Decentralized exchanges (DEX) seem to be gaining popularity as more people turn to crypto as an alternative investment vehicle to traditional stocks and bonds. A digital currency exchange or a crypto exchange is a platform that enables investors to change fiat currency into crypto tokens and vice versa.

These exchanges also support the conversion between crypto tokens. They play a critical role in the crypto sector, and without them, it would be almost impossible to trade and use cryptocurrency tokens. Notably, a crypto exchange’s architecture is quite similar to that of a bank.

Both of them are institutions that work as middlemen and hold the people’s funds to keep them liquid, safe, and guarantee their easy transfer from one location to the next. Just like banks, most of the crypto exchanges are also centralized. What that proves is that there is a central, trusted authority that is responsible for the control and safety of the platform.

Just like banks, investors offer centralized crypto exchanges with full control of their wallets. By doing that, investors offer access to their wallets to a third party and lose the burden of 100% control over their money.

That is ideal for the investors as they are offered a degree of protection, and peace of mind that they do not have in case they remain independent. In recent years, there have been rumors of investors losing cryptos worth millions since they have lost their private keys. These exchanges prevent this from happening.

The exchanges offer traders protection through easy access to their funds. In case they lose or forget their password, after the essential verification, the decentralized exchange can help them regain total access to their accounts. That works like the banks, where whenever you lose a debit card you can simply ask for a new one after authentication.

Centralized exchanges offer stability to the market and enable investors and traders to sell and buy their assets at a stable price. That is due to the huge volume of tokens they hold enabling them to stabilize the general market and ensure that investors trade their tokens with relative ease.

Why Are Decentralized Exchanges Gaining Popularity?

Centralized exchanges appear to have it all. Why is there a need to create a decentralized exchange? The issue is the centralized nature offers it all the benefits. These are the major limitations that are found in the centralized exchanges:

- Censorship is a major limitation of centralized exchanges. The motivating factor behind cryptos is that they are not centralized and hence they deserve decentralized exchanges. Cryptocurrencies cannot be controlled by government institutions. For instance, the government may intervene and control the levels of access to a person’s funds at their bank. In most cases, the centralized exchanges suffer from the issue, where the government regulations and seizures can freeze investors’ money.

- Centralized exchanges collect the data of their users and put it in a centralized server. Normally, the customers gain access to their funds via an email and password combination, and that information is stored on the server. That makes centralized exchanges a major target for hackers who want to get rich quickly. Several exchanges have now suffered from such attacks and lost investments worth millions. Some of the exchanges refunded the users from their coffers.

Decentralized crypto exchanges have been developed to resolve the issues. Just like cryptos, the decentralized exchanges are peer-to-peer and use automated algorithms for the validation of transactions. They are also known to support a plethora of decentralized applications (dApps).

Related:Decentralized Exchanges: 2019’s Key to a Dapp Comeback

How Do Decentralized Exchanges Work?

Decentralized exchanges do not use any central controlling server or several grouped servers to control the data of the users. There is no need for a third-party service to hold investors’ money while they execute transactions. Here are some of the notable differences between centralized and decentralized exchanges.

Control

In centralized exchanges, the server holds the order books and the funds while a transaction happens. Nonetheless, in the case of decentralized exchanges, a central server is not necessary. The transactions are executed directly with peers without the central servers. Thus, the funds of the users are mainly controlled by the participants of the transaction.

Anonymity

The regulatory space that surrounds exchanges is becoming tougher, which makes it challenging for centralized exchanges to ensure that their users remain anonymous. Since anonymity in crypto transactions is paramount, users prefer it because they feel hesitant in sharing information with exchanges.

On the flip side, decentralized exchanges operate in the same way as the distributed blockchain, where each transaction is encrypted and anonymous. This guarantees the privacy of the users and protects them from any form of government intervention.

How Are The Decentralized Exchanges Better?

The decentralized exchanges support faster and cheaper transactions. Elimination of third parties in the transaction process means that these exchanges can execute quick transactions at greatly reduced fees. Since these transactions are peer-to-peer the lag that is normally found while processing transactions are heavily reduced.

As noted earlier, centralized exchanges are vulnerable to hacks, and users’ information can be stolen. In the case of decentralized exchanges, hacking is minimal since user information is not stored in a centralized server. Whenever a hacker does not gain any access to user information, the attack remains localized, and accessing the entire network is nearly impossible, as is the case with blockchains.

Another advantage that comes with decentralized exchanges is the ability to directly integrate with hardware wallets like Ledger Nano S and Trezor. In the case of centralized exchanges, users need to input their private keys to move their coins from the blockchain wallets to the exchanges.

It creates a risk for keylogging attacks. In decentralized exchanges, users directly transfer from their hardware wallets to smart contracts provided mainly by the decentralized exchanges.

In decentralized platforms, funds are in control of the users instead of a central authority. Control of funds is in the hands of users even when executing transactions, as the general platform uses a peer-to-peer network architecture. Private keys are not shared with the crypto exchange and remain in control of the user.

Shortcomings Of Decentralized Exchanges

Although these platforms seem to be the best solutions for the investors and traders in the crypto space who prefer anonymity, they come with some shortcomings.

Unlike centralized exchanges, the decentralized platforms lack some components and features like margin trading, stop loss, and many others. The features can be a major hiccup in a trader’s performance. These features are yet to be included in the decentralized exchanges, but the centralized platforms already have these components.

Centralized platforms dominate the current market since they are mainly easy to use and offer users extensive help. This is not the scenario with decentralized exchanges, where users need to navigate through multiple smart contracts. That can become a major challenge for users even experienced professionals.

Users also worry about recalling their private keys while dealing with these decentralized platforms. These are the main reasons that make decentralized exchanges not very user-friendly.

Related:What Are The Major Decentralized Finance (DeFi) Ecosystem Problems?

Top Decentralized Crypto Exchanges

Bancor Network

Bancor Network is a smart contract-powered decentralized exchange that solves the issue of liquidity that most of these decentralized platforms encounter. Due to that priority, Bancor has a stable network and is less volatile. In that context, it offers investors stable token prices.

The platform has an incredible web application with a massive UI for users to perform various simple functions of acquiring and selling cryptos. Unlike EtherDelta and IDEX, the UI on Bancor is free from clutter and neatly groups the token assets.

IDEX

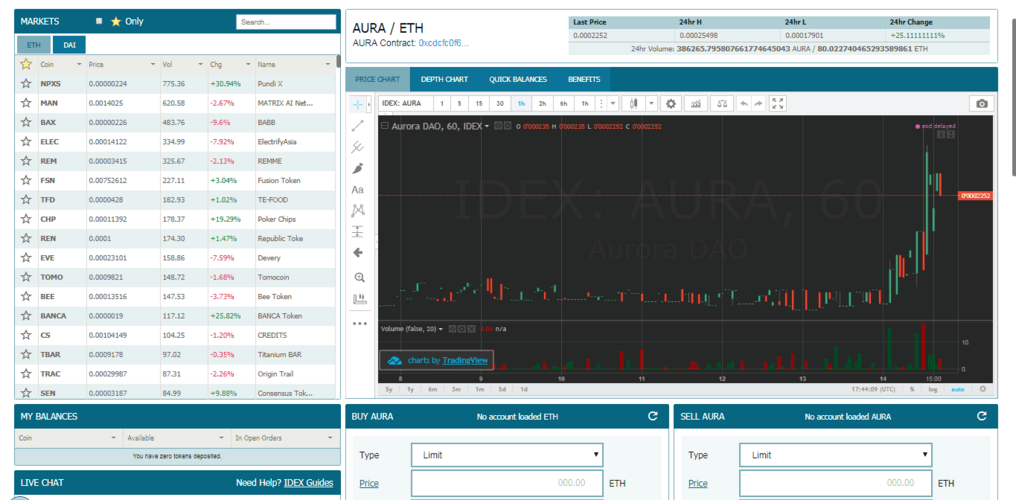

IDEX is a decentralized exchange whose primary focus is trading Ethereum-based ERC-20 tokens. The team says that IDEX integrates the speeds of centralized exchanges with the security level offered by blockchain settlement. In general, the exchange has a functional UI and is among the top decentralized exchanges.

The primary display comprises a Japanese candlesticks chart that describes the performance of assets. Users review the latest trades made on the blockchain and can readily sell and buy assets from the main screen. While registering on the platform, it is crucial to save the backup phrase, or you may risk losing access to the account permanently.

EtherDelta

EtherDelta is designed for trading Ethereum ERC-20 tokens and Ethereum pairs. The entire exchange is powered by ETH-based smart contracts that are responsible for deposits, managing, withdrawals, and wallet integration.

The similarity between IDEX and EtherDelta is uncanny since both boast a similar UI, with a candlesticks chart as the main screen. Just like IDEX, EtherDelta also offers all the important information to the traders operating on the main front screen.

Traders may use the platform to sell, buy, or withdraw their crypto assets.

Kyber Network

Kyber Network is a trusted, instant, liquid ETH-based decentralized exchange for cryptos. Kyber Network is based on peer-to-peer protocol. This platform boasts a no sign-up feature that enables users to directly log in through a wallet of their choice and instantly start trading. Kyber Network also has a considerable amount of reserve to complete the transactions nearly immediately.

Bisq (BitSquare)

Bisq offers traders a desktop application that can be used to trade crypto assets anonymously. Bisq is known to support fiat currencies and other alternate cryptos, which are yet to become famous.

Related:Decentralized Bitcoin Exchange Bisq Has a New UI and DAO

Unlike the traditional exchanges, Bisq does not need a lot of information for approval from a central authority. Traders just download the app and immediately begin trading. This platform is a peer-to-peer system that is free from a single point of failure.

The primary benefit of Bisq is probably its support for fiat currencies. It fields 126 cryptos but is majorly affected by low trade volume.