Cryptocurrencies and blockchain technology undoubtedly have a bright future ahead. However, apart from the many success stories, many cryptocurrencies have failed as of March 2023. Since Bitcoin was launched in 2009, thousands of cryptos have been launched with the aim and hopes of introducing new utilities to the end users.

Sadly, not many of these cryptos survive beyond launch and those that survive can still encounter crippling challenges.

While it is hard to determine the exact number, between 1,700 and 2,500 cryptocurrencies might have failed and disappeared from the market entirely. Popular examples of coin failures include UST, SQUID, LUNA, and BCC tokens. Some of the key reasons why the cryptos fail include lack of investment and trading volume, abandonment by the developers, hacks, and rug pulls.

Many platforms define failed Cryptos as ‘dead coins.’ Normally, dead coins are associated with a lack of liquidity, abandonment by the developers, a scam, or a combination of all three. It is critical to know the dead coins since the digital assets can continue existing within the blockchain ecosystem.

Although all value is stripped from them, dead coins can be listed on crypto exchanges and coin aggregators, which becomes a major hazard for investors.

Which Are The Largest Cryptos That Have Failed?

Luna (LUNA)

LUNA was the native crypto of the Terra blockchain; a network that was perfectly designed for the creation and use of stablecoins. In November 2021, LUNA reached an all-time high market cap of $44.8 billion and a price of $116. Nevertheless, in May 2022, Terra’s whole ecosystem imploded. Because of the massive selling pressure, Terra’s biggest stablecoin, TerraUSD (UST), started to de-peg from $1.

Being an algorithmic stablecoin, LUNA was utilized in the stabilization and defense of the peg. Nevertheless, the Terra Foundation failed to regain the peg, and in the end, the price of both LUNA and UST collapsed.

LUNA was rapidly removed from a majority of the crypto Exchanges. The drop of LUNA is still one of the largest, if not the largest crypto failure in the history of the entire crypto market. It was significantly big that it was referred to as ‘Mt. Gox 2.0’ by members of the different crypto communities.

Related: BUCKLE UP!- Why Did Terra LUNA And UST Crash So Steeply?

TerraUSD (UST)

UST was the leading stablecoin of the whole Terra blockchain. Due to its constant stability, the coin was incorporated into multiple CeFi platforms and DeFi protocols. Nevertheless, the 1:1 USD dollar peg of the coin was violently attacked in May 2022, which resulted in one of the biggest crypto failures ever seen.

UST’s de-peg was caused by a huge UST sale that happened on a decentralized stablecoin exchange called Curve. Most people believe that the sale was an intentional attempt to destabilize the whole Terra network, and that is what eventually happened.

The failure of UST resulted in the abandonment of the whole Terra network, including the native coin, LUNA. TerraUSD was pulled down from all the major crypto exchanges.

Squid Game (SQUID)

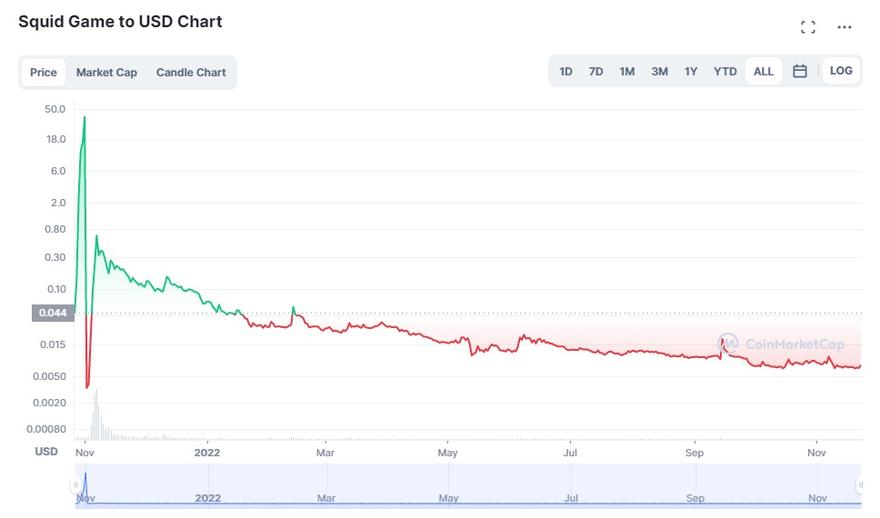

Due to the hype linked with the released TV series, Squid Game, a set of unknown developers introduced an accompanying Squid Game token. After launching in October 2021, SQUID gained 23,000,000% within a week, before rapidly collapsing back to 0.

Marketed mainly as a utility token for a play-to-earn game, the developers of SQUID were seen to use the backdoor within its code to access funds held in a decentralized exchange liquidity pool. After the malicious creators exited with liquidity, the price of the coin collapsed greatly; a move commonly known as a ‘rug pull’.

Based on reports, the SQUID developers stole nearly $3.4 million worth of assets from the investors.

Related: Squid Game Coin Tanks by 99% after Developers “Pull Rug” on Investors

BitConnect (BCC)

BCC was the native token of BitConnect, a platform that enabled investors to earn some interest on Bitcoin. Investors may swap BTC for the BCC token and earn interest while holding it. It was said that high returns were the result of a proprietary trading bot that could spot different profitable opportunities in the market. At its peak, the BCC token reached $400 per token.

Nevertheless, in January 2018 the platform was quickly closed by the authorities due to concerns that it was a front for a Ponzi scheme. The extent of the Ponzi scheme was revealed in early 2022, when the founder, Satish Kumbhani, was indicted with a range of fraud charges.

After the closure of the exchange, the BCC token dropped 90% and was rapidly delisted from all crypto platforms, leaving thousands of investors holding the dead coin.

SafeMoon (SAFE)

In 2021 a crypto known as SafeMoon, also called SAFE, was released and it quickly gained attention on social media. Due to a well-implemented marketing scheme, that involved getting the backing of many celebrity figures, the SAFE token became widely known within the entire crypto space.

The crypto offered a strange mechanic whereby 5% of each transaction went back to the SAFE holders, thereby encouraging investors to hold it. 5% of each transaction was also destroyed.

Nevertheless, in 2022, many crypto lawsuits were filed against the founders and promoters of SafeMoon for artificially pushing prices up. Although the coin is tradable and continues to have a small community, the coin was removed from most of the platforms.

Why Do Cryptocurrencies Fail?

Cryptos and crypto projects fail for many reasons. By understanding what these reasons are, crypto investors can place themselves in a stronger position when creating a crypto portfolio. The most common reasons that have made crypto projects fail include:

- Saturated market – although cryptos have existed for around 14 years, there are more than 10,000 cryptos in existence. This has resulted in oversaturation and the weaker projects have failed as a result.

- Lack of liquidity – a major side effect of oversaturation is low liquidity. If interest in a crypto project drops, liquidity mostly falls. When liquidity falls, it becomes quite challenging for investors to sell and buy. Most platforms consider crypto to be ‘dead’ in case the trading volume of the coin is below $1,000 in the previous 3 months.

- Inexperienced team – lack of real utility can mostly arise from an inexperienced team. The most successful crypto projects are run like businesses. Although people can be great at coding and generating ideas, the implementation of these ideas is what results in success. If the developers are inexperienced in the business world, the project may eventually fail.

- Lack of funding – if a project lacks adequate funding, it is bound to fail.

- Scams – it is almost too easy to create crypto, and that makes the crypto market highly risky, and malicious parties and scams exploit easily. Many examples of crypto scams involve investment schemes and rug pulls that are abandoned after enough money is collected from the investors.

- It does not solve a problem – most of the successful cryptos are designed with utility in mind. Nevertheless, there are thousands of cryptos created with no specific purpose. While some joke and meme coins like Shiba Inu and Dogecoin are doing well, most of the others have failed after launch.

Related: What is Shiba Inu Used For?

Many cryptos have failed so far in 2023. As more coins are developed, more keep failing and the market keeps eliminating the weaker projects. Despite a large number of failed coins, the crypto market still promises to be a great investment opportunity for many investors seeking to diversify their investment portfolios.