Collection frenzy

California, Los Angeles, United States, Nov. 23, 2021 (GLOBE NEWSWIRE) — Steve Aoki, a Grammy nominated musician, NFT artist, and collector has recently teamed up with The Untamed, a popular Chinese murder mystery drama. Together they have established a special NFT vault called The Steve Aoki Untamed Vault (#AokixTheUntamed.) With the ambitious goals to support NFT artists, the vault focuses on collecting and purchasing bluechip NFTs, as well as releasing special editions with partnered artists. The first two NFTs that the vault currently owns are CryptoPunk #1570, and #BoredInTheHouse, the first TikTok Moment featuring Curtis Roach.

The popular TikTok moment, Bored in The House is the first NFT layer 2 solution on Ethereum created by Curtis Roach.

Immutable X aims to solve popular problems on the Ethereum blockchain with zero-gas fees, instant trades, and scalability

In recent years, there has been a surge of Asian content continuously breaking the boundaries of the entertainment scene in the western markets. From “Pokémania” to the latest phenomenon, Squid Game. NSMG Senior Vice President Luffy Huang hopes to connect with fans worldwide and unite everyone through his love of art. “Love knows no boundaries, we hope to introduce The Untamed to a wider audience. And by establishing The Steve Aoki Untamed Vault with Steve, our vision is to invest in quality NFTs to show respect to the NFT community, rather than just selling our own NFTs directly to the community. This is what makes us different.” said Huang.

Talking about the vault itself, Huang stated “Steve Aoki is the perfect epitome of diversity and creativity, values that align with NSMG.” Aoki also expresses his excitement, “I’m constantly traveling and being introduced to different countries’ pop cultures. And it was through my travels that I met The Untamed team and learned about the massive audience behind the series. This Vault is an opportunity for us to partner together to introduce The Untamed globally to the NFT community in an organic and native way driving conversation around the IP in a whole new community.”

The Untamed, is the most watched series in Asian Television history with over 10 billion views. The popular murdery mystery drama is the first successful Chinese IP of its kind to break into the US, European, and Latin American markets. The series has received an overwhelmingly positive response on Netflix, and has become a global sensation since 2019.

Prior to the success of the series, Huang was already laying out a blueprint for The Untamed. Resembling The Marvel Cinematic Universe, his aim is to grow the IP from a culture universe to Metaverse. After the franchise grew over the past few years with record-breaking music album ‘Chinoiserie’, merchandise, live concerts, themed restaurants and more, NSMG is now extending The Untamed universe into the realms of immersive experiences and venturing into the NFT business. Under the influence of vault, NSMG will drop “The Untamed” NFTs ahead of the global launch of its mobile game. The purchased NFTs will act as a key for fans to ultimately enter The Untamed Metaverse, where they could unlock exclusive items once the game is released.

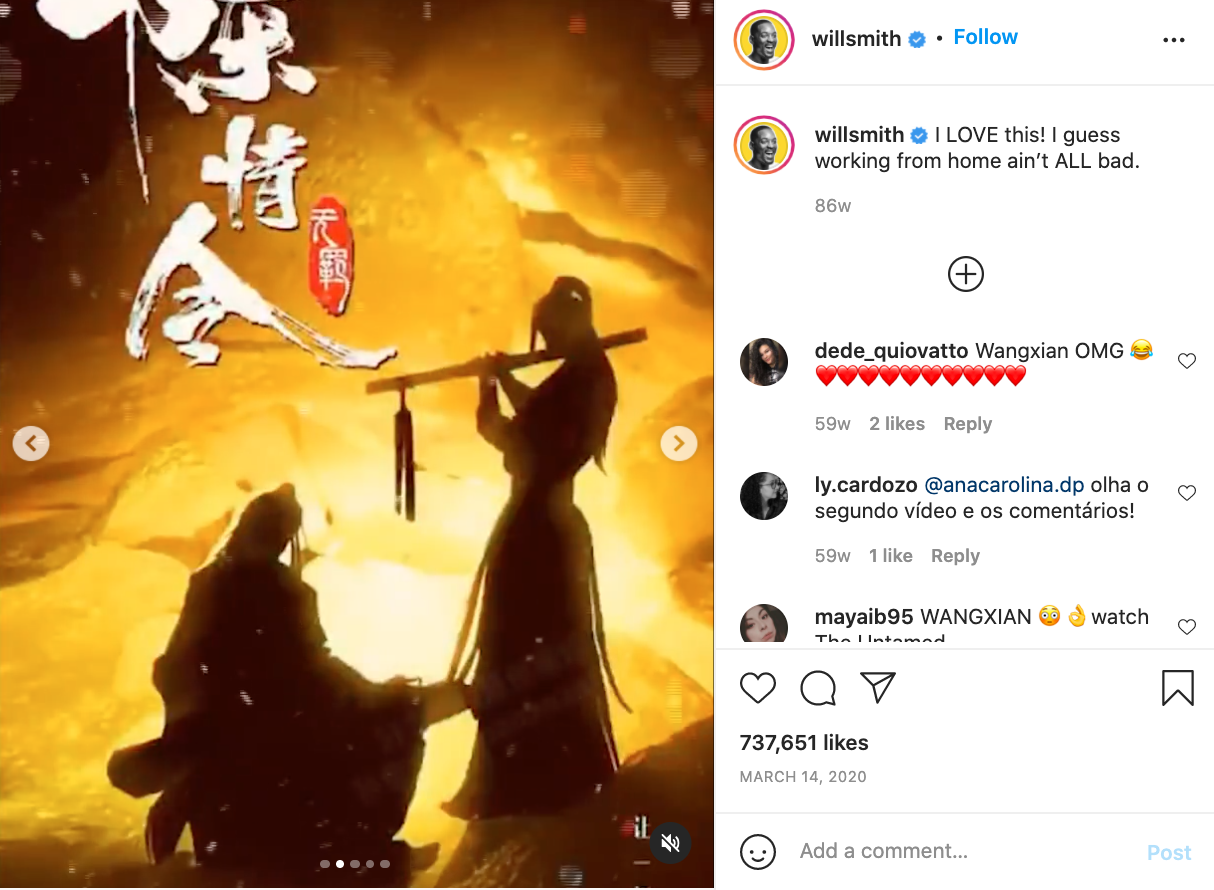

Will Smith shared about The Untamed on Instagram as the series has become immensely popular on Netflix during lockdown.

Download high res images here

About NSMG

Established in 2015, NSMG is a new generation of entertainment and multimedia enterprise with head offices based in Los Angeles and Beijing. Spanning artist management, music & film production, merchandise, mobile gaming and NFT.

About Steve Aoki:

Counting nearly 3 billion music streams to his name, Steve Aoki is a true visionary. Billboard described the 2x-GRAMMY-Nominated artist/DJ/producer and Dim Mak Records founder as “one of the most in-demand entertainers in the world.” As a solo artist, Aoki boasts a lauded cross-genre discography that includes 7 studio albums and collaborations with Lil Uzi Vert, Maluma, BTS, Linkin Park and Louis Tomlinson amongst others. In 1996, he established Dim Mak out of his college dorm room, a trendsetting record label, events/lifestyle company and apparel brand. It has served as a launch pad for global acts like The Chainsmokers, Bloc Party, The Bloody Beetroots, and The Kills, in addition to being the home of early releases from acts such as ZEDD and Diplo. As a nightlife impresario, Aoki’s legendary Hollywood club night Dim Mak Tuesdays hosted early performances from future superstars such as Kid Cudi, Daft Punk, Lady Gaga, and Travis Scott. A true renaissance man, Steve Aoki is also a fashion designer, author and entrepreneur. In 2012, he founded THE AOKI FOUNDATION, which primarily supports organizations in the field of brain science research with a specific focus on regenerative medicine and brain preservation. In addition, Aoki has pushed his clothing line Dim Mak Collection to new heights, both with original designs and collaborations with everyone from A Bathing Ape to the Bruce Lee estate. Aoki’s multi-faceted journey is chronicled through the Grammy-nominated Netflix documentary I’ll Sleep When I’m Dead (2016) and his memoir BLUE: The Color of Noise (2019). In the summer of 2020, Aoki unveiled his Latin music imprint, Dim Mak En Fuego, continuing to break down musical and cultural boundaries ‘by any means necessary.’

Online Twitter Instagram Facebook

About The Untamed

The Untamed (scored 9.0 on IMDb) is the most watched series in Asian Television history with over 10 billion views. The popular murdery mystery drama is the first successful Chinese IP of its kind to break into the US, European, and Latin American markets. The series has received an overwhelmingly positive response on Netflix, and has become a global sensation since 2019.

More than just a series, The Untamed is a culture universe offering a broad scope of franchise spanning from TV series, music albums, merchandise, mobile game, live concerts, restaurant, and NFT. Back in 2017, NSMG began working with Netease in developing The Untamed mobile game which is slated to launch in 2022. Following the hype, The Untamed franchise has grown to include the record-breaking music album ‘Chinoiserie’, merchandise, live concerts across China, Thailand and Japan, plus the recent launch of The Untamed themed restaurant in Shanghai, China.

NSMG is currently working on the title film production and the creation of The Untamed Metaverse to pay tribute to worldwide fans.