Since the invention of Bitcoin more than a decade ago, there have been countless ways to make money through cryptocurrencies (gambling, mining, staking, copy trading, etc.). One of the most popular ways, however, is actively trading in the cryptocurrency markets.

Everyone knows that trading can be a lucrative venture, but over 90% of people who try their hand at trading crypto will fail. So how do we become the 10% that succeed and can make it long-term as a trader?

Well, if you listen to enough trading professionals talk about how they learned to become consistently profitable traders, you’ll see that the secret was this:

- They worked incredibly hard at it.

- They developed serious self-discipline skills.

- They didn’t give up no matter what.

If you go into it thinking it is a get-rich-quick scheme, you are certain to fail. If instead, you go into it with a long-term mindset, you can change your financial future forever.

Now the biggest challenge that people face when learning how to trade Bitcoin is the fact that it can be quite confusing at first. This is especially true if you don’t have any prior experience with trading other assets, such as stocks or forex.

One of the key things that you need to understand when trading Bitcoin is that the market is incredibly volatile. Prices can swing sharply up or down in a matter of minutes, which can make it difficult to determine when is the best time to buy or sell.

Another common challenge that traders face is trying to identify chart patterns. Many novice traders get overwhelmed by all the information that’s displayed on a candlestick chart and they don’t know where to start.

Trading also involves a lot of risks, which can be difficult for some people to stomach. It’s important to remember that even professional traders often experience losses, so you need to be prepared for this if you want to be successful in this market.

For this reason, it’s vital to still have the majority of your cryptocurrency money in long-term investments within something like a crypto IRA account — something that you just dollar-cost-average into every month and never actively trade within.

When you have the majority of your money in long-term investments, it makes it MUCH easier to trade without emotion because you know that the majority of your cash is tucked away for the long haul.

Finally, one of the most important things that you need to remember when trading Bitcoin is to start small and slowly increase your trade sizing as you gain experience. Don’t go all-in on your first trade – this is a recipe for disaster. By starting out slowly and increasing your exposure gradually, you’ll give yourself a chance to learn from your mistakes and become a successful trader.

So without further ado, let’s get into the steps to trading Bitcoin like the pros.

Understand Candlestick Charts

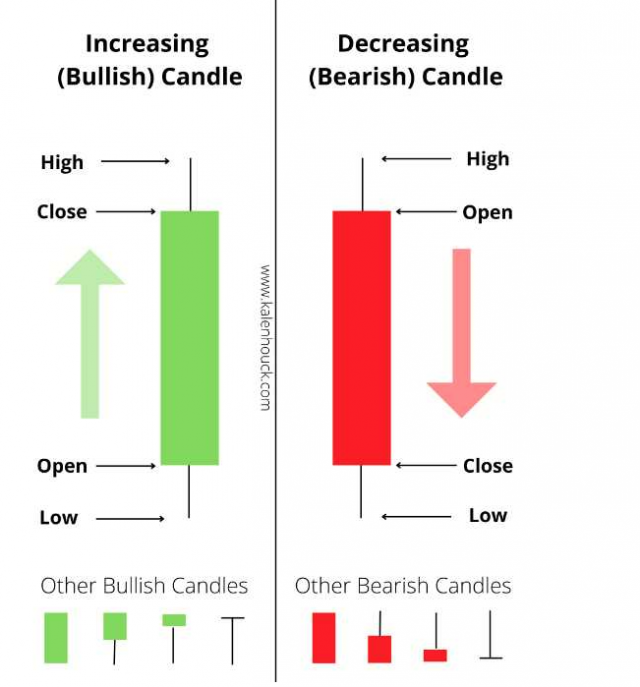

Candlestick charts are a foundational thing to understand when trading any instrument, and trading cryptocurrencies is no exception. This tells you where the price has moved over a given period and can give you much insight into how other traders are feeling about the current price.

If there is a long “wick” on the bottom of the candle, it tells you that a lot of buyers stepped in at that price and so you have an indication that there might be increased demand at that price level if it comes back to it. I

f you see a small candle body, it tells you that buyers and sellers were fighting each other hard at that price level and that there was no clear winner (if the buyers won, there would be a large-bodied green candle, and if the sellers won, there would be a large-bodied red candle).

Learn the Fundamentals of Technical Analysis

When trading, if you can learn how to read and understand these three things, you’ll be farther along than 90% of other traders out there:

- Price action

- Volume

- Support/resistance

That’s ALL you need to be a successful trader.

Price Action

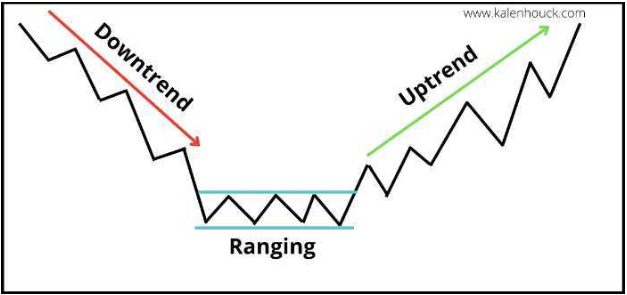

Price action simply refers to how price is reacting to different levels, how quickly it is moving up or down, and whether it is trending or consolidating/ranging.

You can see in the picture below that the price is downtrending, then it finds a base and starts ranging, then it begins uptrending.

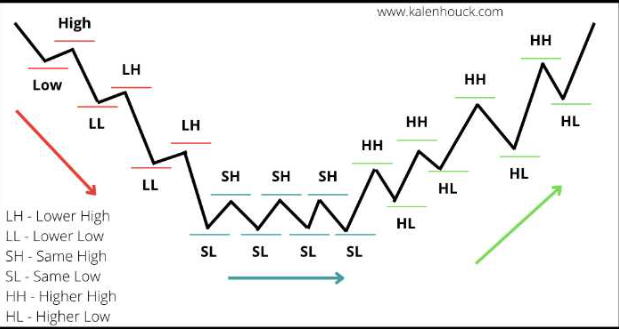

How do we know whether it is downtrending, ranging, or uptrending? We simply look at the highs and lows of the pivot points.

- Making lower highs and lower lows –> downtrending

- Making the same highs and some lows –> ranging

- Making higher highs and higher lows –> uptrending

Once we know to be looking for the pivot points to determine the type of market we are in, it becomes much easier to determine our trading strategy.

Source: https://quantstrategies.academy/2020/08/28/how-to-use-moving-average/

The key here is this: don’t fight the trend.

If the price is in an uptrend, don’t try to short the market. If the price is in a downtrend, don’t try to go long. If the price is consolidating/ranging, just wait until it starts trending in one direction again before entering a new trade.

Volume

Volume is simply the number of shares that have been traded during any given time. It’s a measure of activity and conviction — it tells you how many other traders are actively participating in the movement of the price.

Reading volume along with the price will give you a much fuller picture of the strength of the move. If there is a breakout of a consolidation range on low volume, you should have little confidence in entering that trade. However, if there is a breakout of a range on increasing volume, you can feel more confident that the price will continue onward.

Source: https://www.investopedia.com/terms/a/averagedailytradingvolume.asp

Support/resistance

Trading is all about learning what other traders are most likely to do in a given situation and jumping on board with the majority. This is why support and resistance are so important for every trader to understand. Support is where the price has found a bottom, and resistance is where the price has found a top.

When you start to look for major levels of support and resistance, you will start to understand the market. The key here is to not just look at the last few minutes, hours, or even days of trading, but to look back as far as you can.

You may be wondering why Bitcoin has found support around the $18,000 level recently after the large selloff.

Well if we zoom out several years and look for key pivot areas on the monthly chart, we’ll see pretty clearly why BTC is having a hard time getting through this price level.

Oftentimes if a trader will just zoom out, and keep zooming out, they will find the answer is very obvious to see why the price has stopped at a certain point.

High-Probability Chart Patterns

As a trader, your goal should always be to trade high-probability chart patterns. This means that you are only taking trades that have a very high chance of success. By trading high-probability patterns, you will greatly increase your chances of making money in the markets.

The goal in trading is not to be doing things uniquely — the goal of trading is to figure out what the majority of other traders are doing and just ride the wave.

So, we don’t want to be trading some obscure chart pattern that we learned about in a tiny chat room somewhere based on an “insider secret”. We want to be trading chart patterns that LOTS of other traders are watching. It will give us the most profitable places to enter into trades.

To help you become a successful trader, I’m going to introduce you to two of the most common and profitable high-probability chart patterns. These patterns have been proven to work time and time again, so by learning how to spot them, you’ll be able to make money consistently in the markets.

Double Top/Bottom

The double top or bottom is one of the most reliable chart patterns to trade. The psychology behind it is this: many other traders can see a very clear point where the price has reversed in the past and they’ll be looking at the same point to do it again.

The pivot point should be obvious to you — if you have to ask yourself, “Is this a pivot point?” then it’s not a good place to take a trade. Wait for the setups where it is 100% clear where the previous top or bottom of the move was.

You can trade this one hyper-aggressively by not waiting for confirmation but blindly buying or selling at the double top/bottom with a stop-loss set little ways outside of the previous top. Or you can be more conservative and wait for a clearer sign of rejection. And if you want to be very conservative you can wait for the lower high to be formed before entering the trade.

The same thing applies to double-bottoms, just reversed.

Ascending/Descending Triangle

The ascending/descending triangle is a very reliable chart pattern that traders can use to consistently make money in the markets. This pattern is created when the price is confined to a tight range and begins forming higher lows or lower highs up against a base/top.

The pattern is completed when the price breaks out of the range, typically on higher volume. You can see that Bitcoin is currently forming a descending triangle on the daily chart as of 10/7/22.

It has lower highs being put in up against the same lows now for a few weeks. We see that the overall chart is forming a triangle that is pointing down (i.e. a descending triangle). An aggressive entry is right on the breakout of the base, and a more conservative entry is waiting for a breakthrough and then backtest before seeing follow-through and going short.

For an ascending triangle, you look for the same thing just in the opposite direction going up.

Conclusion

By understanding these two high-probability chart patterns, you’ll be able to spot profitable trading opportunities with a higher degree of accuracy. These patterns have been proven to work time and time again, so by learning how to spot them, you’ll be able to make money consistently in the markets. And making money consistently and reliably should be a priority for everyone, especially as global economic conditions continue to deteriorate.

As the government continues to go deeper into debt every day, the economy continues to show signs of weakening, and people are seeking hedges against inflation through real estate, precious metals, and cryptocurrencies (things that have value outside of fiat currency), it can be a scary time to be a trader within the financial markets.

That’s why it is vitally important to formulate a trading plan and then stick to it. As the world around you gets more and more unstable, if you can learn to create a stable environment in your mind and become a consistently profitable trader, then no outside pressures can crack you.

But if you don’t have a strategy, a plan, and the discipline to carry it out, you’ll be no better off than the people that did nothing. If you will learn the fundamentals of trading through price action, volume, support/resistance, and a few high-probability trading patterns that you practice often, then you can make as much money as you could ever need within the markets trading Bitcoin and never concern yourself with money again.

BIO:

Kalen Houck is a personal finance, trading, and online business expert who is passionate about teaching people the secrets to building generational wealth. He is the founder of KalenHouck.com where he regularly writes about cryptocurrencies, online business, personal finance, and mental mastery.