About VALR

VALR is a digital-asset platform headquartered in Johannesburg, South Africa, that allows customers to buy, sell, store and transfer Bitcoin and other cryptocurrencies seamlessly and securely. It offers a vast selection of digital assets. VALR’s mission is to help build a financial system that recognizes the oneness of humanity. Learn more at www.VALR.com.

VALR, a cryptocurrency exchange headquartered in South Africa, today announced that it has raised $50 million (over R750 million) in Africa’s largest ever crypto funding round. This values the company at $240 million (R3.7 billion).

VALR’s oversubscribed Series B equity funding round was led by Pantera Capital with participation from Alameda Research, Cadenza, CMT Digital, Coinbase Ventures, Distributed Global, GSR, Third Prime, Avon Ventures, a venture capital fund affiliated with the parent company of Fidelity Investments, along with existing investors Bittrex and 4Di Capital, and others.

VALR offers its customers the ability to safely buy, sell and store Bitcoin and 60 other cryptocurrencies—the widest selection of any platform in Africa—at some of the lowest fees in the world. VALR has processed over $7.5 billion (R115 billion) in trading volume since its launch in 2019 and now serves over 250,000 retail customers and 500 institutional clients from across the globe.

The proceeds of the raise will be used primarily to expand across Africa and into other emerging markets such as India, and to bring more products and services to its growing base of global customers. VALR is also hiring extensively across all areas of its team.

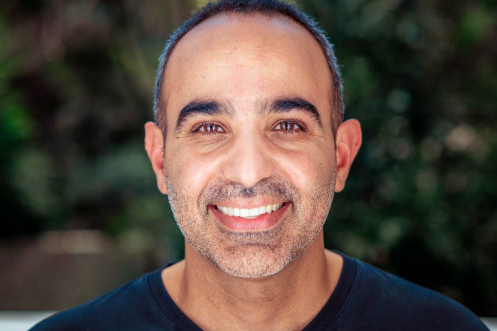

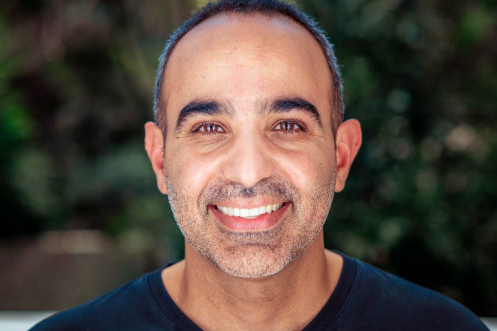

“Society’s financial tools should unite us, not divide us. That’s why I’m very excited that VALR is helping to build a financial system that recognizes the oneness of the human race. There is no longer any room for doubt regarding the impact crypto assets are having on our global financial system,” says Farzam Ehsani, VALR CEO and co-founder. “We already help VALR’s customers enter this new world of crypto from the traditional financial system using their USD or ZAR, and I’m very excited that this round of funding will allow us to serve so many more across Africa and the world.”

VALR has seen its valuation grow by more than 10X since it raised its $3.4 million Series A round of funding in July 2020.

“Pantera is extremely excited to be leading the Series B round for VALR, as we believe that Africa’s future is bright for the adoption of cryptocurrencies for both asset diversification and payments,” says Paul Veradittakit, Partner at Pantera Capital. “VALR brings an amazing product and service to onboard both retail customers and institutions.”

“We’re very impressed with what VALR has built for retail and institutional traders over the past few years,” says Kumar Dandapani, Founder and Managing Partner at Cadenza Capital Management. “VALR is extremely well-positioned to emerge as an enduring financial institution that provides its clients asset allocation abilities in crypto and other global markets.”

VALR plans to onboard many more institutions from the traditional financial system, including the largest banks, insurers and hedge funds, to assist them with the infrastructure needed to enter the crypto asset market.

“The world is on the precipice of huge financial change. Crypto assets will become more and more pivotal to all our lives. VALR is here to help bridge our customers from the old financial system to the new. Whether you’re an individual or an institution, we look forward to serving you,” Ehsani concludes.