The Bitcoin halving has proven to be an integral benchmark for traders trying to time the market, but how could the new spot BTC ETFs impact the trend?

Crypto Twitter has been immersed in the speculation and expectation of the eventual approval of the spot Bitcoin (BTC) exchange-traded funds (ETFs) in the United States.

After some turbulence arising from an alleged phony tweet from the U.S. Securities and Exchange Commission, all 10 spot Bitcoin ETFs got approved.

The ETF hangover seems to be over now, and attention can now move to the next big event: the Bitcoin halving. The largest Bitcoin event has less than 100 days to go. The previous halving events have directly correlated with Bitcoin’s bull runs, but could the spot Bitcoin ETFs influence the price of Bitcoin in the coming halving cycle, interfering with short- and long-term Bitcoin price predictions?

What Is The Bitcoin Halving?

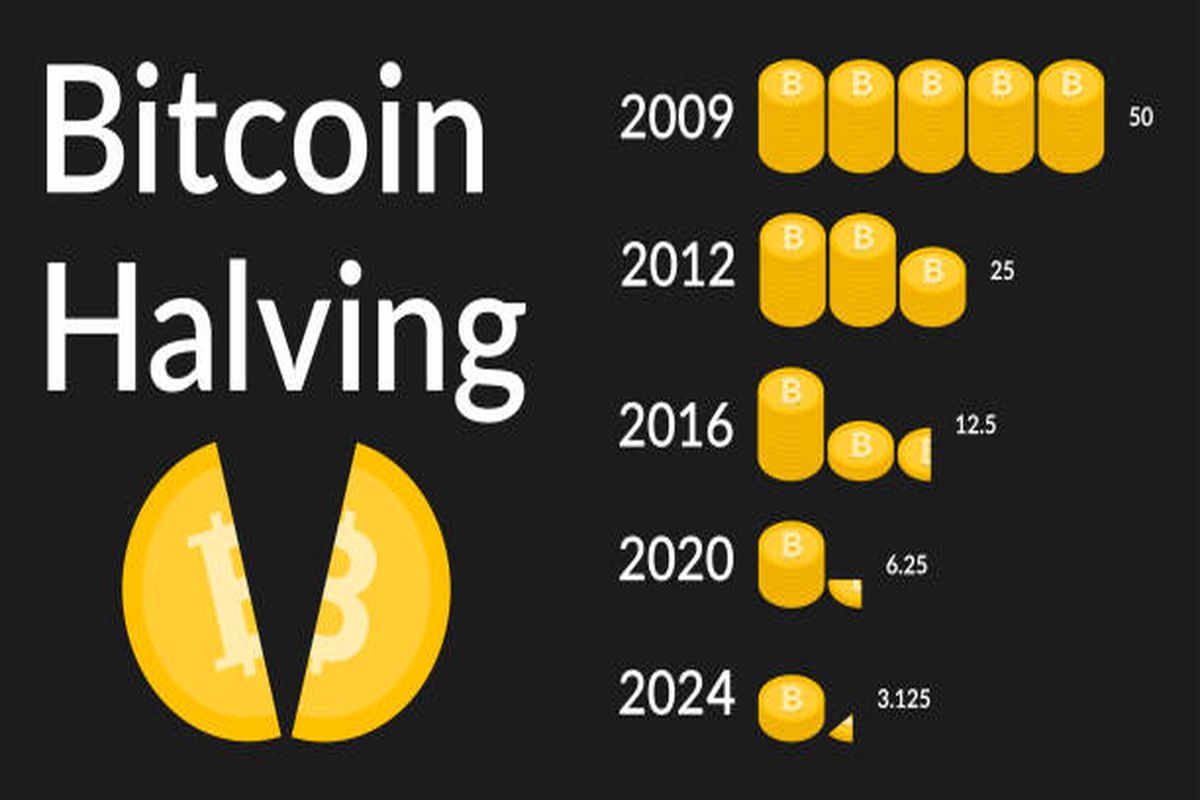

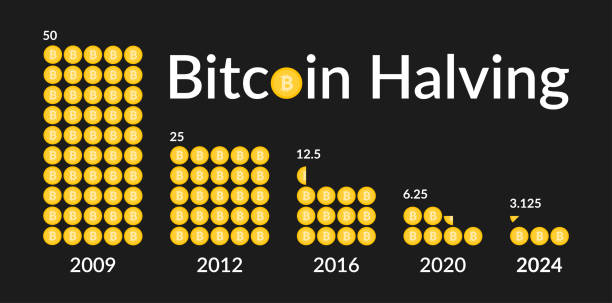

The Bitcoin halving is an event that happens nearly every four years, reducing the rate at which new BTC units are generated and earned by the miners in the Bitcoin network. Particularly, miners’ reward for validating and adding the new blocks to the blockchain is reduced by half.

Interestingly, the initial reward began at 50 BTC per block, and after every halving event, it dropped by half. The most recent halving happened in May 2020, reducing the reward by 6.25 BTC per block. The next Bitcoin halving, estimated to happen in mid-April 2024, will reduce the Bitcoin mining rewards to 3.125 BTC per block.

The process is programmed into the Bitcoin protocol. It is designed to develop scarcity, mimicking the scarcity of precious metals such as gold. This crypto community closely watches the halving events, as they impact the general supply of Bitcoin and can have some impacts on market dynamics and the value of the crypto.

Bitcoin is still young and has a relatively short history. Most fundamental analysts find it quite hard to offer a specific value because of its novelty and alleged revolutionary factors. Looking at Bitcoin’s history, the halving has had a constant effect on the price of Bitcoin.

Related:Bitcoin Halving: Everything You Need To Know and How To Prepare For It

Halving 2012: Bitcoin Was Declared Dead By Mainstream Media

The first halving happened on November 28, 2012, and reduced the block reward from 50 to 25 BTC. Interestingly, the price of Bitcoin at the time of the halving was $13, peaking the following year at $1,174.

In 2012, Bitcoin was not taken too seriously by the mainstream markets. It was popular among cypherpunks, which nurtured the technology from its infancy. The price of Bitcoin became a marketing tool for the digital asset after it surged above the benchmark of $1,000, making headlines in the mainstream media.

Since Bitcoin was an unknown intangible asset most did not comprehend, it was condemned as dead once the price dropped back to $200. The phrase “Bitcoin is dead” would become common in the media in the following years, but the digital asset remained resilient and survived the criticism.

Halving 2016: The Retail Speculation Bubble

The second halving changed Bitcoin from an underground crypto into a legitimate asset class. The halving happened on July 16, 2016, reducing the block reward to 12.5 BTC. On that note, the price at the time of the halving was $664; the following year, it peaked at almost $20,000.

Retail investors jumped into the new wave of altcoins, pushed by the initial coin offering (ICO) boom, which was made possible thanks to the new attributes provided by Ethereum’s blockchain. ICOs flooded the market, but most were incomplete projects, and some were straight scams, bringing lots of criticism to the crypto market in general.

The rise after the halving was considered a simple retail speculative bubble. Nonetheless, Pandora’s Box had already been opened, and the blockchain sector would arise from that halving event.

Halving 2020: The Arrival OF Smart Money

When the third halving arrived on May 11, 2020, reducing this block award to 6.25 BTC, BTC was valued at $9,734. A new all-time high (ATH) came the following year at $69,045.

The halving cycle caught the attention of several billionaire investors like Paul Tudor Jones and Michael Saylor, co-founder who was the CEO of software company MicroStrategy at the time.

Saylor became the first CEO to hold Bitcoin on his firm’s balance. As the price of Bitcoin increased, MicroStrategy’s stock value increased with it. Saylor’s strategy inspired other prominent businessmen such as Elon Musk.

Musk’s Tesla acquired Bitcoin, and a new wave of funds and firms followed Saylor’s lead to allocate certain percentages of their treasury into Bitcoin. As was the case with the last two halvings, the price of Bitcoin dropped after it hit a new all-time high.

The Halving Cycle Pattern

Throughout the halving cycles, a constant pattern has emerged. There seem to be five stages to a Bitcoin halving cycle:

- Significant rally before the halving

- Brief correction

- Period of consolidation

- Major bull run

- Steep correction.

The all-time high happened nearly 18 months post-halving. That represents a simplified yet accurate depiction of the previous three cycles.

PlanB, a popular but controversial analyst in the crypto space, summed up a simple strategy for investors, mostly those not inclined to engage in active trading, which respected the theory of these halving cycles.

[Buy bitcoin 6 months before a halving and sell 18 months after a halving] has historically beaten [buy&hold]. The next halving is in April 2024 … will this strategy work again?https://t.co/9kjaCUulwb pic.twitter.com/cbO80Ym7iC

— PlanB (@100trillionUSD) July 3, 2023

The strategy features buying Bitcoin six months before the halving and taking profits 18 months later from its date.

What To Expect For The Imminent Bitcoin Halving

As is the case with the last halving, there is a narrative that Bitcoin’s price will surge higher than the previous bull cycle – and reach a new all-time high. In this cycle, the spot Bitcoin ETF approval was the next milestone the market was expecting.

The forthcoming halving event is less than 100 days away, and market observers are optimistic about the potential of a new Bitcoin all-time high.

CEO of investment analytics company Blockcircle, Basel Ismail, he thinks Bitcoin’s price will increase as the halving gets closer but said the trading activity of the spot Bitcoin ETFs might impact the crypto market.

Ismail compared the gold ETF launch in 2004 and its impacts on the price of gold. A pattern came up where an increase in gold’s price correlated with net gold inflows and decreased with the net outflows, suggesting a feedback loop influenced mainly by cash transactions in the physical gold market.

In his opinion, the spot Bitcoin ETF will mirror the behavior of the gold ETF, possibly acting as an accelerant to Bitcoin’s value and price movements. Massive inflows should positively impact Bitcoin’s value, but that can be a double-edged sword.

Lead-lag analysis shows that inflows can create price momentum and price changes can influence flows, hence stressing on positive and negative market trends. When the gold ETF was launched, the price of gold fluctuated considerably.

Related:Spot Bitcoin ETFs Add Another 10,600 BTC On Day 5

Market charts highlight how gold was trading in a range-bound sideways accumulation zone. Gold failed to break out above certain levels for two-thirds of the year. Every time the momentum surged, the price pulled back into the same price range. As the market kept heating up, the selling pressure appeared to outweigh the buying pressure.

For Ismail, the analysis offers insight into how spot Bitcoin ETF may also impact Bitcoin’s market dynamics. Ismail expects a pullback in the first month after the ETF approvals, saying that the market’s expectations for a quick Bitcoin price increase after the ETF approval were considerably high. He claimed that impatience in the market might result in a quick shift to a pessimistic trend and result in a downside momentum.

Due to the stagnation in market activity, the crypto trader believes that negative trends might lead to news cycles that will pull down the price of Bitcoin. The market will then frame it as an “underwhelming response to Bitcoin ETFs being approved.” For Ismail, the horizontal trend might be caused by two factors: a weak and volatile market sentiment and the accelerant impact of the spot Bitcoin ETFs.

Bitcoin Post-Halving 2024 Prediction

In case the reduced supply of new BC is not accompanied by increased demand, prices might unlikely surge. The spot Bitcoin ETF has dominated all the media attention on the potential inflow of money from traditional to cryptocurrency markets. But what about the retail investors?

Ismael highlighted several signs showing that investor sentiment is improving, including an increase in web traffic to Bitcoin’s Wikipedia page, Google search volume for many Web3 keywords, a new wave of X followers to prominent layer-1 blockchain and tier-1 centralized cryptocurrency exchanges (CEXs) and more.

Even if he forecasts some months of downside pressure for Bitcoin, he expects that Bitcoin will break a new all-time high after the halving, reaching highs of $100,000–$150,000 in late 2025.

Related: Bitcoin’s Potential: Timing Your Entry for Maximum Profits!

Before the spot Bitcoin ETF approval, many predictions have been made. When 2023 reached its end, artificial intelligence applications suggested $120,000 as the average predicted all-time high for Bitcoin. Others have also predicted higher valuations as well.

Multinational bank Standard Chartered forecasts that Bitcoin will hit $200,000 by late 2025, supported by the ETF approval. Others like PlanB, insist that Bitcoin will peak at $532,000 after the halving cycle as highlighted in his stock-to-flow model. ARK CEO and founder Cathie Wood projects that Bitcoin will hit $1.5 million by 2030.

With the arrival of the spot Bitcoin ETF, crypto investors and traders have high morale and trust in Bitcoin’s price for the coming months. Hence, patience is necessary.