As 2023 fades away, and we run into 2024, many within the cryptospace wonder what will come next. Everything is happening all at once.

We contacted 17 industry heavyweights, who gave us their thoughts and predictions for next year.

Their answers might surprise you.

C’est la vie…

Farooq Malik, CEO at Rain Cards

Tokenization’s Impact on Banking:

“I foresee a groundbreaking transformation in the banking sector through the widespread adoption of tokenization. This shift will not only streamline processes and reduce administrative burdens but also serve as a game-changer for banks. Faster settlement times, increased book size, and reduced operational costs will redefine the way we perceive and engage with traditional banking.”

Strategic Embrace of Payment Processors:

“There’s a noticeable industry-wide shift toward embracing payment processors over self-custody wallets. This strategic move is fueled by the convenience of fiat conversion and simplified accounting reconciliation. In navigating the evolving crypto landscape, the emphasis is on finding a delicate balance between maintaining control and ensuring ease of use.”

Merchant Adoption Driving Crypto Momentum:

“I predict a substantial boost in cryptocurrency adoption driven by the increasing acceptance of crypto payments by merchants. This trend is not just about cost-effective solutions; it signifies a fundamental shift in creating a more seamless, cash-like experience for both businesses and consumers. Merchant adoption will play a pivotal role in shaping the broader landscape of cryptocurrency acceptance.”

Crypto Adoption Surge Through Real Fungible Use:

“In 2024, we anticipate a surge in crypto adoption, catalyzed by the immediate conversion of cryptocurrency payments to fiat. This practice is a key enabler for unlocking the true potential of crypto payments in real, fungible use cases. Beyond speculation, we’re entering an era where cryptocurrencies offer tangible benefits, including instant payments, chargeback protection, and the ability for immediate reuse.”

David Kemmerer, CEO, CoinLedger

“Based on current trends and industry predictions, I’d expect crypto spaces to continue to develop as we head into 2024. This can mean more investment options and ways for people to invest and use crypto, along with better infrastructure and technology for things like encryption and data security. I would expect these types of developments to result in crypto being considered more stable and a more viable investment option, which can only benefit the industry as a whole.”

Tyler Adams, CEO, and Co-Founder at COZ

“2024 will focus on new, exciting ideas that could lead to mass Web3 adoption. “Crypto” is still an overwhelming, confusing, and undefined term for many. Giving people a touchpoint to Web3 through something tangible and useful will work to onboard the masses to Web3 and highlight the benefits of decentralization, blockchain, and crypto. I believe that this will be achieved through NFI (Non-Fungible Item) technology.

2023 highlighted to many that NFTs are not just for collecting and trading but also have real-world use cases that could easily become an everyday feature in people’s lives. The evolution of NFT to NFI technology establishes a link between both the physical and digital realms. This is of great use to artists, for example, who can ensure that their work is attributed to them through the inclusion of NFI technology in their pieces. As we move into 2024, I believe that the new year will provide an emphasis on tangible technology in an effort to onboard more people to Web3 and introduce them to the many benefits of blockchain.”

Sam MacPherson, CEO and Co-Founder at Phoenix Labs

“DeFi’s three main pillars are lending, decentralized exchanges, and synthetic assets (stablecoins). Looking at the current DeFi landscape, I believe that we will see the bulk of liquidity converge into a power law distribution of these primitives. In addition, I think that innovation will continue at the margins, but due to the open-source nature of DeFi, the improvements could be absorbed by the market leader.

I also believe that RWAs will continue to experience rapid growth due to the high-interest rate environment. The RWA trend is inevitable, but the speed at which it arrives is determined by the interest rate environment.

My final, slightly more subjective prediction relates to the bull market. Through my analysis of the Maker balance sheet from the past five years, the current level of leverage we are experiencing hasn’t been seen since 2021. I think that we will see a bull market starting soon and that it will definitely arrive in 2024.”

Vince Padua, Chief Production Officer at Axway

The Future of Cryptocurrencies is Looking a Little Cryptic

Here’s what I see falling out of favor in 2024:

“Cryptocurrencies and NFTs: The cryptocurrency and NFT markets have been highly volatile and speculative in recent years, leading to significant investor losses.

Traditional IT security approaches: Traditional IT security approaches focus on protecting the network’s perimeter. However, these approaches are not practical against modern cyberattacks. In 2024, businesses will likely adopt more proactive and layered security approaches.

Metaverse platforms: The metaverse is a virtual world still in its early stages of development. While there is a lot of potential for the metaverse, it is unclear how widely adopted it will become in the near future.

Web 3.0: This decentralized version of the internet is still under development. Web3 projects often rely on cryptocurrencies and NFTs, which could hurt their adoption if the cryptocurrency and NFT markets continue to struggle.”

Lars Seier Christensen, Co-Founder and Chairman of Concordium

“With the Bitcoin price on the rise, the prospects of ETFs receiving approval and the industry stabilizing”

How do you see the crypto market evolving in 2024? Do you think we’ll experience a “crypto summer”?

It is all a little bit too much “textbook stuff” for my taste – halving, ETF approval, and then a new bull market. Normally, in traditional financial markets, these types of scenarios aren’t necessarily predictable because experienced participants are able to anticipate potential developments beyond the obvious. But maybe, due to the immaturity of crypto markets, it will play out as everyone predicts. I would be very careful, though. I think we will be in for some surprising deviations from the generally predicted path.

Governments across the world are looking at the viability of stablecoins and their potential implementation. How do you think stablecoins can supplement the industry, and what are your expectations for their adoption in the next year?

I think stablecoins right now are the most important use case for blockchain, eventually to be replaced or expended by more general RWA tokenization. In their current stage, stablecoins make a lot of sense when it comes to transfers, settlement, and finality. For these reasons, they will be embraced further in 2024, both in private solutions and new public sector experiments.

What obstacles has the industry faced in 2023, and do you feel we have seen significant efforts being made to overcome them?

The industry is still characterized by too much promise and too little actual usage. It remains critical to onboard significant, industrial-scale use cases that add real value to processes, through security and transparency. Blockchain has a lot to offer, but it needs to come of age and really begin to prove itself. That being said, corporate interest is really only going one way – up – so I believe it is a matter of when, not if.

Do you think 2024 will see greater adoption of blockchain-based digital identity frameworks? What are the most significant use cases you expect to see coming from this?

Absolutely. ID and various personal credentials are some of the more obvious use cases for blockchain and are only becoming more and more important with virtual reality and avatars, especially given the rise of deepfakes and identity theft. A reliable and trustworthy ID solution is becoming an absolute necessity and blockchain is the obvious infrastructure to support this.”

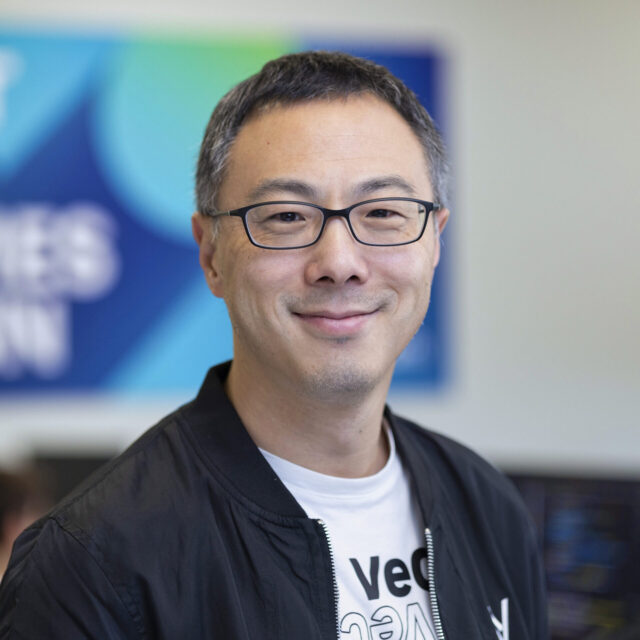

Sunny Lu, CEO at VeChain

“What are your expectations for the Bitcoin market and the broader cryptocurrency landscape, especially given the highly anticipated Bitcoin halving event?

The entire crypto market is going through a major change. The impact regulation is having on the market is becoming more significant than the impact of Bitcoin Halving. The attention of the entire crypto market is on ETF progress for Bitcoin spot, which I believe may be the biggest milestone in bitcoin and crypto’s history. The ETF will open the door for the world’s biggest institutional investors to enter the crypto space. Major progress on the regulatory side, such as with MiCA in Europe, will also pave the way for the mass adoption of blockchain and crypto in the real world.

I am quite excited about driving real-world value through blockchain, which has been VeChain’s vision and mission from day one and the milestone we’ve been working toward for years.”

What were the biggest challenges the blockchain industry faced in 2023 with regard to mainstream adoption, and to what extent do you think they will be addressed in 2024?

“The biggest challenges in 2023 were the lack of user-friendly interfaces, limiting accessibility, and generally negative perceptions about the blockchain industry, which has been an issue for many years.

2024 will see the development and implementation of greater crypto regulation, stemming from leading examples like MiCA in Europe. Additionally, there will be an increase in use cases and applications with seamless interfaces and tangible value for everyday people, enabling the industry to onboard mainstream users, who in turn will have greater access to and utility for crypto and blockchain.”

How do you see blockchain sustainability initiatives evolving in 2024? What kinds of sustainability use cases do you think will grow or come into existence?

“Firstly, I believe more and more blockchain players will pay closer attention to sustainability in 2024. VeChain started this journey a couple of years ago and released the third version of the white paper, “Web3 for Better,” along with BCG in early 2023 to make a clear statement about what we are going to build together. After a year of preparation and hard work, we will spearhead the delivery of a new sustainability ecosystem in 2024.

I believe sustainability will be crypto’s killer use case in 2024 and really drive Web3 mass adoption. At VeChain, we are working on developing use cases that will incentivize individuals to act sustainably on a daily basis, empowering them to live greener lives. Our aim is to drive and motivate individuals to create a collective impact from fractional efforts to make the world better. Web3 is the perfect answer to address this type of challenge.”

Do you think 2024 will see a greater development of enterprise use cases for blockchain tech? Which ones are you most excited for?

“Definitely, yes. 2024 will experience the development of enterprise use cases, especially thanks to the major progress to be made on the regulation side and with MiCA coming into effect in Europe. Clearer regulation will pave the way not only for institutional investors but for enterprises as well. I believe enterprise applications will fully embrace the utility of blockchain technology, enabling them to experience major “upgrades” and integrate tokens into their applications. I also believe onboarding enterprises to the Web3 sustainability ecosystem will draw the most attention and be the main driver of mass adoption.”

Cuautemoc Weber, CEO and Co-Founder of Gateway.fm

“In 2024, I expect several key themes to define the crypto sector’s development. Regulatory clarity and compliance will take center stage as governments worldwide seek to establish comprehensive frameworks for cryptocurrencies and blockchain technology. The crypto ecosystem’s underlying ethos of decentralization is sound, and policy makers and institutions are coming to terms with this fact. With greater regulatory oversight, will come heightened security measures. Looking ahead, it will be increasingly important for Web3 projects to implement robust security measures for the good of the industry.

Steps that can be taken include implementing multi-factor authentication, cold storage for digital assets, and regular security audits. In 2024, growing sustainability concerns and the environmental impact of mining operations will drive efforts to transition to greener blockchain solutions. As the first truly decentralized blockchain infrastructure node provider, Gateway.fm uses independent and carbon-neutral data centers to minimize the environmental impact of operating blockchain nodes, contributing to a more sustainable and eco-friendly crypto ecosystem. We also see a big opportunity around tokenized RWA and the proliferation of new dedicated app chains which will help unlock the next wave of blockchain use cases. We’re already seeing tremendous upside in this area which is why we have focused on building Presto, allowing anyone to build their own dedicated blockchain with 4 clicks and 5 minutes.”

Laurence Latimer, CEO at Dinara

“ETF approval: While everyone predicts that Bitcoin ETF and Ethereum ETF will get approved and launch with tremendous enthusiasm, we believe that the actual uptake will be slower than anticipated. Moreover, we predict the approval will drive a surge in BTC demand, pushing prices higher and bring BTC back into the popular consciousness as a ‘good’ thing rather than as a negative headline, further helping accelerate mainstream adoption. We are already seeing hints of this as BTC is up about 10% this week mainly on expectations of an ETF being approved.

Meteoric growth: Total crypto market cap (~$1.4T today) gets to $2.5T by EOY 2024. This momentum will be driven by more institutional adoption and optimism on legislative action.

Evolved gaming: gaming, both in game tokens and play-to-earn, will continue to evolve and have at least one breakout hit in 2024.

Legislation: Congress passes at least one crypto bill into law, with the best bet being a revised stablecoin bill that got close to a vote in 2023.

Record fundraising: In terms of capital raised by crypto startups/protocols, the lowest quarter in 2024 will outperform the highest quarter in 2023 (~$3B in Q2 2023).

Seamless Integration: Large company adoption of digital assets as part of their core operations – but there will be fewer and fewer references to “crypto,” “digital assets” or “blockchain.” Similar to the early 2000s when there was a pivot from having a dedicated “web” or “internet” strategy to just having a “strategy,” widespread adoption to capture the benefits of digital assets and blockchain results in less mention of the underlying technology and more seamless integration with existing platforms.

Rate Arbitrage will motivate institutions to explore Crypto (for example, low borrowing rates in DeFi can be arbitraged with high Treasury returns).

Resumption of BaaS and other novel activity, with traditional banks re-engaging with FinTech partnerships.”

Karel Kubat, Founder, Union

What tools do you believe will be in the spotlight in 2024 as the Web3 industry focuses on scalability and interoperability?

“The use and awareness of ZK technology have grown substantially in 2023, and while this is inherently positive, the current fragmentation of ZK algorithms will continue to impede acceleration unless addressed next year. To overcome this, there should be a new focus on hardware accelerators for arbitrary circuits, such as Cysic, gnark, and other low-level circuit builders such as Lasso and Jolt. Highlighting the significance of these tools will not only provide essential education to individual projects that need them but on a broader scale, prepare the entire ecosystem for frictionless scalability.”

Zk proof projects saw increased VC interest late this year. Do you think this trend will continue in 2024? Why so, or why not?

“Builder education, an impetus in VC backing, and the maturation of backend systems mean that applications that were previously impossible on-chain, are now being built and deployed without hindrance. We are finally realizing successful Web3 applications without the requirement of trusted intermediaries – this is quite exciting to observe! These achievements by our team and our industry peers tell me that VC support will not only continue, but firms will begin to focus on how and where projects are applying ZK tech in their products. a16z’s backing of the tech in August of this year was a welcome development, and hopefully a gateway for greater attention from other VC giants.”

What use cases for zk proof technology do you expect to see grow or come into existence in 2024?

“The value proposition of Zk-proof technology is limitless within and beyond Web3. The tech will be evident in myriad use cases across financial services and DeFi concerning privacy-preserving transactions and cross-border payments. It also stands to revolutionize identity, governance, and supply-chain solutions. However, only the use cases that apply the tech by also prioritizing security, efficiency, and privacy, in addition to fulfilling their intended purposes effectively will emerge as the killer use cases in the arena.”

What do you think 2024 holds in store for zk-trustless bridges?

“With the expansion of the ecosystem, interoperability between chains is paramount. Zk-trustless bridges are the solution to this growing demand. Considering this, the tech’s offering of improved scalability, and increasing privacy concerns from users, the industry will be primed for mass adoption of zk-trustless bridges in 2024. By 2025, zk-trustless bridges are set to become the default transport layer.”

Pavel Matveev, Co-Founder/CEO at Wirex

“Looking ahead to 2024, the cryptocurrency market could see some significant growth. This is especially true if Bitcoin and Ethereum Spot ETFs get the green light, which would make it easier for big players like pension funds to invest in crypto assets.

One key thing to keep an eye on is the Bitcoin halving scheduled for 2024. Past trends suggest that these halvings often come before big price increases, which could not only boost Bitcoin but also spark more interest in other cryptocurrencies, creating favourable conditions for the bull run.

At the same time, crypto enthusiasts are expected to be turning their attention to the on-chain economy model. This innovative approach to handling money relies on blockchain technology, ensuring that once transactions occur, they remain unchangeable and secure. This transparency fosters accountability, as individuals become more conscious of their financial decisions. Moreover, the reduced dependence on centralised intermediaries grants people greater autonomy over their funds.

That’s why at Wirex, we are gearing up to launch W-Pay, a revolutionary payment system based on a ZK-powered App Chain. Empowered by Polygon’s CDK, W-Pay is set to transform the landscape of crypto payments by providing a scalable, secure, and interoperable ecosystem. W-Pay is part of Wirex’s Six Pillars detailed in Wirex’s roadmap, each addressing a crucial aspect of the company’s overall mission.”

Igor Telyatnikov, CEO and Co-Founder at AlphaPoint

“Analyzing technological and regulatory dynamics, I anticipate 2024 may prove a pivotal year that unlocks sidelined interest for explosive growth in digital assets. Financial institutions, post Bitcoin spot ETF approval, will receive greater demand from their customers for access to digital assets or be left behind for newer platforms. We will see dozens of new large financial institutions enter the market enabling access and usage of these new financial vehicles for a broad range of financial services and use cases.

Concurrently, Bitcoin’s next halving event expected in early 2024 will reduce new BTC supply by 50% almost instantaneously. This supply shock comes at a time when Bitcoin adoption continues expanding globally across payments, remittances and as a deflationary store of value. Additionally, 2024 marks Bitcoin’s third halving milestone which arrives with unparalleled mainstream and institutional participation compared to prior iterations, with major multinationals, banks and investors gaining exposure. These dynamics underscore Bitcoin’s intrinsic economic design to highlight scarcity against a backdrop of global adoption growth.”

Jonathan Solomon, Co-Founder and Co-CEO of ARIA

“As we approach 2024 and with Q4 of 2023 leading to a close, multiple developments could occur that will affect the crypto landscape – with current expectations undoubtedly positive.

First, the launch of Bitcoin Spot ETFs in 2024 isn’t merely a financial development; it’s a testament to regulatory maturation. As clarity unfolds, institutional investors find a regulated gateway, injecting new liquidity and reshaping market dynamics. In 2023, Bitcoin rallied more than 120%, with many predicting the asset to rise to a new all-time high, potentially over $100,000. Investors are focused on what I define as positive developments, in which the Bitcoin ETF will be approved soon – bringing in a larger audience of traditional investors who might have been apprehensive about crypto. The Bitcoin halving in 2024 will also become a focal point, not just for its numerical impact but for its role in catalyzing market evolution. This event, set against a regulatory clarity backdrop, draws institutional and retail players into a renewed Bitcoin narrative.

Moreover, 2024 marks the resolution of industry uncertainties with the conclusion of the FTX case and the settlement between Binance and the US Department of Justice. These milestones alleviate lingering concerns, bringing a sense of closure to two outstanding issues that have cast shadows over the market.

The maturation of regulation, coupled with the resolution of industry uncertainties, should promise to usher in a new chapter for crypto, attracting a broader investor base and fostering increased confidence in the market’s resilience.”

Rick Porter, Co-Founder & CEO at DSCVR

“In 2024, the digital world is poised for a transformative shift, where the insights and advancements of SocialFi will start to seamlessly merge with the well-known landscapes of Web2 social platforms. We’re seeing a fascinating trend unfolding of pseudonymity and authenticity in Web3. This empowers users to explore and express more authentic and unique versions of themselves, unhindered by the constraints of physical identity. In this burgeoning space, we’re seeing content creators not just generating content but crafting entirely new identities. As we navigate this next year, the fusion of Web3 and SocialFi stands poised to revolutionize the future of the digital space. We will see more than just a technological shift; we’ll see a cultural and creative renaissance that reimagines how we connect, create, and exist in the digital world.”

Kerel Verwaerde, Chief Marketing Officer at Cryptology.com

Bitcoin Halving

“Firstly, we have the Bitcoin Halving that sees the minting of new Bitcoin reduced by 50%. Historically this has positively impacted the price.”

Regulations

“We have had a big year for legislation as world governments have cracked their whips. More regulations from the SEC will impact prices. Exchanges such as Binance and Gemini have been at the brunt of lawmakers for illicit business practices.”

Investment Firms

“Investment firms like BlackRock are creating their own crypto ETFs, making crypto investing more accessible than before for new users.”

Macro Thoughts

“On a macro level, current world conflicts in Europe and the Middle East may have a positive or negative impact, it remains to be seen.

Overall, 2024 is poised to be a big year for cryptocurrency, and we cannot wait for it!”

Graeme Moore, Head of Tokenization of Polymesh Association

“The cryptocurrency market has come through a challenging 2023 to end the year with a strong Bitcoin rally and a bright outlook for 2024. Based on the positive communications and meetings between the SEC, BlackRock, and others, it looks almost certain that these initial Bitcoin spot ETF approvals could occur in early January. Based on public comment periods, the most likely dates for approval are on or around January 10th.

The coming year will also see the Bitcoin halving, which has generally been bullish for the Bitcoin price. Another important catalyst for price is the resolution of many blow-ups and lawsuits from the 2021-2022 period finally giving investors confidence that the worst is behind us, and that brighter days are ahead.

If a Bitcoin spot ETF is approved in early January, my short-term price target for BTC is $50,000 with my December 2024 price target at $100,000.”

Rob Greig, Co-Founder and Co-CEO of Cornucopias (a popularWeb3 game)

“In a rollercoaster year for NFT holders marked by little action, game studios stumbled upon a chance to thrive amid the chaos by ‘building within the bear.’ The calm in the NFT world gave these studios a breather to buckle down, strategize, get creative, roll out unique products, and bond with their core crowd – all setting the stage for future wins when the market is in full swing. At the same time, the broader blockchain scene in 2023 marked a pivotal moment as institutions, governments, and regulators showcased their readiness for the transformative impact of blockchain technology. This forward-thinking and groundwork indicate a profound shift on the horizon, ready to reshape numerous industries in the not-too-distant future.

Looking ahead to 2024, I’m eagerly anticipating the ongoing expansion and development of the Web3 gaming space. The journey for blockchain games has been a bit bumpy, with players expressing various feelings about NFTs and tokenization.

The blockchain gaming projects that hit the mark will deliver engaging storylines and fun gameplay while ensuring top-notch performance and user experience. Making blockchain terms less confusing while improving the user experience is crucial for bringing new users into the space, whether they have a curiosity about crypto or not. I’m confident that in the coming year, the divide between blockchain and traditional gamers will narrow, playing a part in reshaping the industry’s reputation.”

Stephen Pair, CEO of BitPay

“2024 will be “the year for cryptocurrency payments,” with the most spenders, the most volume, and more brands accepting crypto payments. Multiple factors will come into play.

With the upcoming Bitcoin halving, we’ve historically seen increased spending post the halving event. We expect 2024 to be no different. One industry we’re incredibly excited about is luxury goods. Following the last halving, cryptocurrency payments in the luxury goods industry increased 700% compared to the pre-halving period. Since then, even more brands and retailers across the jewelry, auto, and fashion sectors have opened up to accepting payments in cryptocurrency, giving spenders even more choices for how and where they’ll spend their coins.

While Bitcoin will dominate as the crypto of choice for payments, we expect Litecoin and stablecoins (USDC) to be number two or three. Solana, Polygon, and the Lightning Network will also rise as users seek to avoid high fees. Look for a jump in smaller, more recurrent payments for everyday purchases.

Finally, expect the adoption of self-custody wallets to continue steadily. In light of disturbances with custodial service providers, it’s becoming increasingly clear to savvy crypto users why controlling your keys is paramount. Along with the security benefits, self-custody wallets often provide a better payment experience, which will only become more top of mind for spenders.”