Crypto enthusiasts are currently setting their sights on Ethereum this week, as the crypto undergoes an upgrade dubbed Shanghai. According to some users, the Ethereum Shanghai upgrade might hurt the price of the biggest altcoin in the market, in the near term.

For several months now, Ethereum has been building on this Shanghai Upgrade. With barely days to go investors’ interests appear to be changing gradually. It might eventually happen to be so that the currently massive staking hype might not be sustainable, and most of the money could flow back into this segment of the cryptocurrency industry.

The Shanghai upgrade is scheduled to activate on April 12. Interestingly, it will allow users who have beforehand staked lots of their ether (ETH) on the platform to withdraw funds for the first time. Some commentators insist that these withdrawals may have significant negative impacts on the Ethereum price moving forward.

This upgrade also features the implementation of different Ethereum Improvement Proposals (EIPs).

Related: Ethereum 2.0: Is It Any Better from Its Predecessor?

Money Is Moving Out Of Altcoins

Recent market analysis reports have shown that the growing dominance of Bitcoin is appearing to triumph over the altcoins, with their market capitalization remaining mainly unchanged since mid-February.

The cumulative market cap of all cryptos, excluding Bitcoin, was expected to record some growth, but the market cap is oscillating around $613 billion, which is the same high it was nearly seven months ago in September 2022.

Nonetheless, the crypto sector is still expected to perform well, considering the depreciating conditions of the general TradeFi markets. In that context, Ethereum might be the leader of the improved markets with the introduction of staking withdrawal on the chain. This is expected to be the case since the Shanghai upgrade will unleash $36 billion worth of ETH, which might increase the general liquidity in this market.

But, before all that takes place, the dwindling alt-season might push investors to pull out of altcoins and focus on the currently thriving decentralized finance (DeFi) sector.

Here are some of the things users need to know about Ethereum’s Shanghai upgrade and how it will eventually affect the Ethereum market.

Completion Of The Shift To Proof-Of-Stake

In recent months, Ethereum has been moving from proof of work (PoW) to a proof of stake (PoS) consensus mechanism, and the Shanghai upgrade is the last step of this process.

Proof of stake is a highly energy-efficient method of validating crypto transactions where validators are chosen indiscriminately based entirely on the staked ETH. Proof of work consumes lots of energy since all validators compete to be the first to validate blocks.

Ethereum launched as a PoW network. However, its PoS-based Beacon Chain that operated concurrently with the PoW blockchain was launched in December 2020, and a merger between these chains, called The Merge, happened in September 2022.

Related: With the Upcoming “Ethereum Merge”…We Talk to a Professional

While Ethereum users have managed to stake their ETH since the introduction of the Beacon Chain, they did not have a chance to unstake their ETH. The Shanghai upgrade changes everything in the form of EIP-4895 and completes the transition to Proof of Stake.

Investors Wary Of Staked ETH Coming Into The Market

Many investors are now worried about the ability to unstake Ether and the involved staking rewards earned so far because it might allow many users previously unable to sell their staked ETH to offload their possessions on the market. Today, around 15% of the total ETH supply is staked on the network.

Based on recent reports, up to $2.4 billion worth of selling pressure may drop into the ETH market because of the Shanghai upgrade.

Nevertheless, it should be known that all of the staked ETH will not be unstaked at the same time. A preset limit of the staking withdrawal amounts that can happen per block is already activated. Based on some previous estimates, it would take about 60 days for 20% of the stakers on the Ethereum network (validators) to unstake their ETH.

Related: What Are Liquid Staking Derivatives (LSD)?

Liquid Staking Will Not Sustain The Hype

The DeFi market has grown by more than $14 billion within a month, even as the general crypto market struggled hard to gain. Notably, the total value locked (TVL) across the various blockchains increased from $66 billion to $80 billion, recording a seven-month high.

For now, investors appear to be highly interested in Lending protocols than Liquid Staking protocols. That is regardless of the huge Ethereum Shanghai hype that has been a major underlying power and support for the Liquid Staking Derivative tokens.

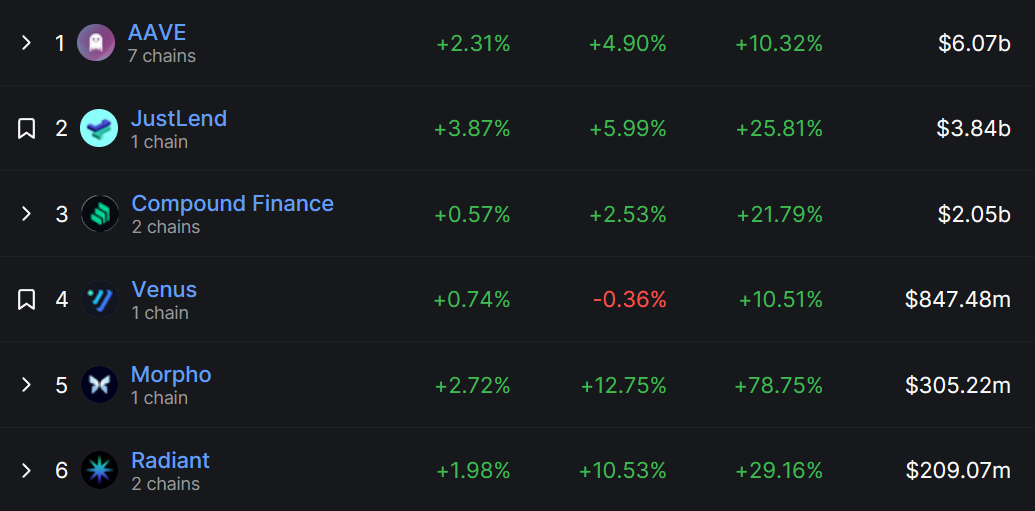

Lending protocols have recorded a massive increase in TVL in the past month compared to staking. Tron-based JustLend and Compound Finance have gained 21% and 25% respectively in their inflows. Morpho, an emerging decentralized application, has gained more than $300 million in TVL, surging by 79% in the same period.

On the flip side, some of the leading Liquid Staking protocols’ total value has only recorded a 10% average growth. It is only Coinbase Wrapped Staked ETH and Lido Finance which grew by 20% and 16% respectively. The others did not record considerable gains in the month leading to the Shanghai upgrade.

This means that investors possibly consider the overwhelming staking hype as a bubble. A reason for such sentiments is that despite the availability of the option, people will not really withdraw their staked Ether.

Also, the staking hype is short-lived because the focus is expected to shift back to investment in rewards-yielding options after the market weighs in on the Shanghai upgrade entirely.

Environmental Impact

Shanghai is the final step for Ethereum’s shift from PoW to PoS. The upgrade also reintroduces crypto’s continuing debate about its potential environmental impact. PoW needs miners to substantiate their reliability to the network via the use of computer hardware, while Proof of stake goes for the strategy involving the staking of a cryptocurrency asset.

For that reason, proof of work uses a lot more energy than proof of stake.

The PoS supporters mostly refer to PoW as a wasteful strategy, while the PoW supporters view PoS as less secure and easily affected by centralization.

Ethereum Transactions’ Technical Upgrades

The capability of unstaking ETH is not the only notable change that is coming with the Shanghai hard fork. For instance, there is the EIP-3651, EIP-3855, and EIP-3860, which are all expected to boost the efficiency of all the transactions executed on the Ethereum network and lower gas fees for different decentralized applications (dApps).

Please note there are multiple consensus-layer alterations featured in the Shanghai hard fork. These changes come in the form of a Capella upgrade. For that reason, most ETH developers refer to the integration of the two upgrades as Shapella (a mix of Shanghai and Capella).

:max_bytes(150000):strip_icc():format(webp)/Ethereum-b49ef699d76e47c78965579ec7c25ac1.jpg)