Now that Bitcoin ETF Futures have come, we no longer have to worry about how to get into Bitcoin futures or if cryptocurrencies like Bitcoin have a future.

The recent introduction of Bitcoin ETF Futures is also a win for a community.

The global cryptocurrency market capitalization continues to wow people.

It brings to the fore many considerations about how and when cryptocurrencies will be adopted.

Introducing Bitcoin ETF futures also gives mainstream access.

Members of the cryptocurrency community had to face any technical challenges before they could prove the technology worked.

This approach also occurred at the birth of the internet.

Today, technology companies rule just about everything we do and are some of the most capitalized institutions on earth.

Will the same happen with the cryptocurrency space? Time will tell!

One thing is sure, though: Cryptocurrencies and their allied technologies will change how the world works in ways we have never thought of before.

Until these technologies take center stage globally, we will never really know what exactly cryptocurrencies can do.

However, the introduction of Bitcoin ETFs is a start in the right direction.

What are the implications?

They are many!

The Cryptocurrency Space will Experience Increased Liquidity

Much of Bitcoin’s liquidity has remained locked due to two factors: one is lost Bitcoin wallet keys, while the other is the existence of HODLers who sit and wait for Bitcoin prices to go up.

Both parties have significantly increased the deflationary effect, producing the high prices in the Bitcoin markets right now.

And as we all know, deflation increases scarcity, which in turn raises prices.

The introduction of Bitcoin ETF Futures will add further fuel to the fire.

Market participants will now be looking for access to an already scarce digital commodity.

These forces will drive demand and prices up.

But, with the usual price volatility that everyone within the cryptocurrency space is used to.

We shall see other forms of securities backed by cryptocurrencies enter the space.

World Governments and other State Actors continue to pass laws that at least in some part regulate the global cryptocurrency space.

The regulatory frameworks will give institutional investors the courage to consider having some form of exposure to the cryptocurrency markets.

Some will create new solutions, and new kinds of financial institutions will emerge from these activities.

Greater regulation after some time will ensue as people will find ways and means around already existing laws.

Innovation will continue as cryptocurrencies and their allied technologies will become the de-facto standard while the world waits for the introduction of web-4 technologies.

And out of the blue, someone somewhere will introduce web-4 technologies before the process starts all over again.

For now, Bitcoin ETF Futures and how they perform remain the key to unlocking the future.

We reached out to William Cai of Wilshire Phoenix to give us his views on introducing Bitcoin ETF Futures into the United States markets.

Here is what he had to say.

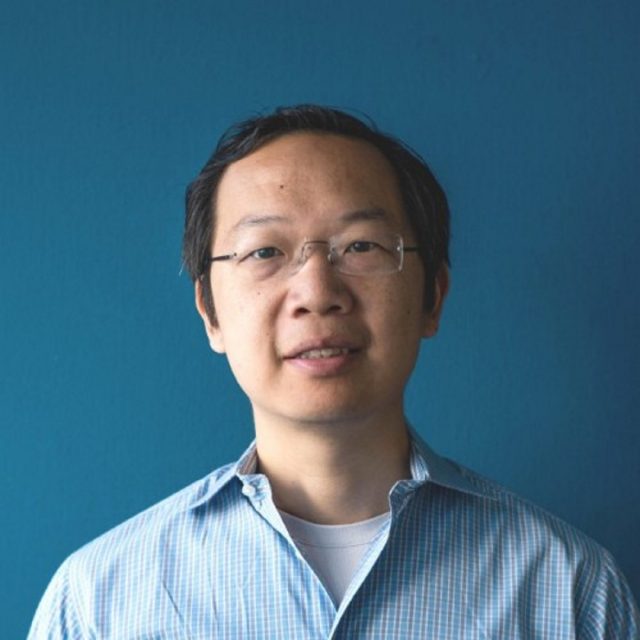

William Cai Partner at Wilshire Phoenix

E-Crypto News:

What are the potential benefits and drawbacks of the launch of bitcoin futures ETFs?

The newly launched bitcoin futures ETFs offer investors another way to access bitcoin exposure, albeit in an indirect way. Proxy exposure through futures has several significant drawbacks and complexities due to the fact that a futures contract is a derivative and a long futures position needs to be rolled (selling the expiring futures and buying the next).

The periodic rolling of the futures exposes the ETFs to risks and negative impacts on performance from trading costs, contango (futures prices increase at longer maturities), and potential front running by market participants.

These risks can be insidious to unaware investors as daily performance could track bitcoin very closely but with drastic divergence over weeks and months.

These non-theoretical risks have been shown to significantly impact performance in existing commodity ETFs over the years.

Retail investors should understand these risks before investing. Indeed, money flow indicates that institutional players have been actively trading bitcoin futures ETFs while retail investors have been on the sidelines, perhaps seeing the complexities and waiting for a more direct spot bitcoin product to become available.

Related: Bitcoin Prices Hit an All-Time High After ProShares ETF Launch

E-Crypto News:

Does the introduction of bitcoin futures ETFs serve as a panacea to cryptocurrency price volatility?

Bitcoin futures ETFs introduce another way for investors to access bitcoin; they do not fundamentally alter bitcoin’s price discovery process. Investors can already access bitcoin through spot and options on crypto exchanges, OTC products, bitcoin futures, and company stock proxies.

It is another tool in the shed for investors rather than something that changes the core properties of the asset.

E-Crypto News:

Does the introduction of bitcoin futures ETFs indicate the demand for cryptocurrencies as an asset class?

The market demand in the week of the launch demonstrates significant unsatiated interest in bitcoin and cryptoassets among investors. We look forward to continued regulatory progress, especially with regard to a spot bitcoin product that can more directly and efficiently replicate bitcoin exposure for all investors.

Related:Top Reasons Why Bitcoin’s Popularity is Growing

E-Crypto News:

What are the capacity constraints of bitcoin futures ETFs?

Capacity constraints on futures in bitcoin futures ETFs are imposed by the futures exchange CME, which is regulated by the CFTC. Futures limits are imposed so that no single entity can own an outsized position in futures to corner the market. It is a protection mechanism implemented to mitigate market abuses and does not automatically disappear when trading liquidity changes.

E-Crypto News:

Do you think the markets are ready for cryptocurrencies and their related instruments? Please, can you tell us the reasons for your answer?

Investors, both retail and institutional, have been demanding access to cryptoassets for a while now.

Educated investors should be able to make their own investment decisions.

It is up to market participants to create products that allow investor access but with clear risk disclosures and with the regulator helping to ensure fair, orderly, and efficient markets.

E-Crypto News:

What is the best solution to the prevailing lack of technical knowledge about crypto-assets and their underlying technologies?

There is no silver bullet solution. What was the “solution” to the lack of technical knowledge about the internet in its early days? Time and continued development and adoption made its acceptance and usage commonplace.

Related: SEC Punts Decision on Wilshire Phoenix’s Bitcoin ETF Proposal to February

E-Crypto News:

As an investment class, how and when do you think crypto assets will reach maturity?

Cryptoassets as an asset class is still in its infancy. It takes time for an asset class to mature but it is occurring right before our eyes, gradually but inevitably. We believe there will be exciting developments to come as the space continues to evolve and progress, merging with and changing traditional finance at the same time.