NFTs have been in the news a lot lately, and there is a lot of hype around them. But are they really worth investing in? There are some risks to consider before making any decisions. In this blog post, we’ll explore whether or not NFTs are still a good investment despite the risks.

What is an NFT?

An NFT is an emerging form of digital asset ownership that is revolutionizing online commerce. It stands for “Non-Fungible Token,” and describes a type of cryptographic token that represents a unique item or asset. These tokens are embedded with important information such as an ID number and proof of authenticity. They serve to verify individual ownership and authenticity of digital property, often things like artwork, music, video clips, and tokens connected to physical goods like real estate.

Unlike traditional forms of ownership which may involve exchanging money or legal documents, NFTs provide security by being stored on the blockchain, allowing buyers to securely store their digital assets. This new technology will completely revolutionize the way we exchange value and collectibles in our digital world!

Risks Associated with NFT Investments

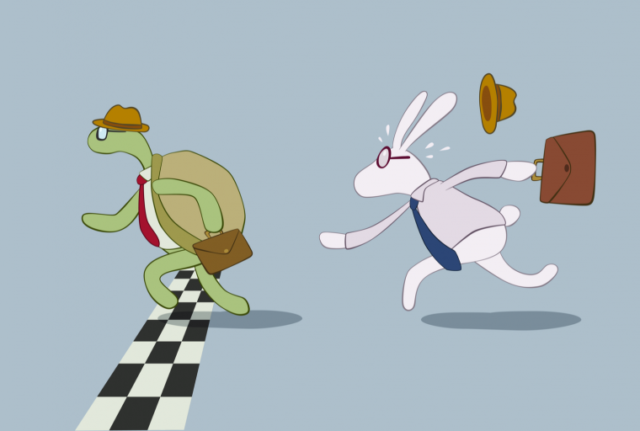

Investing in Non-Fungible Tokens (NFTs) can be a high-risk, high-reward opportunity. Although prices for some of these tokens have skyrocketed in recent months, the truth is that there are numerous risks associated with this bold investment strategy. As investors may not have complete control over the underlying asset, their chances of making a return could be impacted by harsh market conditions, sudden bankruptcies, and unforeseen changes in supply and demand.

What’s more, since NFTs are not linked to major financial indices like stocks or commodities, investors cannot rely on established metrics to measure short-term growth. They must also take into account potential issues such as fraud or malfeasance by developers and protect themselves from vulnerability threats posed by careless coding.

With so many factors to consider before committing capital to the non-fungible token market, investors should be sure to do their due diligence before jumping into this brave new world.

Potential Solutions for Mitigating Those Risks

Mitigating risks is essential for the success of any project or initiative. The key to success lies in being proactive, rather than reactive; addressing potential risks before they arise. To do this, it is important to identify and assess the potential risks that may arise. Using data-driven methods such as Monte Carlo simulation can help to identify areas of risk so they can be addressed accordingly.

Another effective strategy is developing a risk management plan with contingency measures should things go wrong. This includes allocating resources, selecting risk response strategies, identifying tasks and responsibilities, and ensuring stakeholders are consulted and kept informed throughout the process. Finally, it is helpful to introduce a system of checks and balances into your strategy for minimising possible risks for greater assurance of success.

Examples of Successful NFT Investments

Although investing in non-fungible tokens can involve a certain degree of risk, there is no denying the fact that many smart investors have landed lucrative returns from NFT investments. Take a look at the Bored Ape Yacht Club Collection, which was only worth 14.99 ETH when it came out and how worth around 70 ETH but rose to as high as 150 ETH in May 2022.

In another example, one investor was able to sell an Ethereum-based artwork for $69 million, while another sold virtual real estate for $500,000.

And even celebrity fame can be leveraged when it comes to NFT investments! To illustrate, take a look at popular rapper and artist Akon, who made waves recently by selling his own NFTs and raising millions. This is just further proof that despite their associated risks, astute investors who do their due diligence can tap into a long term wealth creation strategy through NFTs.

To get started on your own NFT journey, take the time to understand the technology behind these assets – the sky could truly be the limit if you make all the right moves.

DYOR – Do Your Own Research

As the saying goes, knowledge is power, and in today’s highly competitive world, it pays to do your due diligence before making any big decisions. Doing your own research can help you make smarter, more informed choices regarding investments, career paths, or even important purchases like a car or a home.

Not only will taking the time for research give you peace of mind that comes with knowing you made the best decision possible, but it will also expand your understanding of any given topic. So next time you’re faced with an important decision like if you’re planning on investing in NFTs, don’t take anyone’s word for it—do some research and get empowered to make great choices!

Key Takeaway

While there are potential risks associated with investing in NFTs, there are also plenty of opportunities for making a profit. By doing your own research and due diligence before making any decisions, you can mitigate the risks and make informed choices about which NFTs to invest in.

And as we’ve seen from the examples above, even successful investments come with some risk – but that doesn’t mean they’re not worth it. So if you’re thinking about investing in an NFT, go for it! Just be sure to do your homework first.