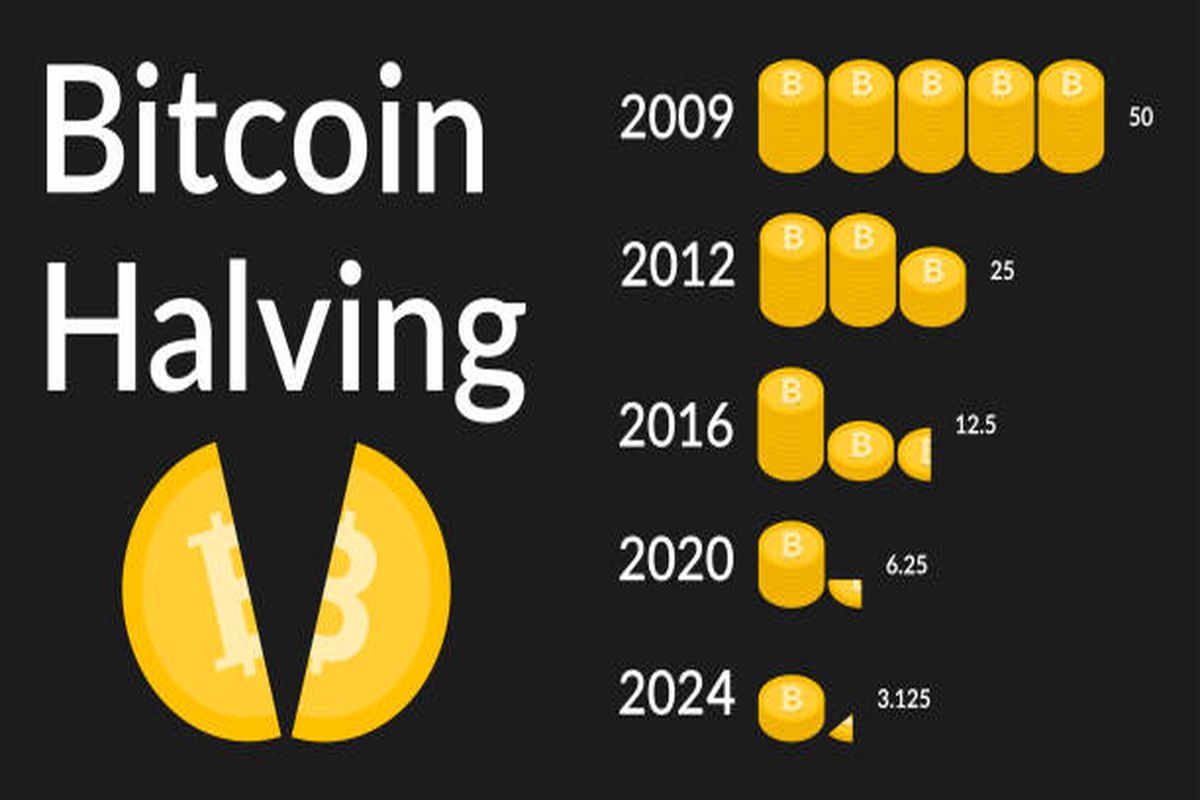

The Bitcoin protocol has been reducing the supply of new Bitcoin by 50% through the quadrennial Bitcoin halving. This strategy translates into a 50% drop in revenue for the Bitcoin miners and poses some indirect implications for cross-chain interoperability.

Bitcoin halving happens every four years and it reduces the block rewards for the Bitcoin miners. The halving process is hard-coded into the Bitcoin protocol by its mysterious developer, Satoshi Nakamoto, as is its limited supply of 21 million Bitcoin (BTC).

The first Bitcoin halving happened in 2012 and it reduced the reward for mining a block from 50 to 25 BTC. The next Bitcoin halving effect will happen in April 2024, and these halving cycles will continue until 2140 when the last Bitcoin will be mined.

Cross-chain interoperability is the ability of various blockchain networks to smoothly share information and value. It lets users and assets move seamlessly, boosting blockchain convergence with a highly integrated and efficient financial ecosystem.

In the crypto space, Bitcoin is renowned for its impact on value and scarcity, stands as a leader, and is undisputed in its market dominance. Nevertheless, with its proof-of-work (PoW) mechanism and intrinsic design as a highly non-interoperable chain, the Bitcoin blockchain is disconnected from cross-chain discussions. Bitcoin’s prominence and market dominance still make it important to consider in the interoperability discussions, although indirectly.

Bitcoin’s Halving’s Effect On Network Congestion And Transaction Fees

With reducing mining rewards, miners might compete more aggressively to validate transactions, which can result in network congestion. The halving process is meant to control the issuance of new Bitcoin and maintain the scarcity that helps support its value. A significant consequence of the event is its impact on network congestion and transaction fees on the Bitcoin blockchain.

After a halving event, miners might have to adapt their approaches to maintain profitability. As the miners become more selective about the transactions in the blocks, users who offer higher fees gain priority, resulting in a competitive environment.

The general drop in block rewards and increased user activity mostly seen during the halving events, causes a surge in the number of transactions, intensifying network congestion.

This spike, integrated with the market-powered response to growing transaction fees during times of high demand can push users to consider alternative blockchains that may offer benefits like quicker transactions, lower fees, and better cross-chain compatibility. The trend, while challenging to measure accurately, highlights the dynamic and evolving nature of the crypto industry.

Bitcoin halving events cause a chain reaction that influences network congestion and transaction fees. Reducing block rewards, altering miner behavior, and increasing user activity develop an environment where transaction fees become highly competitive.

Related: Bitcoin Network Hashrate Reaches Record Highs Awaiting Spot ETF Approval And Upcoming Halving

Investors Look For Alternatives Amid Bitcoin’s Plunging Issuance Rate

As Bitcoin’s issuance rate drops, investors seek alternative options on other blockchains. Halving periods push for the reevaluation of risk and reward dynamics for investors who previously considered Bitcoin a lucrative investment due to its deflationary nature. As the rate of new Bitcoin supply drops because of its halving events, its increased scarcity enhances its appeal as a ‘digital gold.’

Nevertheless, the investment dynamics in the crypto industry are multifaceted and complex. Investors, in pursuing risk management and portfolio diversification, mostly explore alternative blockchains offering other features, utility, and potential returns.

The search for alternative options among the investors necessitates increased cross-chain interoperability as investors look to invest in various blockchain projects and seamlessly move value and assets across the platforms.

Interestingly, the interoperable multichain ecosystems also become important, enabling the support of smooth transactions and active interactions between various blockchains, hence increasing the scope for investment strategies and risk management.

Cross-chain interoperability works as a bridge, enabling the smooth movement of assets and value across different blockchains. As more capital flows into alternative blockchains and platforms, the demand for efficient, secure, user-friendly, and cross-chain interaction mechanisms grows.

In turn, it intensifies innovation in the sector, creating complex multichain platforms and interoperability protocols that can readily accommodate a wide range of financial products and services.

The interplay between Bitcoin’s token issuance rate and investor behavior highlights the wider trend of decentralization and develops an environment for the steady maturation of the crypto space.

Revolutionize your trading game with Finance Phantom, where complex market trends are simplified through AI-powered insights.