds flowing to developing countries.

Estimates indicate that annual climate adaptation costs in developing countries could reach $300 billion in 2030 and, if mitigation targets are breached, as much as $500 billion by 2050.

But current funding is less than a quarter of the 2030 figure and the report warns that relying on private finance will not deliver on scale or to the countries most in need.

Related:What Is The Environmental Impact Of Creating Non-Fungible Tokens (NFTs)

E-Crypto News:

How is the SDG Exchange a Global carbon offset market?

Cooner: Carbon offsetting is the key mechanism to stop global warming.

Through reforestation efforts and sustainable farming practices, we can fight back against the damage wreaked by gaseous emissions.

For their work, farms are entitled to carbon credits. SDGX will purchase those credits to build the basis of our carbon exchange.

The International Paris Agreement created guidelines for each member country to limit their carbon footprint. Countries and companies that will fall below their maximum carbon allowance are entitled to sell their credits to buyers seeking an alternative to expensive emission cuts.

Likewise, companies can gain credits by developing programs that reduce total carbon.