Gresham’s law has historically influenced the circulation of currency and keeps impacting economic behavior by addressing how users prioritize various types of money.

Gresham’s law is a principle in economics that says that when two types of money are in circulation, people normally spend or trade the money they think is more valuable while hoarding or using the money they think is less valuable.

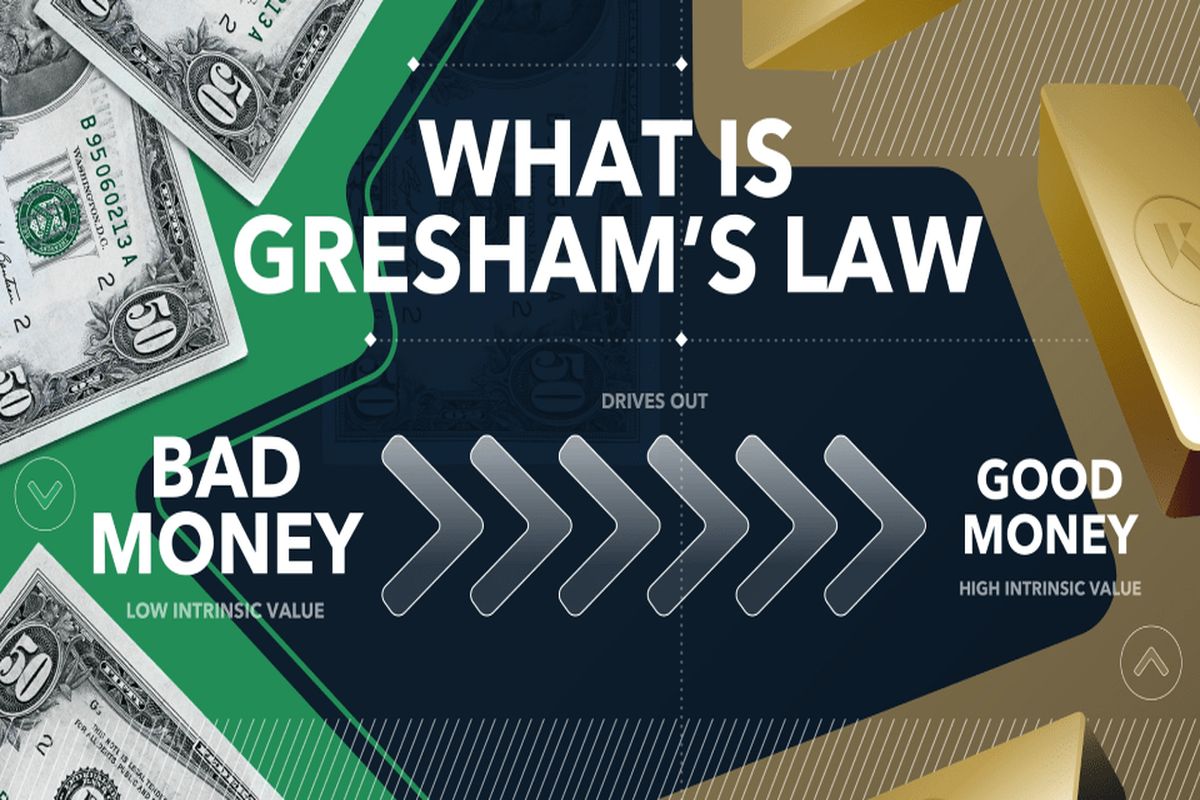

A common way to summarize all this is that “bad money drives out good.” Here, “good money” is described as a currency that has higher intrinsic worth and is held onto, while “bad money” is described as a currency that has lower intrinsic value and people seem eager to get rid of it.

Although he was not the originator of the concept, Gresham’s law is named after Sir Thomas Gresham because he played a significant role in popularizing the idea of how bad money pushes out good money in monetary ecosystems. He was a 16th-century English financier and adviser to Queen Elizabeth I.

Historically, Gresham’s law has been seen in several fiat currency systems, where debased or counterfeit coins would drive out of circulation the more valuable, legal coins since people would rather hold onto the higher-value currency and spend the lower-value currency. That idea seems to still be relevant currently when debating the use of cryptos and their differing levels of utility and stability.

How Gresham’s Law Applies To Cryptos

When it comes to using cryptos, Gresham’s law holds that more volatile digital currencies are used particularly for speculative investments, while stable and well-established digital currencies are selected for daily transactions, highlighting the principle of ‘bad money’ and ‘good money.’

In the matters of selecting which crypto is suitable to use for transactions, people mostly opt for the one they believe is less valuable because of its stability and store of value. Gresham’s law suggests that users appear to utilize cryptos that are less volatile and well-established for daily transactions, saving the more speculative and volatile ones for investments or assets. The principle appears to remain relevant in crypto usage patterns and adoption.

Gresham’s law and crypto’s function as a store of value seem to be closely related. Some digital currencies, such as Bitcoin, are said to be relatively stable and valuable due to their scarcity and massive use as digital assets similar to gold.

In the same way that people have held precious metals, investors are more likely to hoard these cryptos as a hedge against inflation or financial upheaval. Equally, more volatile cryptos are often used in speculative trading, highlighting Gresham’s law’s concept of bad money and good money.

Within the crypto space, stablecoins – cryptos linked to conventional assets such as commodities or fiat money – have a considerable effect on Gresham’s law. Due to their constant value, reliable digital assets are favored for daily transactions and serve as the modern equivalent of good money.

Additionally, the growing acceptance and assimilation of cryptos into financial institutions is affecting people’s use and prioritization of various digital assets, which is consistent with the ideas that are presented by Gresham’s law.

How Gresham’s Law Affects The Competition Between Traditional Currencies And Cryptocurrencies

Gresham’s law highlights the importance of perceived money quality, volatility concerns, hoarding motivations, and legal and regulatory considerations, all of which can affect the competition between cryptos and fiat money.

Gresham’s law sheds light on the dynamics influencing the ongoing competition between cryptocurrencies and fiat money. It highlights the tendency for individuals to either hoard or exchange less preferred currencies while favoring and actively using what they perceive as superior money. In the context of cryptocurrencies, people often store them as a form of investment, anticipating potential value appreciation, while relying on traditional fiat money for their everyday transactions.

For an explanation, consider a person who owns Bitcoin and the US dollars. The individual would probably decide to use their US dollars for daily transactions, knowing that the value of the US dollar erodes over time because of inflation. On the flip side, they may decide not to spend their Bitcoin because they would miss out on the potential of future growth in its value.

Furthermore, Gresham’s law indicates that people would steer clear of cryptos out of fear of steep fluctuations in value and instead favor the steadiness of fiat money for daily transactions. Due to this volatility risk, cryptos may just be used mainly in various high-value transactions or as a store of value.

Businesses mostly accept traditional currencies for transactions because they are recognized as legal tender within their respective nations. On the flip side, the legal environment surrounding crypto is unclear and uncertain.

Consequently, individuals may opt for traditional currency in response to regulatory measures. The prohibition of cryptocurrencies in China illustrates how regulations can impact the selection of currency. Gresham’s law is evident, as the ban compels individuals to utilize the official currency, the yuan, owing to legal obligations and potential penalties associated with the use of cryptocurrencies.

Related: $23 + Million Global Cryptocurrency Market Size is Expected to Grow

Limitations Of Gresham’s Law

Gresham’s law, while a valuable concept in currency dynamics, faces several limitations, including the challenges posed by cryptos’ volatility and the evolving global financial landscape.

Gresham’s law, being a valuable concept in currency dynamics, has some limitations that spread to the world of cryptocurrencies. Its presumption of stable exchange rates is among the main limitations.

Consequently, individuals may opt for traditional currency in response to regulatory measures. The prohibition of cryptocurrencies in China illustrates how regulations can impact the selection of currency. Gresham’s law is evident, as the ban compels individuals to utilize the official currency, the yuan, owing to legal obligations and potential penalties associated with the use of cryptocurrencies.

Psychological factors also play an integral role. Gresham’s expectations may not match people’s choices and, especially the older generations, connection to the traditional currencies due to cultural influences, trust, and familiarity. Moreover, the extensive volatility of crypto presents a distinct issue.

Many people seem reluctant to spend them because they run the risk of experiencing an abrupt value fluctuation, but some investors store them in hopes of appreciation. This calls into consideration the application of the law by muddying the line between bad and good money.

Ultimately, the evolving landscape of payment systems and fintech innovations enhanced by artificial intelligence also complicate the traditional application of Gresham’s law, calling for a highly sophisticated understanding of the modern currency dynamics.