Elastic supply tokens, or rebase, work in a manner that their circulating supply expands or contract due to the changes that happen in the token price. They have a changing circulating supply and their operation idea is that instead of price volatility, token supply changes through rebases. The increase or decrease in supply is what is known as rebasing.

What if the bitcoin protocol can adjust how much bitcoin is in the user wallets to achieve a targeted price. Today you have one bitcoin, tomorrow you have two BTC but they are worth half of what they were the previous day. In general, that is how a rebase mechanism works.

Overview

Decentralized finance (DeFi) has introduced an assortment of new financial products on the blockchain. Some that have already gained popularity are tokenized Bitcoin on Ethereum, flash loans, yield farming, and Uniswap. The other segment of the crypto industry that has become interesting to review and follow is elastic supply tokens, commonly known as the rebase tokens.

The distinct mechanism behind them enables users to do lots of experimentation. Whenever a rebase happens, the token supply is decreased or increased algorithmically, according to the prevailing price of every token.

Elastic supply tokens can be compared to stablecoins in some ways. They are designed to achieve a target price and the rebase mechanisms are known to facilitate that. Nevertheless, the main difference is that these rebasing tokens are designed to achieve the price with a changing (elastic) supply.

But many ask, aren’t many cryptos operating with an ever-changing supply? The answer to that question is a somewhat ‘YES’. Today, 6.25 new bitcoins are minted with every block. After the 2024 halving, that amount will reduce to 3.125 BTC per block. Since it is a predictable rate, it is to estimate how much BTC will exist in 2022 or after the next halving event.

Notably, the supply-elastic tokens work differently since the rebasing mechanism adjusts the token circulating supply frequently. For instance, if an elastic supply token aims to achieve a value of $1, the rebase increases the current supply if the price is above the target. The increase in supply reduces the value of every token.

On the other hand, if the price is below $1, the rebase decreases supply which makes every token worth more. It means that the amount of tokens that users have in their wallets keeps changing whenever a rebasing happens.

If one has 100 Rebase USD (rUSD), which is a hypothetical token that targets a $1 price, the balance in their hardware wallet keeps changing. If the price drops below $1, one may have 94 rUSD in their wallet after rebasing. However, each of these rUSDs will be worth more than before the rebase.

The idea behind it is that your holdings that are proportional to the total supply remain constant with the rebase. This strategy ensures that one’s holdings proportional to the total supply do not change with the rebase. If one had 3% of the supply before the rebase, they should have 3% after it even if the number of coins in the wallet changes.

Thus, users get to retain their share of the network regardless of the price at any given time.

The Shortcomings Of Elastic Supply Tokens

Although they seem to be a great solution to the high volatility associated with the crypto market, elastic supply tokens are highly risky and quite dangerous forms of investment. It is advisable to invest in them only when one knows what they are doing.

Reviewing price charts might not be all that helpful because the number of tokens one holds will change after rebases happen. The strategy can amplify gains on the bright side or amplify losses on the flip side. If rebases happen when token prices are dropping, users lose money from the token price going down and own lesser tokens after every rebase.

Since they are challenging to comprehend, investing in rebasing tokens results in losses for many traders. It is only advisable to put money in elastic supply tokens if one is fully aware of the mechanisms that power them. Otherwise, investors who are not knowledgeable are not in control of their investment and cannot make informed decisions.

Rebasing Token Examples

Ampleforth

Ampleforth (AMPL) was among the first coins that work with an elastic supply. The coin aims to become an uncollateralized synthetic commodity, where 1 AMPL aims for a price of $1.00. Rebases in this market happens once after 24 hours.

This project had little traction until a liquidity mining campaign known as Geyser got introduced. This scheme distributes tokens for participants over a 10-year duration. Geyser is a major example of how liquidity incentives can create considerable traction for decentralized finance (DeFi) project.

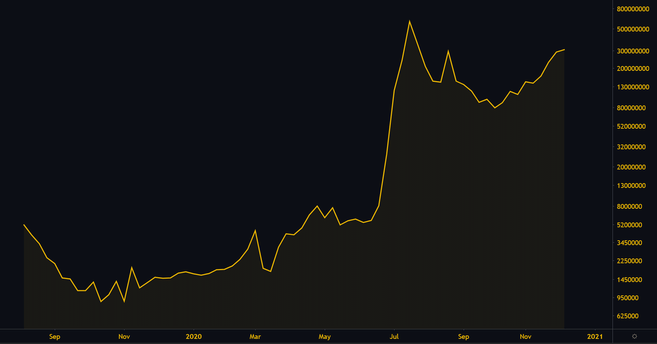

Although it is technically a stablecoin, the AMPL price chart shows how volatile the elastic supply tokens get.

Please note that the price charts show the price of individual AMPL tokens and do not take into account the changes that happen in supply. Ampleforth is quite volatile which makes it a risky coin to invest in.

It might be more sensical to chart elastic supply tokens in terms of market capitalization because the price of the individual units does not matter as much. The market capitalization may act as a better barometer of the network’s growth and traction.

Yam Finance

Yam Finance is an example of the elastic supply tokens that have gained significant traction. The Yam protocol’s general design is somewhat a mashup between Synthetix’s staking system, Ampleforth’s elastic supply, and yearn.finance’s fair launch. Notably, YAM tokens also target a price of 1 USD.

YAM is a community-owned experiment because all of the tokens were distributed via liquidity mining. There was no founder or pre-mine allocation which means that the space for the acquisition of these tokens was uniform for everyone using a yield farming scheme.

Being a new and barely known project, Yam acquired 600 million dollars of value locked in its staking pools within two days. What might have attracted massive liquidity could be how YAM farming was particularly targeting the holders of some of the popular DeFi coins. These were MKR, SNX, ETH, COMP, ETH-AMPL Uniswap LP, LEND, LINK, and YFI tokens.

Nevertheless, a bug in the rebasing mechanism affected the project with more supply minted than was planned. This project was eventually relaunched and then migrated to a new token contract supported by a community-funded audit and joint effort. Today, the future of Yam is entirely in the hands of YAM holders.

The Takeaway

Many now believe that elastic supply tokens are some of the innovations to watch out for in DeFi. As it is clear, these are tokens and coins that can algorithmically adjust their supply aiming to achieve a target price.

For now, these tokens may be in the experimental stage but might eventually gain massive traction and carve out their niche. At first, it might be challenging. However, several new DeFi protocol designs are in the pipeline which may take the idea further.