The US Securities and Exchange Commission (SEC) appears to be targeting crypto companies it believes are evading regulation. The SEC is not the only watchdog in the country that is baying for the blood of crypto operators. The Commodity Futures Trading Commission (CFTC) also accuses firms of violating the Commodity Exchange Act and multiple CFTC regulations.

Notably, the SEC’s actions are the latest in a flurry of actions being taken by regulators against crypto operators.

For now, the largest target has been FTX exchange, a firm that imploded abruptly and faces many criminal charges that threaten to send the founder and former CEO, Sam Bankman-Fried, to prison for more than 100 years.

Gary Gensler, the SEC chairman, has repeatedly compared the crypto industry to “the Wild West.”

Ever since the collapse of FTX, Binance’s market share has grown massively and recently, it has been the target of law enforcement agencies and regulators in the United States, and across the world. In March 2023, the CFTC accused the firm of violating several regulations and the Commodity Exchange Act.

Although the crypto space needs to be adequately regulated to attract more investment, crypto experts believe that draconian laws will push investments away from the United States. Crypto expert Brandon Zemp, an entrepreneur and investor as well as the Forbes Books author, weighed in on the charges against Binance and now Coinbase:

“If the SEC continues down this path, there are two possible outcomes. The first is a ‘Crypto War’ and legal fight in the United States that will decide the fate of the sector. The second possibility is a mass exodus of investment and innovation from the United States to more favorable countries and territories (Europe, Singapore, Hong Kong, El Salvador, etc.).”

US SEC Sued Binance And CEO Changpeng Zhao

The SEC filed 13 charges against Binance, the biggest crypto exchange in the world, and its founder Changpeng Zhao (CZ). Notably, the SEC insisted that both the exchange and its founder comingled billions of dollars of user funds and sent them to a European firm controlled by Zhao.

In that context, the US watchdog claimed on June 5, 2023, that Zhao and his exchange subverted their controls to let high-net-worth U.S. investors and clients continue trading on Binance’s unregulated international exchange.

One senior executive supposedly told a compliance agent that the firm was working as a “[f—ing] unlicensed securities exchange in the USA bro.”

The SEC’s complaint insists that Binance set up Binance.US as a shield for the main firm and Zhao, to “reveal, retard, and resolve” law enforcement focus and insulate Binance exchange.

Related:Op Ed: Is the SEC Trying to Undermine the Progress of the US Digital Asset Industry?

Two former Binance.US CEOs were worried about Zhao’s excessive control levels, according to the SEC. Both testified before various federal regulators but neither were named. However, the company’s first and second CEOs were Catherine Coley and Brian Brooks.

An ex-Binance.US CEO called “BAM CEO B” testified to the SEC:

“I’m not actually the one running this company, and the mission that I believe I signed up for isn’t the mission. And as soon as I realized that, I left.”

From June 2018 to July 2021, Binance earned $11.6 billion in revenue, with a huge chunk coming from transaction fees, according to the complaint. Since its launch, the crypto exchange has “at first overtly and later furtively strived to come up with packages that attract US clients. The strategy has been implemented under the control and direction of Zhao, according to the SEC claims.

Binance was aware of thousands of users being in the United States but did not act accordingly despite federal laws banning the unregistered offer and sale of securities. Binance eventually complied in 2019 but the SEC said that the move was just a public show to dupe the authorities.

The SEC insists that Changpeng Zhao ordered the setting up of an evasion plan for the high-net-worth users, using a VPN service to hide their US location and offering compliance documents to help hide their country of origin.

According to a recent CNBC report, Binance staff encouraged customers to dodge this exchange’s “know your customer” infrastructure using VPNs.

Based on SEC allegations, Zhao told his top team in 2019:

“We do need to let users know that they can change their KYC on Binance.com and continue to use it. But the message, the message needs to be finessed very carefully because whatever we send will be public. We cannot be held accountable for it.”

Strangely, the SEC also claimed that Binance and Zhao used market-making firms they controlled to inflate trading prices to help profit off of their users.

Sigma Chain and Merit Peak are said to have acted as “market makers” for Binance’s two platforms, which means they were available to fill a user’s order to sell or buy a Crypto asset. Nonetheless, the regulator highlighted many issues with the two firms’ roles:

Both companies were beneficially owned by Changpeng Zhao and collected ‘tens of billions of dollars’ of customer money. These companies also are claimed to have mixed customer funds with Binance’s money, the same allegations leveled against the now-defunct FTX crypto exchange.

They are also said to have engaged in ‘wash trading’ trading amongst themselves to increase the prices of crypto tokens artificially.

Sigma Chain acquired $190 million for its owner Zhao, the SEC insisted. This proprietary trading company then spent $11 million to buy a ‘yacht.’ Changpeng Zhao denied these charges on Twitter by writing “4,” a famous refrain in Binance’s community telling users to ignore fear, uncertainty, and doubt (FUD).

The SEC’s complaint against Binance comes after the CFTC filed similar charges against the crypto exchange, claiming that it did not prevent US clients from accessing it. Zhao tweeted:

“We will issue a response once we see the complaint. Media gets the info before we do.”

In an official blog post, Binance wrote:

“We are disappointed that the U.S. Securities and Exchange Commission chose to file a complaint today against Binance seeking, among other remedies, purported emergency relief.”

The exchange also said that it has actively cooperated with the regulator’s investigations and “engaged in extensive good-faith discussions to reach a negotiated settlement to resolve their investigations.”

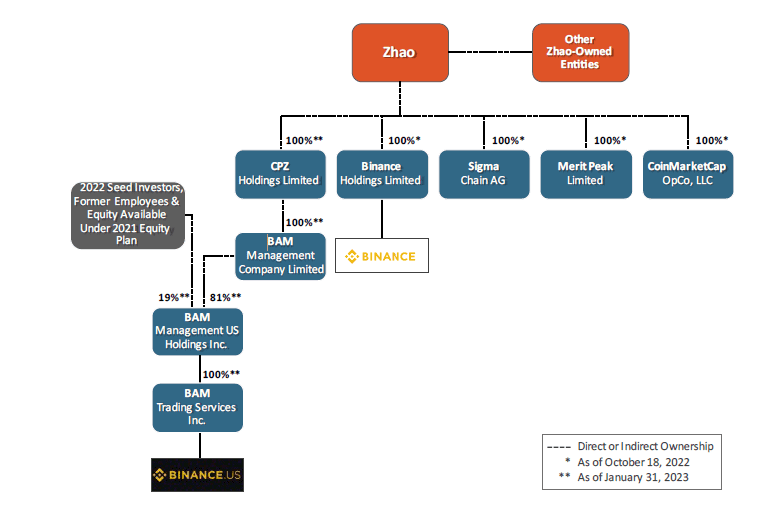

The watchdog says that the defendants showed a “blatant disregard” for federal law. Their complaint featured a ‘high-level’ breakdown of Binance’s ownership structure, with Changpeng Zhao and his holding vehicles said to be controlling 100% of Binance and Binance.US’ different entities.

SEC Chair Gary Gensler highlighted in a release:

“Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.”

Binance.US responded in a statement:

“Simply put, today’s filing is unjustified by the facts, by the law, or by the Commission’s own precedent.”

US SEC Sues Coinbase A Day After Suing Binance

On June 6, the US SEC sued Coinbase alleging that the biggest US crypto platform operated illegally since it never registered as an exchange. The lawsuit comes as another blow to the crypto sector being the watchdog’s second in two days against a top crypto exchange.

Both of these civil cases are part of Gensler’s push to regulate the crypto space which he termed as a ‘Wild West’. The SEC believes that the unregulated market has undermined investor trust in the general US capital markets.

Gensler told reporters:

“The whole business model is built on a noncompliance with the U.S. securities laws and we’re asking them to come into compliance.”

Crypto firms and experts say that the SEC rules are a moving target and the watchdog is overreaching by attempting to regulate them. In that context, Insider Intelligence crypto analyst Will Paige said:

“The SEC’s latest lawsuit highlights its increasingly aggressive stance in regulating crypto firms. In the absence of a regulatory framework in the US, the SEC looks intent on policing the space through enforcement as part of a wider crackdown on noncompliance.”

“The regulator’s suits against Coinbase, generally viewed as one of the more respected crypto firms, and the world’s biggest crypto platform Binance, shows it’s prepared to legally challenge companies it believes aren’t keeping to rules, regardless of their size. Crypto firms may find out the hard way that operating by the ‘better to ask forgiveness than permission’ theory lands them in hot water.”

“For the broader crypto industry, lawsuits against two of the best-known and largest companies will knock already weak consumer confidence in cryptocurrencies.”

The lawsuit resulted in $1.28 billion of net customer outflows from Coinbase, according to estimates from Nansen data firm.

Coinbase’s general counsel, Paul Grewal, said that the exchange will continue operating normally and has shown full commitment to compliance. Ten US states including California on June 6 accused Coinbase exchange of securities law violations in its staking rewards program.

Related:The US Government Is Targeting Crypto And Crypto Firms…Be Prepared…

Rules Should Never Be Ignored

The SEC said in a Manhattan federal court that Coinbase has made billions of dollars since 2019 operating as a middleman on cryptocurrency transactions while evading all disclosure requirements that are meant to adequately protect investors.

In the filing, the SEC insisted that Coinbase traded over 13 crypto assets which are securities that needed to have been registered, including tokens like Cardano, Solana, and Polygon.

Launched in 2012, Coinbase has served over 108 million clients and ended March with $130 billion of client crypto assets and funds on its balance sheet. Transactions on the exchange generated 75% of its $3.15 billion in net revenue in 2022.

In its staking rewards program that has around 3.5 million users, Coinbase pools assets and utilizes them to underpin activity on the blockchain network, in exchange for the ‘rewards’ it offers users after cutting a commission for itself.

The SEC lawsuit is targeting civil fines, to help recover all ill-gotten gains and injunctive relief. The SEC warned Coinbase earlier in the year that charges might be imminent. SEC Enforcement Chief Gurbir Grewal (not related to Paul Grewal), stated:

“You simply can’t ignore the rules because you don’t like them.”

Many states are probing the staking rewards program. They include Maryland, New Jersey, South Carolina, Alabama, Illinois, Kentucky, Washington, Vermont, and Wisconsin. Notably, New Jersey fined Coinbase exchange $5 million for selling and handling unregistered securities.

Coinbase believes that it will have “productive conversations” with the US states and is confident that its staking operations are not securities.

Resistance To SEC Crackdown

The SEC’s crypto crackdown has made the industry boost compliance, suspend products, and move their operations outside the country.

CEO of the Blockchain Association trade group, Kristin Smith, rejected the regulator’s efforts to oversee the sector. She mentioned:

“We’re confident the courts will prove Chair Gensler wrong in due time.”

On June 5, the SEC accused Binance of inflating its trading volumes, improperly commingling assets, misleading customers about its real controls, diverting customer funds, and failing to keep high-net-worth US users off its platform.

Related:The Cryptospace Responds as the SEC Goes to War with Coinbase and Binance

Binance said it is ready to defend itself against this lawsuit. According to the exchange, this lawsuit reflects the SEC’s “misguided and conscious refusal” to offer clarity to help regulate the crypto sector accordingly.

Users withdrew nearly $790 million from the Binance exchange and its US branch after the lawsuit, as reported by Nansen. On June 6, the SEC filed a motion for an asset freeze in the Binance case.

In both lawsuits against Binance and Coinbase, the US watchdog said that over 67 cryptos are securities. This impacts over $100 billion worth of tokens actively traded in the current market.