The present decade and new technology that have emerged have changed the world of finance. Digital and fiat currencies have transformed the way we live and invest.

Cryptocurrencies aim to make the world of finance, one which is available to all and for all to use without the need and interruption of the middle man.

Although this may sound ambitious, blockchain technology does have the power to make DeFi possible and has become more of a reality as the years have gone by thanks to a revolution called Decentralised Finance (DeFi).

What is DeFi?

Since the launch of Bitcoin, which is still one of the most well-known cryptocurrencies on the market, its accompanying technology blockchain has since rapidly evolved, expanding its use in different areas in and outside of finance.

Decentralized finance is an exciting development because it utilizes blockchain technology to render smart contracts, smart loans, and other complex services that can broker agreements between large companies that are automatically executable when certain conditions are met – all without the need for human mediation.

The sensitive contents of these smart contracts are safely stored on the blockchain’s distributed ledger, making them virtually immutable. The use of DeFi services like smart contracts could well be a revolutionary development in the world of finance, saving large companies and individuals alike fortunes in payments to middlemen.

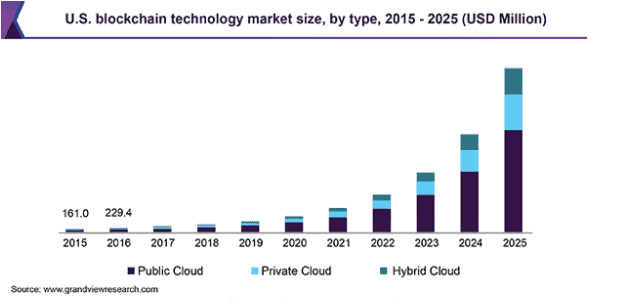

The graph below indicates the popularity of blockchain technology now and in the future and how it is and will be used according to sectors in the US.

(Source: Grand View Research)

The aim of Bitcoin was to help make payments and money on a decentralized network that is universally accessible. Unfortunately, Bitcoin failed to live up to its promise in full, but the potential game-changer is decentralized finance-based blockchain which has huge potential.

DeFi works based on decentralized applications (DApps) which are permissionless applications built on a blockchain network. Many see this as an open-source alternative to almost all financial services that are used today.

Technically it is possible for every financial service currently available by financial institutions to be adopted into the crypto-sphere through DeFi. Doing so will replace centralized financial infrastructures, even if only parts of them. This shift will move the power of control over investors and individuals who will be able to see where their investments are and how.

It is clear DeFi will be a primary expression of blockchain technology, bringing real change to the financial market as it exists, and here are some of the ways analysts see new digital finance methods become implemented.

4 Ways DeFi is Changing Finance

Insurance

Analysts have sighted that DeFi insurance could be the next billion-dollar market. There are currently a handful of DeFi insurance platform providers who deal with most issues providing security for transactions on exchanges concerning lending.

This helps to create a safe and secure ecosystem that offers individuals a service based on transparency and accessibility.

The aim is to reduce, if not get rid of traditional insurance agencies that run in huge part a monopoly. DeFi can help reduce the cost of insurance even for smaller items such as smartphones, smartwatches and tablets.

Already, some of the newest smartphones, like Samsung, which, according to Smartphone Checker, run on high-performance Snapdragon chipset have blockchain integrated, allowing users to utilize blockchain’s capabilities like crypto wallets.

Decentralized Exchanges

DeFi has benefited decentralized exchanges (DEX) with a keen incline in volumes at a new all-time high. DeFi enables users to create smart contacts that allow direct trades between participants’ wallets.

This means users can easily trade digital assets without needing an exchange, such as a bank, to hold their funds.

Exchanging, in this way reduces the risk that comes with depositing crypto into exchanges, which in some cases, can lead to losing funds if someone was to hack the system.

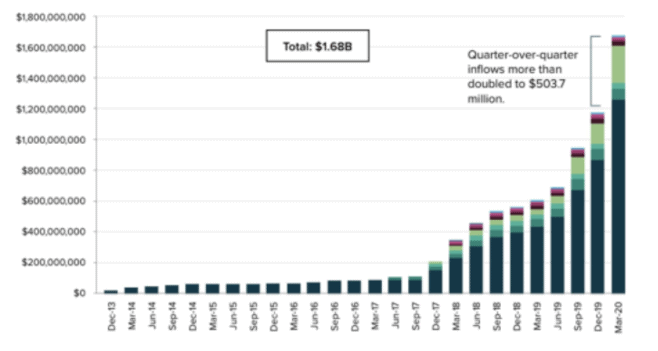

About 57% of all DeFi users who use the dominant Ethereum-based DEX Uniswap platform wish for a spike in users. The graph below shows an incline in institutional interest in digital assets.

Lending

DeFi offers advantages such as the instant settlement of funds which gives investors the opportunity to use digital assets as collateral damage that are not associated with any credit checks.

This creates an attractive appeal for users compared to the traditional credit system that is currently in place.

Reports have shown that DeFi lending has grown in 2020 since March and has surged more than seven-fold amounting to a colossal $3.7billion.

This could be due to the pandemic and decreasing interest rates at a historic low, and so, investors are out seeking a return on investments.

Data That Concerns Finances

Concerning traditional financial markets, for the most part, data is governed by a very small group of stakeholders. These stakeholders traditionally control pricing and access to data. DeFi can help by eliminating corruption while enabling data to be accessed by all parties involved.

By doing so, it will ultimately improve the current financial market and diminish any problems that are currently in place on a global scale.

Although there is much promise surrounding DeFi and it will change the financial market, some of its applications are still early, and so the building blocks are still being put into place.

DeFi is still only scratching the surface of decentralizing key pillars and issues when considering the way of traditional finance.

As adoption takes place, there will still be many new protocols and procedures that will need to be put in place to maintain its sophistication and growth.

However, it is important to keep in mind that even DeFi is not immune to hackers, which raises questions as other DApps have been hacked in the past.