This morning on CNBC’s Squawk Box host Jim Cramer stated that the whole Crypto Market was being held together by Sam Bankman-Fried and Alameda Research. Cramer also wondered out loud if ‘SBF’ had the cash. Here is what you should know about Sam Bankman-Fried and his investment arm company-Alameda Research.

Alameda Research is primarily a Hong-Kong based private equity company launched by Sam Bankman-Fried in October 2017. It offers full-service crypto trading and trades on each market and exchange and engages in OTC trading. The company offers liquidity in digital assets and cryptocurrency markets.

Analysis shows that Alameda Research Ventures (ARV) invests in seed-stage to growth-stage firms in the financial technology (fintech) and crypto industries. As of September 2021, Alameda Research managed at least $1 billion in digital assets. At the time, the company traded $1-10 billion daily across thousands of products including altcoins, major coins, and their derivatives.

But as of recently, Alameda has been throwing a lifeline to companies like Voyager Digital and BlockFi who have had cash flow problems during this Crypto Winter, it is said that Alameda extended a 500 million dollar loan to Voyager to keep the exchange solvent.

The company has a global reach and can trade on all major markets and exchanges. Sam Trabucco and Caroline Ellison are the co-CEOs of the crypto trading company. Backed by Sam Bankman-Fried, Alameda Research is one of the largest venture capitals in the Crypto industry. Notably, the Solana ecosystem is the firm’s biggest investment.

Related: Bancambios Chooses Solana Blockchain to Build its Impact-Driven DeFi Platform

Alameda is one of the few full-service firms for projects. It aims to become a Market Maker that offers liquidity to nearly 35 of the current leading brokers. Or over the counter (OTC) with high liquidity, and low arbitrage, for all assets listed on the exchange.

In 2021, we saw the involvement of venture capitals (VCs) that have been largely investing in the crypto industry. Just like everywhere else, the venture capital space can be categorized into tiers. Top-tier VCs can manage billions of dollars in crypto assets.

On its part, Alameda has made a major bet on Solana and its network, which yielded the venture capital an enormous fortune.

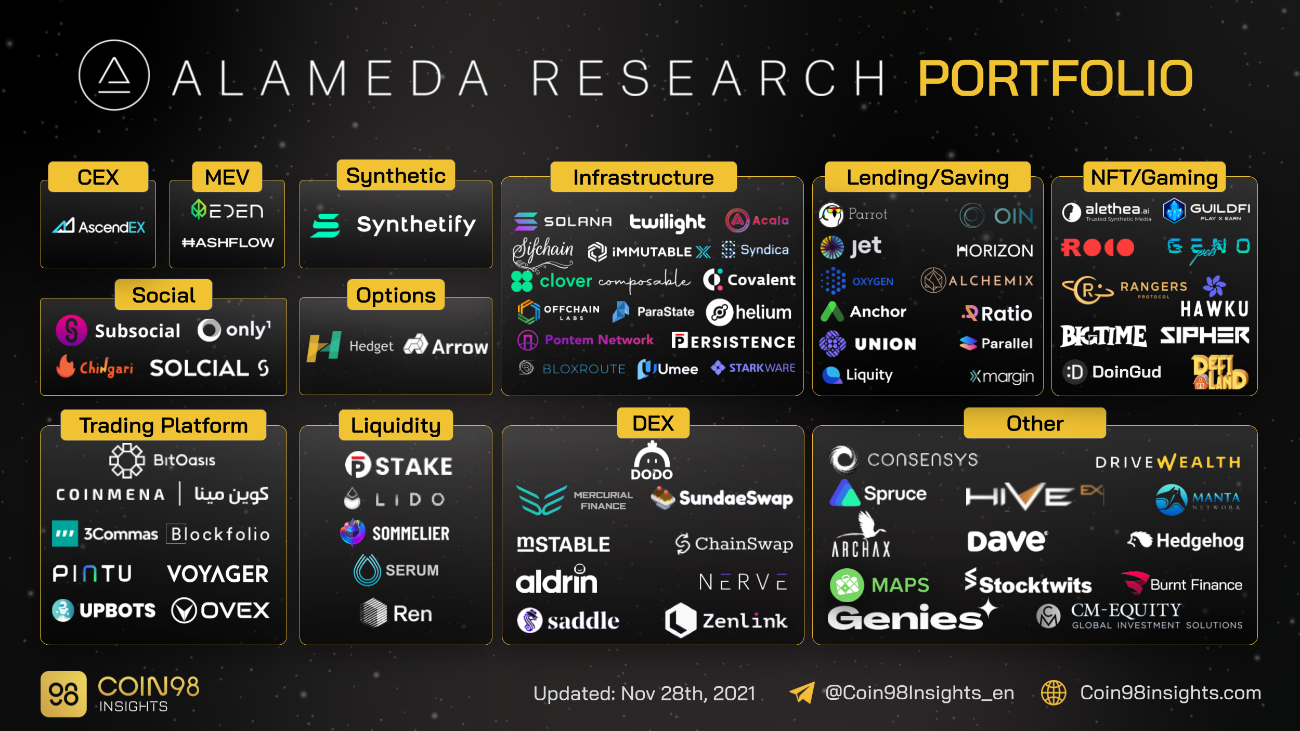

Alameda Research Portfolio

Since 2017 in the crypto space, Alameda Research is now focusing on investing and trading. As already mentioned, they manage $1 billion in crypto-assets and trade $1-10B daily volume in different crypto asset classes.

The portfolio covers every niche in the crypto space. Nonetheless, the team concentrates on the higher layers of crypto platforms. Thus, there are notable projects across categories in market infographics.

Infrastructure

StarkWare raised about $75M in a Series B funding round spearheaded by Paradigm and other investors including Alameda Research as a new investor in March 2021. Many big venture capital firms are coming in to support the scaling solution for the biggest smart contract platform, Ethereum.

Helium is a 5G blockchain network that raised $111 million in a token sale that was led by Multicoin Capital, Alameda Research, and a16z. Sam Bankman-Fried said that 5G would provide a massive opportunity to enrich the quality of lives throughout the world.

Umee got $6.3 million in a seed round led by Polychain Capital in June 2021 with the participation of Alameda Research and Coinbase. Umee is primarily a Cosmos-based platform that uses the IBC protocol to integrate Cosmos with Ethereum and other EVM blockchains.

Acala, being one of the decentralized finance (DeFi) Hub of Polkadot, was among the 12 teams chosen for the second accelerator program by the DeFi Alliance where Alameda Research came in as a mentor.

Related:DeFi Yield Protocol is Building its Way into the Future

Being a trading company, Alameda Research’s investment blueprint is not mainly targeting the infrastructure of projects in cryptocurrency. Furthermore, the venture capital mostly participates as an investor with other huge VC leaders in the infrastructure deals. They have great relationships with other VCs while getting along the way in the crypto space.

Yield Farming

Alpha Finance is now emerging as a cross-chain DeFi ecosystem including Alpha products that can help generate the best yields for clients with minimal risks. For now, Alameda Research has been positioning itself as Alpha Finance in the investment portfolio since 2018. Alpha Finance is considered a yield farming model in cryptocurrency.

Tulip Protocol, previously Solfarm, raised $5 million in a strategic funding round that was done by Jump Capital, Alameda Research, and many other investors. Tulip Protocol operates on Solana and offers yield farming services that can eliminate the current issues faced by the Ethereum blockchain.

The Tulip investment of Alameda Research is the next move to discover a better yield farming company to incubate. The trading company might envision Tulip Protocol to be the next big thing like Alpha Finance of Solana.

Wallet/Payment

Math Wallet concluded a $7.8 million investment deal in a Series A+ funding round that was spearheaded by Alameda Research in November 2020. The platform strives to develop a multi-chain wallet that can support more than 60 blockchains, including the massive to less popular ones.

Coin98 Finance raised around $4 million from Alameda Research in April last year. The quantitative trading company is convinced that the crypto market will grow quickly in the coming years. Hence, they put in an investment deal for the suit of decentralized finance product Coin98 which is based in Vietnam.

MobileCoin raised $66 million in a Series B funding round in August 2021 where venture capital firms like Coinbase Ventures, Alameda Research, and many others participated. The project strives to build up a privacy-focused platform offering mobile payment services.

Crypto wallets are the layer in the crypto industry that has the most exposure to users around the world since all entrants need to have at least one crypto address. In that context, Alameda added some potential projects from around the world into its portfolio.

Decentralized Exchange (DEX)

DODO is a Chinese decentralized finance project that raised $5 million from top venture capitals, including Pantera Capital, Alameda Research, Binance Labs, and several other investors. This project developed a new market-making algorithm “Proactive Market Making” (PMM) that integrates the operational functions of AMM and order book to offer lower slippage and cheaper gas fees.

Mercurial Finance is backed by the decentralized finance (DeFi) Alliance, including Alameda Research. This DEX for stablecoins raised more than $10 million in funding until May 2021. The leader of DeFi Alliance is convinced that stablecoin liquidity is important for Solana to flourish.

Related:What Are Decentralized Exchanges (DEXs)?

Nerve Finance is a stableswap on BSC, which sold $2M worth of tokens for major investors in a strategic funding round in April 2021. These investors include CMS Holding, Three Arrows Capital (3AC), and Alameda Research. In August 2021, Nerve Finance rebranded to Synapse to become a cross-chain AMM platform for tokens.

SundaeSwap is an AMM DEX powered by Cardano. It concluded a $1.3 million investment deal by Double Peak Group, Alameda Research, cFund, and other investors in September 2021. Alameda now aims at possible blockchain ecosystem clients to ensure that they expand their coverage to Cardano. SundaeSwap is anticipated to grow and offer services like PancakeSwap of the Cardano space.

In Which Ecosystem Has Alameda Invested In?

Since the beginning, the CEO of FTX (previously Blockfoli), Sam Bankman-Fried, has said that the future of his products is linked to Solana. He is convinced that the high-speed blockchain will scale considerably to handle most of the world’s demand for transactions.

Solana is on the way to reaching some of the milestones on its roadmap in the coming years. Bankman-Fried made his bet on Solana in January last year through a tween responding when SOL was trading at $3. Later on, SOL exploded to reach its all-time high at $250 (x83). That tweet was epic in the crypto world since many others mimicked the tweeting pattern.

Alameda is inspired by the Solana spirit from the richest name in crypto Sam Bankman-Fried. Therefore, most investments belong to Solana-based projects. Bankman-Fried made a bet on Solana and now he wants to grow the Solana network via acquisitions and investments. Thus, Alameda is famous for its reputation in Solana.

Alameda Research Services

Alameda trades on all major exchanges including the centralized and decentralized networks. It also offers tight spreads guaranteeing that your spreads are tight to reduce the trading costs for anyone interested in selling and buying tokens.

Deep Markets – market depth is an integral indicator of the way confident people are in the price that is portrayed for any token. Generally, the bigger the market depth, the more confident people are within the price discovery phase. By guaranteeing adequate market depth, Alameda lets other market participants trade tokens with less price impact and feel highly confident in the liquidity of the market.

Alameda has traders and support staff helping offer monitoring services 24/7 to offer liquidity and respond to the dynamic market events, including during holidays and on weekends. The platform does not charge any onboarding fees, trading fees, monthly retainers, market-making crosses fees, and any other extra fees.

Notably, Alameda customized daily reports that offer an overview of the market-making operations for tokens and the general activity across all the markets that users trade-in.

Alameda Research In 2022

In 2022, Alameda Research plans to primarily concentrate more on the Solana network since they have many Solana project deals. The trading company will seek projects that can contribute liquidity to the ecosystem, including bridges.

The trading company is investing in early-stage crypto projects and working in other activities like yield farming, over-the-counter (OTC), and trading strategy. Alameda bet heavily on Solana and it seems to be getting massive returns. Led by traders in the team, Alameda understands the importance of liquidity in the network, and is investing in it heavily.