With the current malaise in the markets, many skeptics think this is the end for the cryptocurrency space. While cryptocurrencies have faced similar downturns in the past, the attention hasn’t been this much. We reached out to a round-table of experts who gave us their views on what’s actually happening. Here is what they had to say.

Steve Ehrlich, CEO & co-founder of Voyager Digital

-

Bitcoin took a serious hit last week due to the increased crackdowns in Bitcoin miners in China, and despite analysis that predicted further price weakness, Bitcoin climbed over 15% over the weekend with continued momentum this week.

- While Bitcoin remains in our top weekly net buys, we are seeing other altcoins gaining popularity in the wake of its dip, including SHIB and ETH which took the top two spots for the week.

- SHIB, ETH, DOT, and ADA were among the top net buys in the past 24 hours. Bitcoin did not make the top net buys for today. We may see Bitcoin struggling to regain positive price momentum in the short-term, but I believe it will come out on the other side even stronger, as we have seen historically with the major coin.

- There is a positive side to all of this in the grand scheme of the crypto world. The Chinese government’s crackdown on Bitcoin mines in the country has forced miners to move their operations elsewhere, including Kazakhstan and parts of the U.S. such as Florida, Maryland, and Texas. In the long-term, this could be a good thing for Bitcoin as mining is no longer concentrated in one region and allows it to remain a truly decentralized currency. Until recently, China accounted for about 65% of all the Bitcoin mines in the world. It may take some time for Bitcoin to really rebound and for miners to re-enter the space, but I believe it’s going to have a strong comeback.

- The price swings only reinforce the idea that volatility is a fundamental part of a nascent and expanding market. Investors are still buying the dip, as well as other altcoins, as they are confident in the blockchain technology that powers cryptocurrencies, and many are in it for the long haul.

Weekly Data

Top net buys for this week (6/22-6/29)

- SHIB

- ETH

- BTC

- DOT

- BTT

Biggest rank gains (by net buys week-over-week, 6/15-6/22 vs. 6/22-6/29)

- DOGE

- XVG

- CKB

- EGLD

- OCEAN

24hr Data

Top net buys for today

- SHIB

- ETH

- DOT

- ADA

- STMX

Biggest rank gains (by net buys 24hrs)

- YFI

- GRT

- QTUM

- MANA

- NEO

Debashis Pradhan, Partner, FSI Compliance and Risk, Infosys Consulting

I am almost certain increasing regulatory scrutiny will only help legitimize digital assets and cryptocurrencies and further drive adoption in the long run. Digital assets are highly volatile and can lose value quickly yet it hasn’t stopped retail traders and investors from coming in droves. Moreover, cryptocurrencies continue to be a preferred route for money laundering, tax evasion, fraud and cybercrime, especially decentralized finance or DeFi that doesn’t rely on any intermediary. So it isn’t a surprise that regulators have started knocking on doors hard and are taking a more active role in proposing rules and guidelines.

Amidst this short-term uncertainty, it’s important for clarity to emerge in the market through a consistent and coordinated approach across regulatory agencies. Given some of the recent crackdowns, this will soothe frayed nerves and will also pave the way for more institutional adoption. I also strongly believe that industry participants such as intermediaries, banks, and payment providers, must come together to define common data and reporting standards to support regulatory requirements, and build solutions to drive wider adoption.

Even as the regulatory space is evolving, banks need to assess their tools and methods for traditional Financial Crimes Compliance against what’s needed for digital assets. For example, while existing KYC data and processes can be reused, additional information such as proof of address ownership and beneficiary details will be required to meet the FATF Travel Rule requirements. Complementary to traditional KYC, capabilities to KYV – Know Your VASP (Virtual Asset Service Provider) will also be needed to assure information sharing and reduce the risk of leaked data during transactions.

Regulations might act as short-term hurdles but they can be a force for good in the future.

Justin Chuh, Senior Trader at Wave Financial

Market Overview

We’re probably going to be stuck trading sideways and walking up and down the same staircases for a bit. The mix of China related FUD is still having effects on BTC and therefore all other crypto assets, and overrides positive headlines coming out of other countries. Apparently miners have been relocating to and setting up shop in Pakistan, Kazakhstan, and Texas, but hashrate is still at low levels last seen in May 2020. Also, all China onshore financial institutions have been told to stop processing crypto related transactions with exchanges. Even with El Salvador adopting bitcoin as legal tender and Paraguay possibly following suit, that’s not enough to offset the loss of the largest and most popular region of market participants. Who else is going to use 100x leverage? It’s also going to take time for market participants to heal, those that had forced liquidations will need time to rebuild their bankroll.

~75k BTC options were concentrated on the June 24th expiry, but now options are mostly spread across several dates, with 27.7k at July month end, 29.8k in September, and 34.2k in December. ETH options follow a similar pattern, 205k expiring at the end of July, 235.2k in September, and 294.6k in December.

It seems the buyers and whales like to come in and accumulate more BTC in the $31.5k to $29k range, volume has been consistently heavy around here and this level should remain as support. $35k has also been hard to break through to the upside, and we should expect even more resistance between $39k and $40.5k. ETH is also in a ~10% range between $2,000 and $1,800. Stronger support and resistance are rather equidistant from this area, at $1,600 and $2,200, respectively, so it may be a fair time to load up on gas.

As Q2 2021 comes to a close, BTC is down ~41% through the quarter, but still up ~19% on the year. ETH is still barely up ~3% QTD but posts an impressive ~166% YTD. Crypto markets may be much more volatile than traditional markets, where the S&P is up 7.75% on the quarter, and 14% since the start of the year, but much more fun.

Crypto Yields

All yields dropped further this week. CeFi is not currently paying a premium for duration as market direction remains unknown. DeFi yields are down as well, although still providing a premium to most CeFi yield.

Haohan Xu CEO and Founder at Apifiny

“The recent volatility should not be considered as a real “crash.” This kind of volatility is common given crypto’s emergence as a new asset class. If anything, the “crash” should be seen as a validation of the cryptocurrency space — not as a sign of failure. We should not forget that Bitcoin’s price was less than 1/3 of today’s price at one time. The fact that crypto is maintaining its current market cap despite all the negative news demonstrates that the space still has a strong validation compared to a year ago.

That said, fear and uncertainty are driving price volatility throughout global cryptocurrency markets. For both retail and institutional traders, recent concerns around security and regulation have stoked fear within the market, and in my opinion, have caused Bitcoin to be oversold.

Statements from US Regulators and China’s crackdown are driving uncertainty within the crypto community. However, if done properly, market regulation should have a long-term positive effect on crypto prices. Building global markets takes time, and regulators are finally catching up with crypto.

Security is another major concern, especially for institutional investors. Over the next few months, we expect to see exchanges increasingly invest in enhanced security offerings in order to reassure traders.

Cryptocurrencies have a bright future ahead of them. Institutional investment and innovation within global crypto markets will serve to change global finance as we know it, but these innovations do not happen overnight.”

Blake Harris (Attorney & Managing Partner of Blake Harris Law)

“Several key factors can be attributed to the falling price of Bitcoin. Overall, there are rising concerns surrounding the global economy and another boom-and-bust housing market, which as seen with the stock market, tend to be drivers of volatility. Additionally, increased regulation and announcements from countries around the world related to cryptocurrency have impacted its pricing. China has banned cryptocurrency mining, and the U.K. announced a ban on Binance, one of the world’s largest crypto exchanges, from offering select services. We may be entering into a bear market; however, I strongly believe in the long-term resiliency of cryptocurrency and anticipate that in 50 years, Bitcoin will still exist. With technology, there is always a transitional period before people are comfortable using a new platform or product in everyday life. Crypto has been around for a decade and has always fluctuated. As time goes on, it proves to be a sustainable measure. Bitcoin has been the top performing asset for most of the past decade and there is still plenty of room for growth. More companies are accepting crypto and once they do, it’s going to become a permanent fixture of their businesses. The crypto space is growing as developers continue to improve the technology, which already allows you to guard against inflation, execute larger transactions such as real estate, and transfer payments without the need for a bank.”

Adam Lowe, Chief Innovation Officer and Creator of Arculus, the next generation of cryptocurrency cold storage

While crypto prices have certainly adjusted off recent highs, this is certainly not the end. While prices have reacted to local events, such as crackdowns by the Chinese government and the banning of Binance by the British government, they are already back up off recent lows. ETH will most likely continue to climbs as users look forward to the EIP-1559 upgrade. BTC will most likely also rebound, given its institutional favorability and strong brand equity. Altcoins and meme coins will continue to experience high volatility & seasonality, which is expected for their asset class. Continued adoption and distribution by US Fintechs is expected to drive positive crypto price pressure in the moderate term.

Next expectations for the Crypto space include the continued bifurcation of the communities. Some digital assets will continue to be more centralized on exchanges and treated as currencies as national economies (El Salvador) start to embrace their usage as stores of value. DeFi and smart contract-oriented chains will continue to proliferate to allow users to exchange an innumerable variety of data and digital assets without an intermediary party. This balance of centralized digital liquidity along with peer-to-peer interchange will empower an increase in economic velocity and global exchange of value.

“The cryptocurrency space is here to stay because, for the first time in a long time, people have found a better way to create, transfer, and present value that is not dependant on a centralized authority.

The crypto market goes through bear and bull cycles like any other, but because it is a relatively new market with not much liquidity, the cycles come with high periods of volatility. What is being made possible by blockchain and decentralization and what the crypto markets are doing are two separate phenomena.

The market will go through its growing pains and fluctuate, but the crypto space as a whole will continue to exist, grow and infiltrate all aspects of our lives the same way the internet did when it started in the ’90s and continues to do so today.”

Harrison Jordan, President at HUP.Life

Cryptocurrency is NOT dead. Just like any market, there are cycles – and we don’t even know which part of the cycle we’re even in! Has the bull run ended or is this the calm before the storm? Frankly, nobody knows, and a number of global and interconnected factors will determine how crypto markets fair. But something is certain: The concepts it has brought to prominence, namely decentralized finance and non-fungible tokens are here to stay. We live in a world that could benefit so much from these two concepts, and people around the world are finally waking up.

Riggs Eckelberry CEO at OriginClear

No this is not the end – in fact digital currency allows companies like ours to transition our industry in way that is much easier to solve because of the benefits of the technology of NFTs and Digital currency.

In fact, 2021 is the year OriginClear begins to roll out this new technology for “total outsourcing of water” also known as water as a service.

It is imperative for OriginClear to create a water coin for the world. Such a coin has the potential to benefit a community and that community could vote on how we are going to use the funds developed through this process. With $H2O OriginClear has a trademarked digital coin brand. Imagine this coin community interested in what can be done to help water – this includes brown water in Compton, lead filled water in Flint, toxic water in South Bend, bad water in wells – Africa, and more. How can we affect that? This is where the $H20 coin would bring general benefit – not for OriginClear specifically but really help the world and that’s the vision.

With the idea of rolling out monetized water payment streams as coins, this self-governed water world community can take one of these tokens, wrap it in a unique wrapper and represent the money streams from a particular water system.

This means that as the responsibility moves to local businesses, they could just get their water treatment through a service contract and pay on the meter just as if they were paying the city, but they are paying a water company.

This is very powerful now as every single gallon going through has money attached to it. Pay per gallon systems become the foundation for potential digitization of water. But if this is the case, why doesn’t water as a business have a worldwide market? Because water is local as you cannot effectively move water from Georgia to New York.

Now when that gallon has money attached to it then it becomes a financial instrument. This now becomes the beginning of a market. Our digital currency will enable this to happen now easily. We already know that that ramping up outsourced water treatment that we would have to pay a bunch of different people including investors, operators and so forth and even more complex. Why not solve that and many more problems with cryptocurrency?

This provides tremendous leverage to transform the water industry and improve our water environment.

Willy Ogorzaly, Principal Project Manager ShapeShift

While it may appear from some metrics and recent coverage that cryptocurrencies are “crashing,” if you zoom out and see a broader view, many are still up 2-5x over the past year. When any asset traded on a free market goes from being worth nothing to being worth a lot, it doesn’t happen in a straight line; rises and falls are common, and for newer asset classes, these swings are frequently more dramatic. A 50 percent correction should not be surprising for an asset that has quadrupled in value in a year. This is simply the natural result of free market participants speculating on novel assets that are difficult to value. The same thing happens every crypto market cycle, and each time the price corrects, pundits and watchers speculate that “bitcoin has crashed and crypto is dead.”

While the market strives to determine bitcoin’s price, its true and inherent value remains unchanged. Each cycle pulls more people into the crypto rabbit hole, and, regardless of price, the growing army of builders continues building, adding to an expansive ecosystem that will fundamentally change the world.

Andrew Lee, Chief Financial Officer, BTCS Inc.

Is this the beginning of the end for the cryptocurrency space? As cryptocurrency prices begin to crash, people are wondering if this is the beginning of the end for the cryptocurrency space. I need expert insight into what is happening and why cryptocurrency prices are crashing. I also need commentary on what to expect next for the cryptocurrency space.

Since reaching ATHs of $64,000 in April 2021, the price of Bitcoin plummeted -55% to sub-$29,000. There was a confluence of multiple events that led to the sizable retracement.

-

China’s Crackdown on Mining

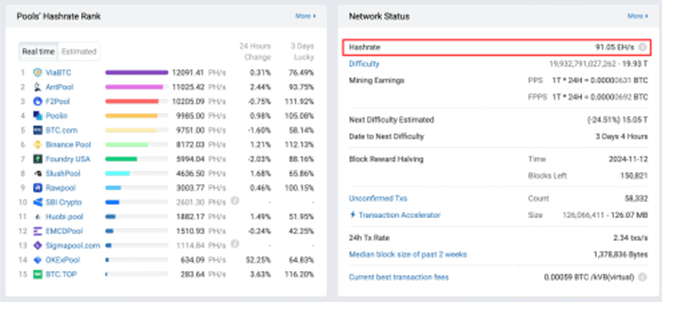

For context, 65% of the global Bitcoin hash rate is concentrated in China. Some of the largest mining pools shown below are stationed in China. So, you can imagine what would happen when Chinese authorities mandate that all Chinese miners power down and go offline.

Cryptocurrency markets plunged, as did hash rates. Miners sold, HODLers sold, short-term speculators sold, Jim Cramer sold. The significance of the China mining crackdown is apparent on a 5-year hash rate diagram:

The 7-day average hash rate is currently at 91 EH/s, levels not seen since the depths of crypto winter of 2019 and far from its ATHs of 200 EH/s in April 2021. It will take at least several quarters for Chinese-based miners to relocate and set up hosting infrastructure overseas. Until then, Bitcoin mining hash power is expected to remain low. The cryptocurrency markets should continue to remain volatile and consolidate over time as we wait for a resolution regarding China and its miners.

-

Death Cross

Bitcoin’s death cross technical chart pattern suggests a bearish outlook. A death cross occurs when the 50- day moving average (red line below) crosses below the 200-day moving average (yellow line below). Previous death crosses throughout Bitcoin’s history have resulted in additional 50%+ corrections, on top of the 50%+ correction leading up to the day of the death cross. It’s no wonder traders, HODLers, onlookers are so fearful and continue to capitulate.

Greater Regulatory Oversight Globally

The highest profile of regulators within the U.S. – SEC, CFTC, DOJ, FinCEN, IRS – continue to investigate and prosecute bad actors/projects in the space, while regulators in Japan, the U.K. and the Canadian province of Ontario have issued warnings and/or banned Binance entities from operating regulated activities within their respective borders. Other unauthorized cryptocurrency exchanges such as Bybit have also shut down in the U.K. after warnings from regulators.

-

Elon Musk

Elon Musk emerged as a vocal, influential proponent of Bitcoin, announcing Tesla’s $1.5B purchase of Bitcoin in Feb 2021 and publicly-engaging with other high-profile Bitcoin maximalists – Michael Saylor (MicroStrategy) and Jack Dorsey (Twitter/Square). Elon helped drive awareness and adoption, growing the overall cryptocurrency market capitalization to $2.6T in April 2021. However, his announcement that Tesla (TSLA)

would suspend vehicle purchases using Bitcoin citing environmental / climate (ESG) concerns precipitated a 10% fall in price from the $60,000 levels.

-

Institutions / Public Companies

One of the catalysts behind the run-up to $64,000 BTC ATHs has been the narrative that “institutions are coming”. For the last year, Michael Saylor of MicroStrategy (MSTR) has championed the public company movement, tapping into capital markets to issue both debt & equity to purchase significant amounts of Bitcoin. While companies like Square have simply used cash on-hand to add Bitcoin to their balance sheets, public

companies like BTCS Inc. (Ticker: BTCS) has bolstered its cryptocurrency treasury reserves, utilizing a strategy similar to that of MicroStrategy. It has also expanded into greener proof-of-stake cryptocurrencies such as Ethereum and Cardano. As BTCS seeks to uplist to NASDAQ, it offers more diverse blockchain and cryptocurrency exposure than many of its public peers and plans to drive revenue via securing disruptive blockchain protocols.

With all the volatility over the last two months, public companies have taken a more cautious approach to adding cryptocurrencies to their balance sheets. There are accounting risks for public companies that hold Bitcoin in their treasuries – specifically, hundreds of millions of dollars in impairment charges have been recorded by MSTR and TSLA in prior quarters. 2Q 2021 will be a memorable quarter for public companies in terms of the absolute dollar value in write-downs. These accounting complexities have certainly contributed to an abatement of institutional buying, adding to the large drawdown in recent weeks.

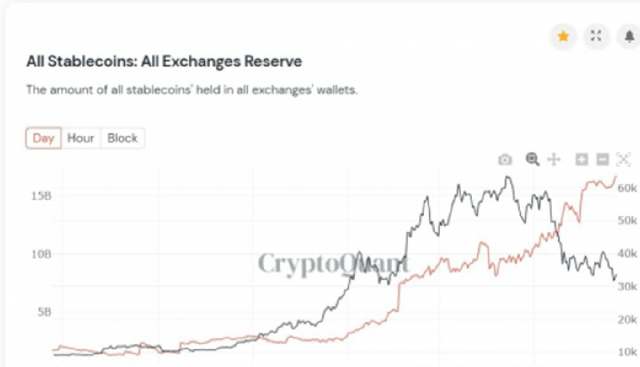

While the above set of events suggest a bearish outlook, on-chain metrics (i.e., long-term holders / aged wallets purchasing more discounted BTC from short-term holders/sellers (younger coins), stables rotating back into the market and onto exchanges from the sidelines – hits new ATHs depicted in the diagram below) suggest we just experienced a mid-cycle correction (albeit, large) and are not yet at the tail-end of this bull cycle. We have yet to see a blow-off top that is typical of crypto bull market ATHs.

John WH Schneider Blockchain & Business Development Specialist at CPI Technologies GmbH

Cryptocurrencies have been declared dead hundreds of times in the last twelve years, ever since Bitcoin’s inception.

When its whitepaper came out in 2009, at each subsequent crash, Bitcoin and cryptocurrencies were declared dead. But what I believe is happening and I’ll try to back that up with some solid research and data.I believe what we’re currently seeing is the biggest and largest transition in cryptocurrency’s history.In the past, Bitcoin has always been the king. It was the first cryptocurrency in the market and people were just getting used to and starting to understand what a cryptocurrency actually is.In its whole life cycle so far, the twelve years, Bitcoin has risen from the lower dollar up to $60k, $64k and now its sitting comfortably at $30k. So, that is incredible growth that we’ve seen.The second-largest cryptocurrency by market capitalization right now that is not a stablecoin is Ethereum. Ethereum’s whitepaper came out in 2013. So it’s more or less four years behind Bitcoin. What I believe is happening is currently the biggest set up for a change in leadership is taking place.So were smart money invested in Bitcoin, they’ve made a lot of money. And they’re pulling it out. But they’re not pulling out of the cryptocurrency space. They are just reshuffling it. [They’re] reorganizing their portfolios.I believe that money is going to flow into Ethereum and into other Alts and as such setting us up for the biggest Alt season we have ever witnessed and ever seen.So let me try to solidify that with some actual actionable data and use. In order to do that let’s look at the Goldman Sachs Cryptocurrency report.The head of commodities research there, he believes that Ethereum is a better store of value. And he’s more bullish on it. That’s for a couple of reasons. To be a really good store of value, an asset needs to have alternative use-cases. Whereas Bitcoin is sitting somewhere between being a store of value and a currency, Ethereum actually has multiple use-cases.It’s similar to gold. Gold can be used as a store-of-value, it can be used in jewelry and it can be used in tech.That’s also what’s kind of happening with Ethereum.