PancakeSwap is a decentralized exchange that enables investors to trade cryptos and tokens without needing to use a centralized intermediary. The platform keeps custody of the users’ tokens all the while.

It is set up on automated smart contracts that are deployed on the Binance Smart Chain (BSC), the network that is managed and operated by the Binance cryptocurrency exchange. Although Binance ideally operates a centralized exchange service, it does not operate or control PancakeSwap.

The platform was entirely developed by anonymous developers. Interestingly, this service appears and feels quite similar to the famous Ethereum DEX, Uniswap. PancakeSwap is mainly used for BEP-20 tokens supported on Binance Smart Chain. But, it is possible to shift tokens from other platforms through Binane Bridge and ‘wrap’ them as a BEP-20 token that can be used on the DEX.

Just like many other DEXs, PancakeSwap is developed on an automated market maker (AMM) system that relies mainly on user-fueled liquidity pools that enable crypto traders. Instead of dealing with an order book and looking for another investor or trader that wants to swap the tokens you have for the others that you want, customers lock their coins into a liquidity pool through smart contracts.

That enables you to swap whatever coin you want and the users that keep their coins in the pool earn rewards the entire time. PancakeSwap is a part of the surging wave of decentralized finance services that enable cryptocurrency traders to do transactions with trade tokens without a middleman taking a chunk of the funds.

This project is one of the biggest such DEXs on the Binance Smart Chain, even though there are DEXs on Ethereum, like Uniswap, with considerably higher average trading volume.

PancakeSwap has managed to flip Uniswap on several occasions becoming the biggest and most popular DEX with respect to trading volume. Nonetheless, it is yet to constantly maintain the title for now.

How PancakeSwap Works

As mentioned earlier, token swaps happen through liquidity pools between token pairs. Customers can exchange a token for another without the need for intermediary services, while the other users that stake their tokens in the liquidity pools get a segment of the rewards that are generated by transactions.

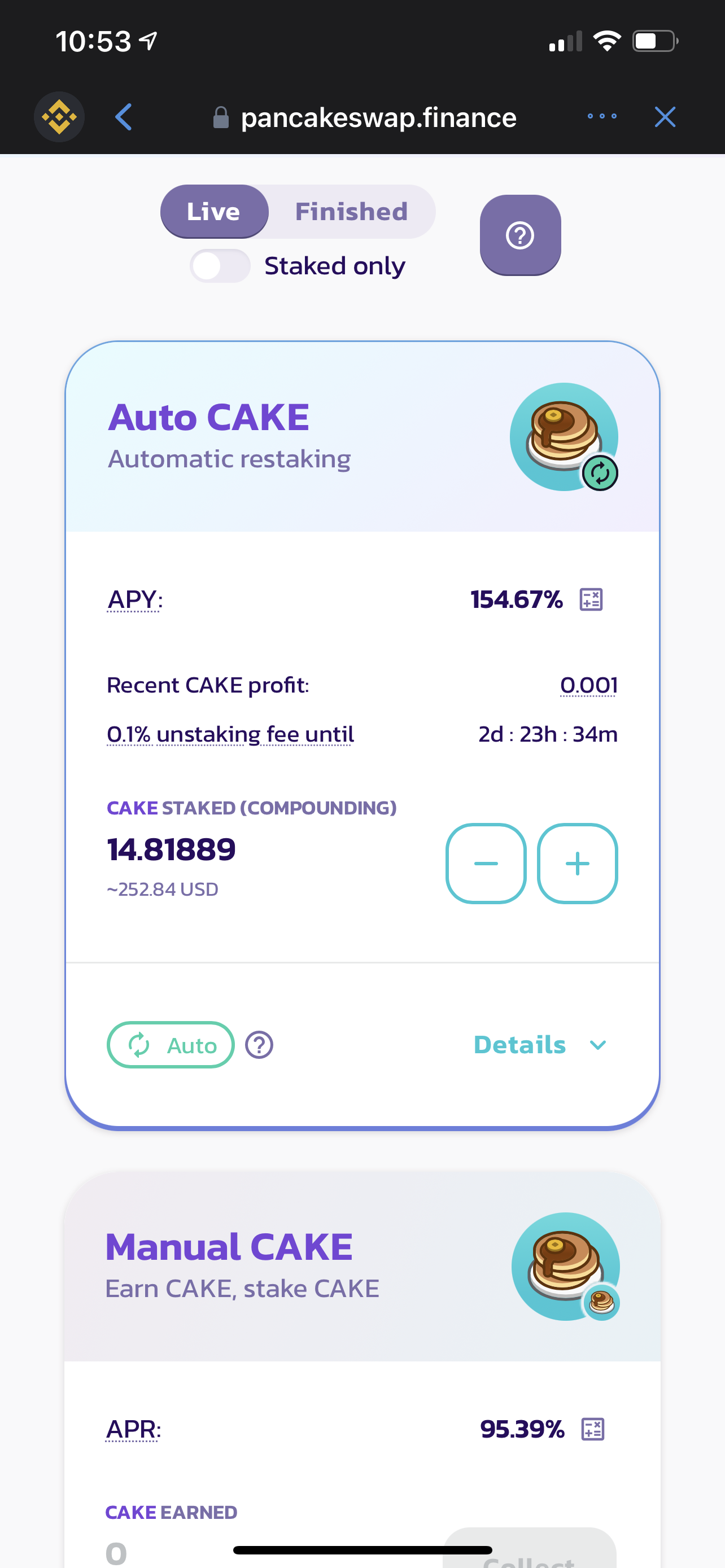

Nevertheless, this is one side of the general PancakeSwap experience. This DEX also lets users stake their coins into the so-called Syrup Pools that offer growing rewards. For instance, you can stake PancakeSwap’s native coin, CAKE, and earn additional CAKE by letting your funds stay in the Syrup Pool for some time.

There is an auto-stake option available enabling users to re-stake their CAKE at least once every hour. This re-staking strategy continuously compounds the investors’ rewards.

When using this platform, you enjoy game-like experiences, including wagering on whether the Binance Coin (BNB) price will surge or plunge within a limited period. Moreover, it has a lottery component that enables users to purchase a ticket hoping that they might win a massive windfall of CAKE.

The DEX also offers an assortment of bunny-themed collectible non-fungible tokens (NFTs) to purchase. Notably, there are also some Initial Farm Offering (IFO) sales that let users acquire some brand new coins from the nascent projects. PancakeSwap is the latest in a growing list of food-themed cryptocurrency projects that include Yam Finance, Kimchi Finance, SushiSwap, and BakerySwap.

What Is Unique About PancakeSwap?

The platform eliminates third parties in the form of centralized exchanges, enabling users to reap the available rewards instead. For anyone ready to lock up their tokens for a while, the involved rewards can be massive, especially when using some of the staking options and liquidity pools.

However, the platform might not be viable for those coming into cryptocurrency for the first time since it has myriad features. But, the rewards are worthwhile for those who take their time to learn how PancakeSwap operates.

In the current cryptocurrency landscape, three major decentralized exchanges dominate. Uniswap is the original decentralized finance liquidity protocol developed on Ethereum. It operates as today’s standard for straightforward and easy crypto trading using the ERC-20 tokens and mainly ETH pairs.

The second decentralized exchange is SushiSwap which is a community-governed Uniswap fork. It has managed to evolve into a DeFi hub offering various token swaps, farming, and cryptocurrency borrowing/lending services.

PancakeSwap is the third most dominant decentralized exchange. It is a Uniswap clone that is developed on Binance Smart Chain to offer fast and affordable trades using BEP-20 tokens in conjunction with the BSC←→ETH bridge.

While all three support community governance, decentralized exchange, LP (liquidity provider), and yield farming opportunities, only PancakeSwap and SushiSwap pay some rewards back to the holders that stake their tokens.