Bitcoin has been making headlines lately, with the price of one bitcoin soaring to £43,290.68 at the time of publication, with projected growth. But even though it’s reached this high point, it has not always been so popular. After all, you might be asking yourself how Bitcoin got to its current high point?

What is Bitcoin?

Bitcoin is a decentralized cryptocurrency. It’s essentially just code that can be traded across the internet. It’s more or less like money because it’s useful for buying things that people want to buy. However, unlike money, Bitcoin cannot be borrowed or lent to others, and it cannot be created out of thin air like fiat currency, like the dollar or pound. Instead, Bitcoin was first touted as an electronic cash system back in 2009 by its creator Satoshi Nakamoto.

Bitcoin is only used for purchases if you first obtain Bitcoins. You can obtain Bitcoins by purchasing them with fiat currency, or if you already have some other cryptocurrency like Ethereum, you can use your existing digital assets to buy Bitcoins.

How Did Bitcoin Get To Where It Is Today?

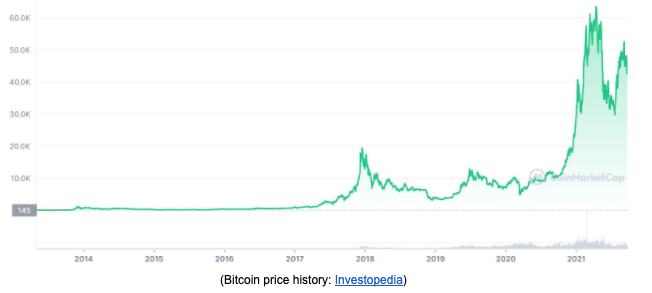

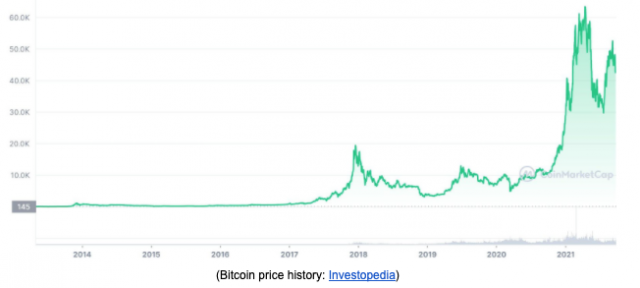

Bitcoin was released as an open-source software in 2009. Still, at first, the price was meager because it wasn’t very popular yet since it didn’t have any stores that accepted it as payment, and there weren’t many users who were making transactions with Bitcoins either.

Fast-forward to early 2011, Bitcoin was beginning to become more popular but still remained very niche; in fact, at this time, it wasn’t even used to buy much at all! By the end of 2013, it started to rise to another all-time high when Bitcoins were traded for $1,000 each; however, in 2014, there was an impending crisis that caused Bitcoin’s price to plummet. This is when you might be wondering why Bitcoin’s price never rebounded like many other assets following the collapse of the financial markets in 2008/2009.

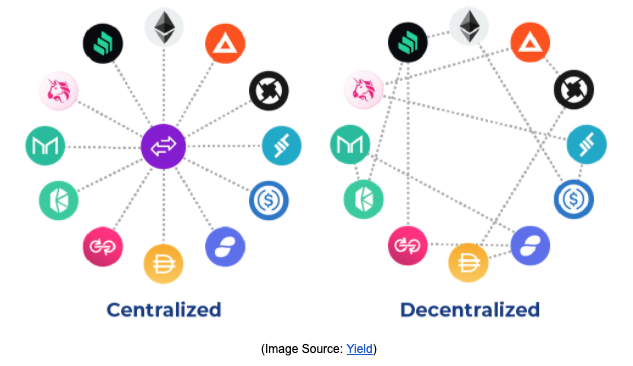

The reason is simple. Bitcoin is not controlled by any one entity, and it’s actually a decentralized network that is made up of computers all over the world. In fact, there are thousands of full nodes on this network at any given moment. And it is these full nodes that release the transactions on the network to make them official and decentralized.

In July 2016, Bitcoin’s price had hit yet another record high when one coin was traded for $11,000 a piece. Since then, Bitcoin has been fluctuating a lot, but it has been on a steady rise since August 2017, when it hit an all-time peak of $17,500 apiece. However, in its years of being up until now, it has experienced a decline. This decline is probably due to the fact that the Chinese government banned cryptocurrency trading within its borders in September 2017 and that most investors were going in blind faith as Bitcoin was the first of its kind, which made people reluctant.

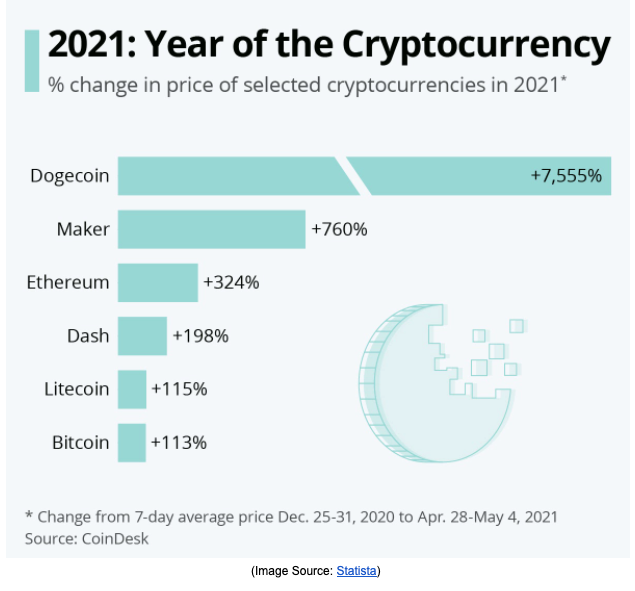

As for its price today, it’s hard to say what will happen in the future. Even though many are predicting that the price of Bitcoin will fall to zero soon due to network congestion or regulation, others are still trying to predict what will happen next. This uncertainty is enough reason alone for people around the world to be interested in cryptocurrencies. Luckily, other altcoins are being created all over the internet, so people’s interest in Bitcoin will likely increase even more.

How People Are Reacting To Bitcoin’s Recent Price Surge

People tend to panic when a financial asset they own suddenly plummets in value. It seems to happen even more in this digital age because people hear about it all over the internet, and this causes them to worry that their assets could be worth nothing in the near future. However, there are also people who see a sudden increase in an asset’s value as a reason to buy it. In fact, you might be surprised at how much investors are willing to pay for one unit of Bitcoin based on its recent price surges.

For instance, you might be thinking that since Bitcoin’s price has been on a steady climb, people must think it’s a good investment. As it turns out, the same cannot be said; investors aren’t necessarily willing to buy Bitcoin based on its growth in value alone. There are several reasons for this:

(1) Volatility: Bitcoin’s price is highly volatile, and it fluctuates a lot during certain periods of time. Bear and bull markets play a significant role in the price of Bitcoin, which ripples down to other coins in the crypto network.

(2) Security concerns: Since Bitcoin is a digital currency, many people wonder whether it can be hacked. This is because Bitcoins are stored on computer servers. So if you’re worried that your Bitcoins could be stolen by some hacker, then buying them would probably be a bad idea. This would also prevent you from making transactions with them as well.

(3) Legal issues: People may also be worried about how the US government will treat Bitcoin in the future. There are some people who say that Bitcoin is perfectly legal, but others still think it’s a violation of their current law. And it’s possible that if the government ever makes Bitcoin illegal, then you could never use it again. This is probably why some countries have started to ban cryptocurrencies altogether.

(4) Supply and demand: The supply of Bitcoin is also limited to 21 million coins. And because of this, many investors think that this could cause its price to increase even further. But there are some people who believe that it will cause the price to fall instead because there aren’t enough Bitcoins to meet the demand.

How Did Bitcoin Become A Hit?

It’s quite interesting that Bitcoin came into existence; right from the start-up until now, it has been praised by many for its acceptance and general use. But let’s not forget about its history. As you may already know, it was created back in 2009 by Satoshi Nakamoto, who was likely a Japanese programmer. But nobody knows who he is because he never and still has not revealed his identity to anyone.

Even though cryptocurrencies are new on the scene, people have been using digital currency for some time now. As an example, Amazon gift cards are an example of digital currency that can be used on Amazon’s website. Amazon gift cards are usually purchased with fiat money, but they are actually stored on Amazon’s computers as an electronic record.

As for why Satoshi decided to create Bitcoin in the first place, there are several reasons for this. One is that he wanted a new type of digital currency that would be decentralized and private. He did this because of a few things that he has experienced in previous jobs. For one, Satoshi had been involved in the development of P2P file-sharing networks and online forums for more than 20 years by this time. In addition to this, Satoshi also had experience with cryptography for many years before Bitcoin’s creation.

Another reason why Bitcoin was created was due to Satoshi’s interest in game theory. He believed that game theory could help him develop Bitcoin into something novel, which could eventually improve upon other virtual currencies like DigiCash or e-gold.

The speculation around crypto has grown over the years, since the release of bitcoin, and today, there are nearly 6,000 crypto coins on the market and a market cap of over $2trillion.