By Tam Gryn & Magnus Resch

The NFT world saw an implosive rise and dramatic fall within less than two years. But what stays? In their new book “How To Create And Sell NFTs – A Guide For All Artists” experts Tam Gryn and Magnus Resch discuss the lasting impact of NFTs on the art world.

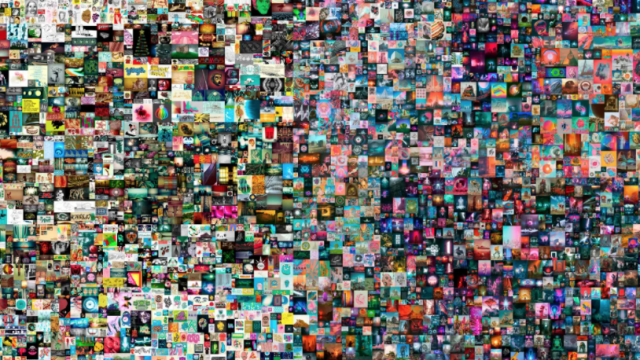

In March 2021, Beeple sold for a staggering $69.3 million, making everydays: The First 5000 Days one of the most expensive works by a living artist. The sales price alone made this transaction remarkable but there was something more.

This unprecedented price left many in the traditional art world bewildered. How could a JPEG file created by an obscure artist without significant gallery representation or museum shows sell for millions of dollars? And what Christie’s had sold was not typical of digital artwork. This record-breaking transaction was for the purchase of a non-fungible token (NFT).

Something very important had just occurred that had the potential to change the function of ownership in the art world: a JPEG could be sold for millions since the associated NFT acted as the custodian of its uniqueness. The problems posed by counterfeits and lack of provenance (ownership history) would vanish overnight through the use of art NFTs.

The owner of work could now sell it at any moment, with complete confidence in the transaction. And the faith of buyers with respect to the legitimacy of their purchases would increase. No longer would costly expert opinions be needed to verify the authenticity of a work and sales could happen within seconds, leaving out auction houses and galleries.

And finally, artists could become millionaires overnight—circumventing galleries, museums, and top collectors. It felt like new dawn had come upon the sleepy art world.

And the markets took off. The total value of sales of NFTs across all industries was $17.7 billion for the full 2021 year. There has been an incredible quantum leap, given that in 2019 the total sales value was only $24.5 million. Lots of NFTs bought and sold, and lots of people bought and sold them.

Risks and Market Downturns

Naturally, with immense opportunities come risks. We hear extensively about fraud, copyright infringements, rug pulls, speculations, volatility, price inflation and storage issues with IPFS. As is the case with any new technology, there is always the risk that opportunists will take the crypto ethos—which is based on decentralization, permissionless and global technology—in an unhealthy or extremely centralized direction that will harm the participants.

And another big risk: Markets are seasonal, and Web3 is no exception. It’s inherently volatile, as we have seen in the May/June 2022 downturns. Currently, you often hear the term “Crypto Winter”, meaning a prolonged period characterized by a sustained general drop in the prices of digital assets which, in turn, hinders enthusiasm for the entire industry.

Summer gives way to winter’s frost, and winter thaws in summer’s heat. When the dust settles, the advancements achieved by builders during difficult times rekindle hope. Some blockchain companies, cryptocurrencies, creators, and NFT projects can survive a bearish winter, while others will not have the confidence, resources, or strength to do so.

Downturns are useful events, in that they serve to flush opportunists and unsustainable projects from a market. Consider that potential entrepreneur who swore off the internet in the wake of the dot-com disaster of the early

The 2000s missed the decade’s biggest opportunities: cloud computing, social networks, online video streaming, and cellphones. The next big projects are often built during a downturn.

What stays?

“Is it art?” asked one critic. “All of these people really amuse us, but the annoying thing is that none of them are worthy of the title ‘artist.’ It’s a con, a hoax!”

What sounds like something that might have been said during the current market downturn in 2022 was actually said in 1940 when art reviewers were discussing an Art Brut display. However, the critics of today sound identical in their condemnation of NFTs and their characterization as a fad—a bubble, a modern version of tulip mania. Obviously, not everyone is excited about the prospect of change in the art industry.

We believe that the advantages of NFTs and blockchain technology will contribute to a better art market, one that is fairer and more equal and democratic. A market that is more inviting, less exclusive and more transparent—converting a large number of new visitors into buyers who purchase art.

It is the collaboration, co-creation, and dialogue between artists, engineers, and the audience that makes this transitional phase between institutionalized “painting and sculpture” tradition and digital art so dominant. The new way of working is laying bare the insularity, elitism and opaqueness of the traditional art market.

The writing is on the wall. You are early, and we congratulate you on reading this book. So, don’t worry: Nostradamus-like predictions of the gradual decline of the traditional art world into antiquity may be slightly premature. We’re simply entering a new era. By reading this book, you are taking the steps to embrace change. The future is what you choose to make of it.

Extract from the book “How To Create And Sell NFTs – A Guide For All Artists”, published in 7/2022. The book can be ordered on Amazon. Tam Gryn is the former director of fine arts at Rally.io and head curator at SHOWFIELDS. Magnus Resch, PhD, is an art market economist, serial entrepreneur, and University Professor, teaching at Yale.